78 min read • Automotive

Unleashing Indonesia’s electric mobility potential

A comprehensive report on the future of EVs in Indonesia

FOREWORD

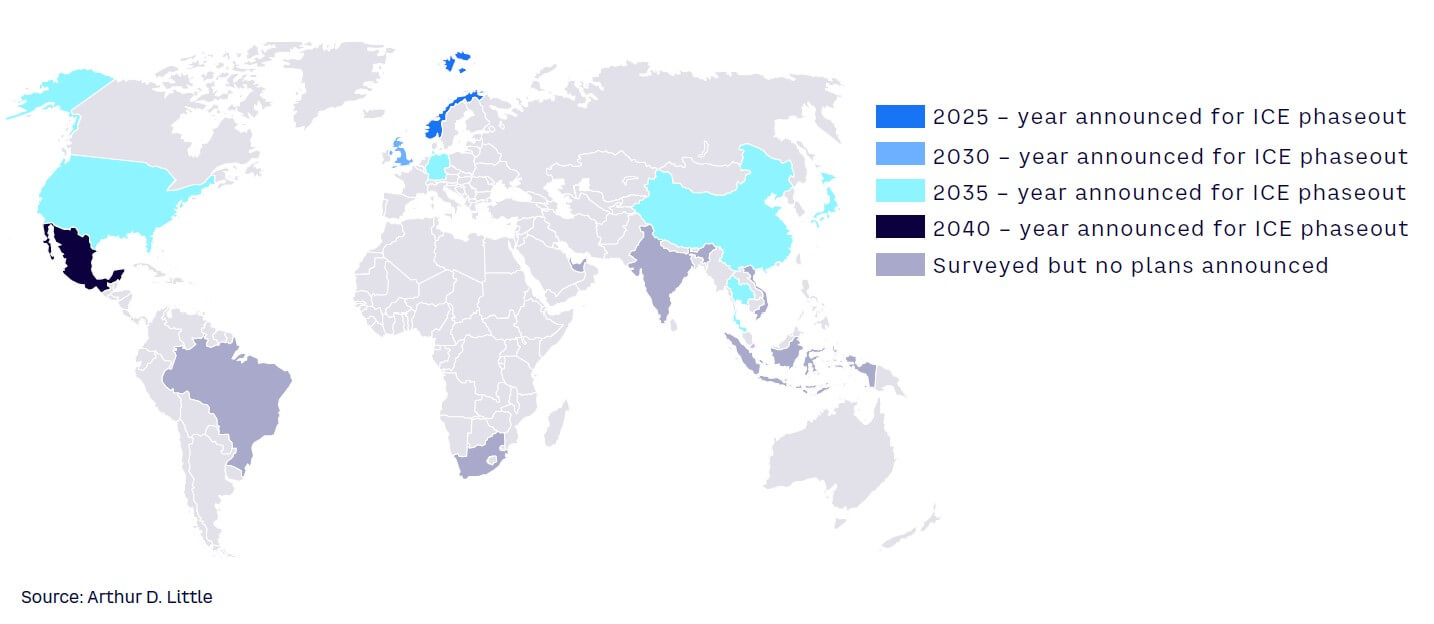

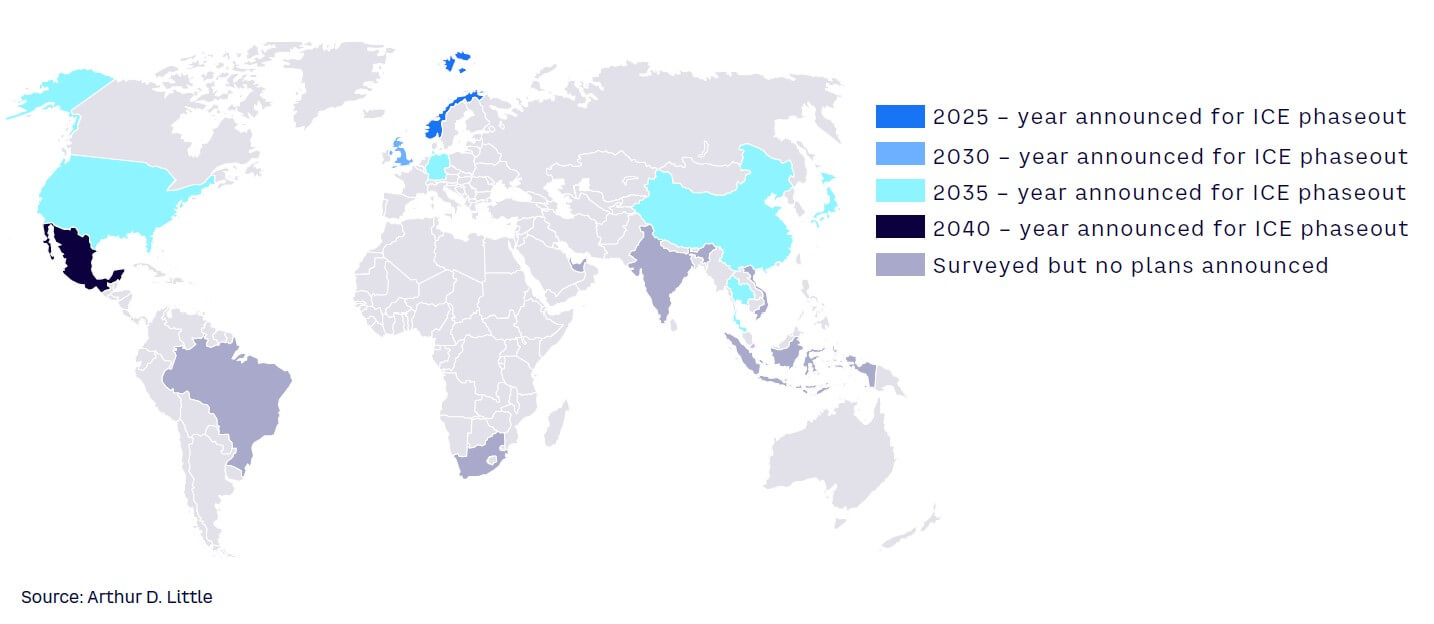

At the 26th UN Climate Change Conference of the Parties (COP26) in October/November 2021, several nations and leading car manufacturers pledged to phase out fossil fuel–powered vehicles by or before 2040. As countries around the globe prepare for carbon neutrality, the automotive industry is undergoing a fundamental transformation. Consequently, governments in Southeast Asia (SEA) have floated ambitious plans to capture a share of the evolving electric vehicle (EV) segment, creating various opportunities for the region in both the domestic and export markets.

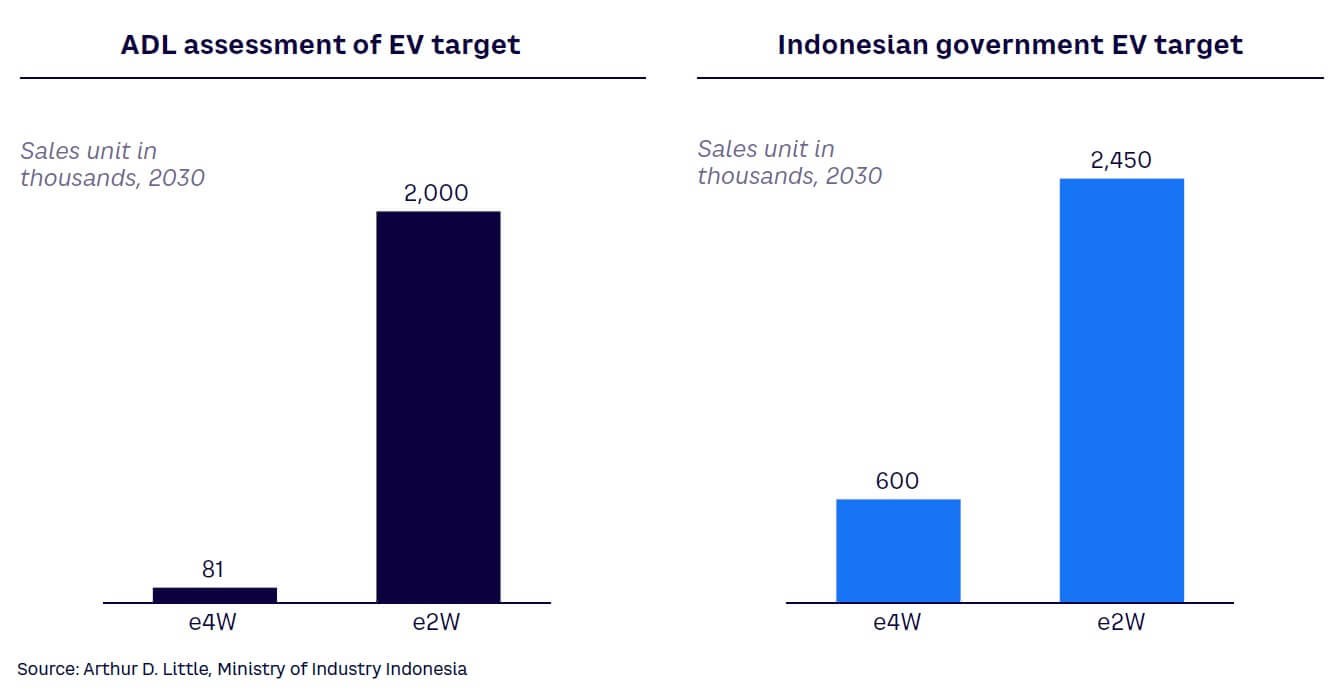

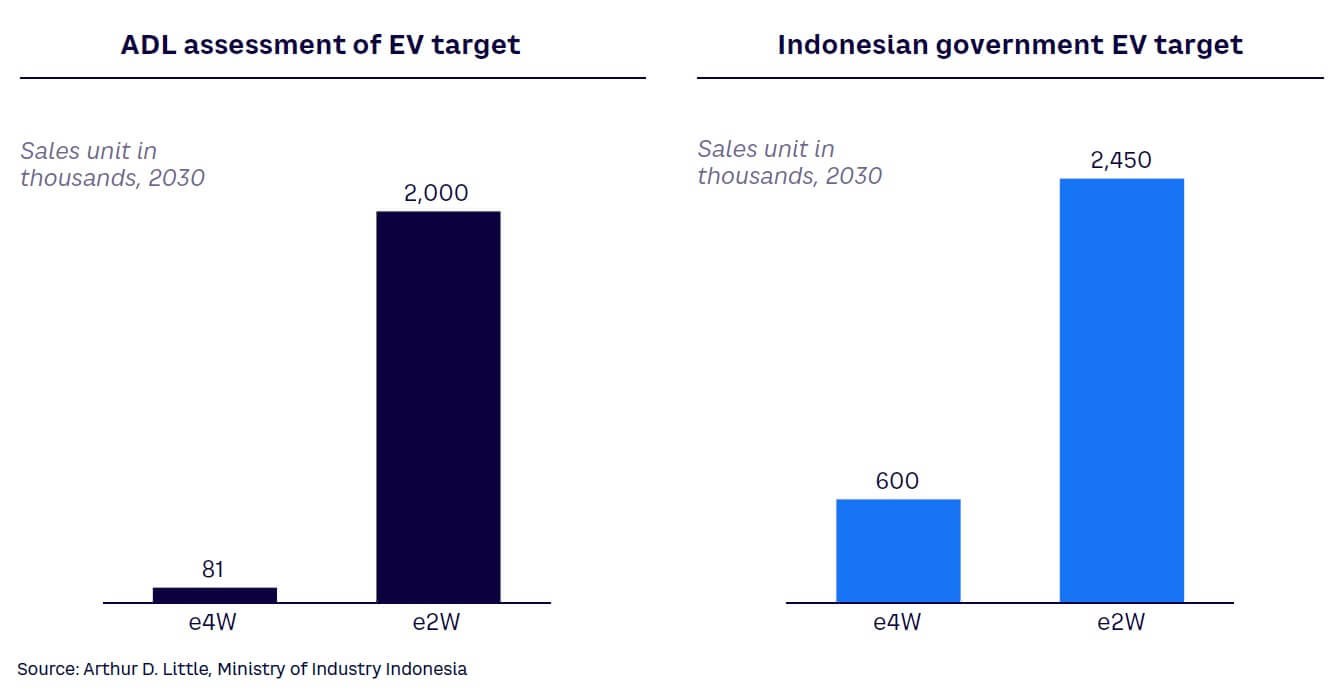

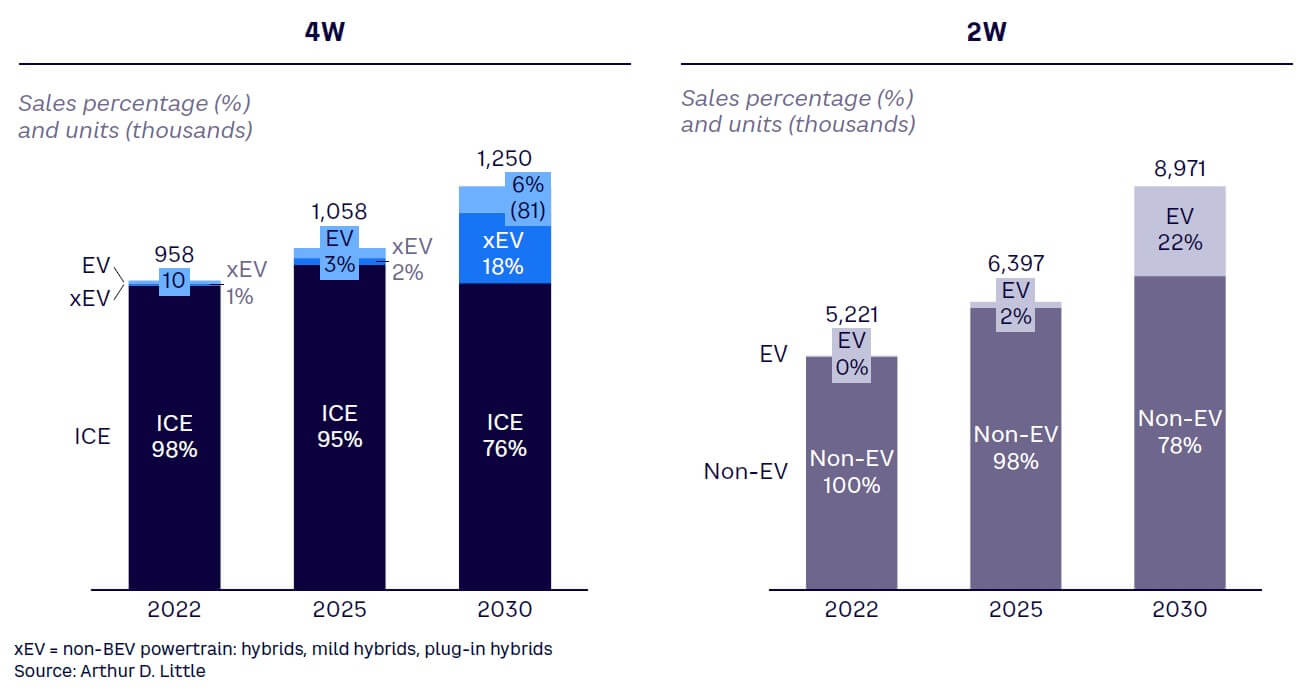

Indonesia has traditionally been a strong automotive market in the region, selling 1 million units, the largest in the Association of Southeast Asian Nations (ASEAN) and producing 1.5 million units (the second highest after Thailand) in 2022. The country has now embarked on an ambitious electrification plan with a target of 600K four-wheel (4W) battery electric vehicles (BEVs) and 2.45 million electric two-wheelers (e2Ws) by 2030.

Indonesia plans to take the lead in facilitating the Regional Electric Vehicle Ecosystem Development, committing to building an EV ecosystem and becoming an important part of the upstream supply chain within ASEAN. The shift toward electric mobility by Indonesia, however, will have its challenges. ASEAN countries need to come together with Indonesia in a cooperative approach, with each country playing a specific role in the overall EV ecosystem.

Arthur D. Little (ADL) has analyzed the current market situation in Indonesia and proposes recommendations to executives at automotive OEMs, battery manufacturers, and industry newcomers to support them as they transform their industries. Our overview of Indonesia’s readiness and challenges for electric mobility provides an understanding of the current situation, while our analysis of critical factors to promote EV adoption offers a broad structure of actions needed to transform Indonesia into an EV manufacturing hub.

In this Report, we summarize the current status of EVs in Indonesia, which includes an overview of environmental concerns and the reasons behind low EV adoption rates. We then examine regulatory issues and market movements and identify the main challenges Indonesia faces by comparing its EV readiness index with other countries. The ADL EV assessment, explained in detail later in this Report, grew from a market-based survey and input from industry experts. We conclude by recommending solutions to achieve the desired EV evolution and meet the established targets.

- Hirotaka Uchida, Head of ADL Thailand, Partner, Head of Automotive & Manufacturing, Southeast Asia & Pacific

EXECUTIVE SUMMARY

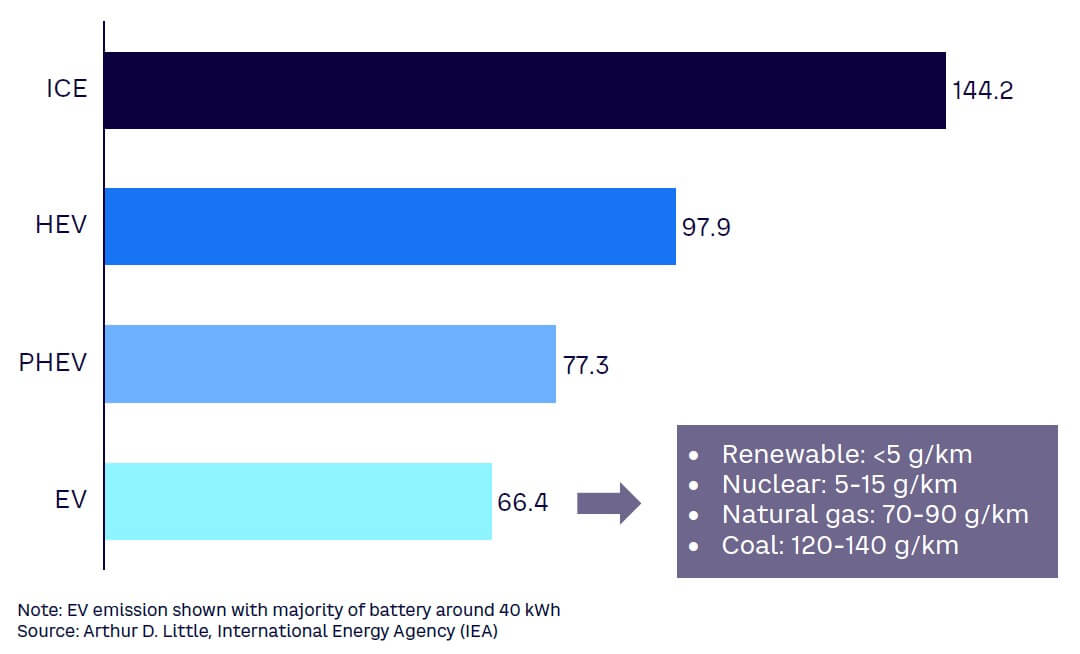

The automotive industry is one of Indonesia’s most significant contributors of greenhouse gas (GHG) emissions; at 27%, it is ranked as the second-largest emitter. Given the government’s net-zero target of 2060, decarbonization of the transport sector is crucial and requires electrification. Moreover, electrification presents the country with an enormous opportunity to reduce oil imports and develop its lithium-ion battery (LIB) supply chain through developing its abundant nickel reserves. Electrification also contributes to a reduction in air pollution, which directly impacts quality of life.

Since 2013, the Indonesian government has been introducing incentives to support xEVs (BEVs, plug-in hybrid EVs [PHEVs], and hybrid EV [HEVs]) through the Low Carbon Emission Vehicle (LCEV) program and Presidential Regulation No. 55/2019, which aims to develop an end-to-end EV supply chain. The government, as per Ministry of Industry Regulation No. 6/2022, has also set a national target of 600K battery electric four-wheelers (e4Ws) and 2.45 million e2Ws by 2030.

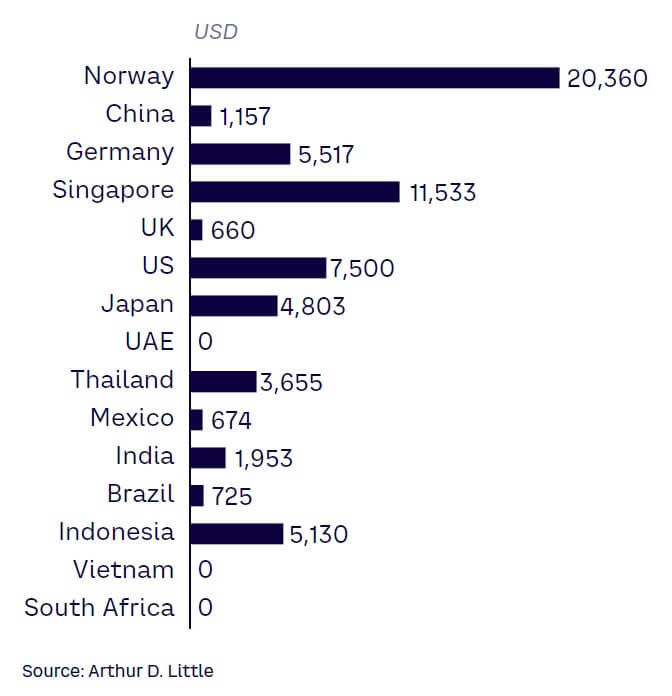

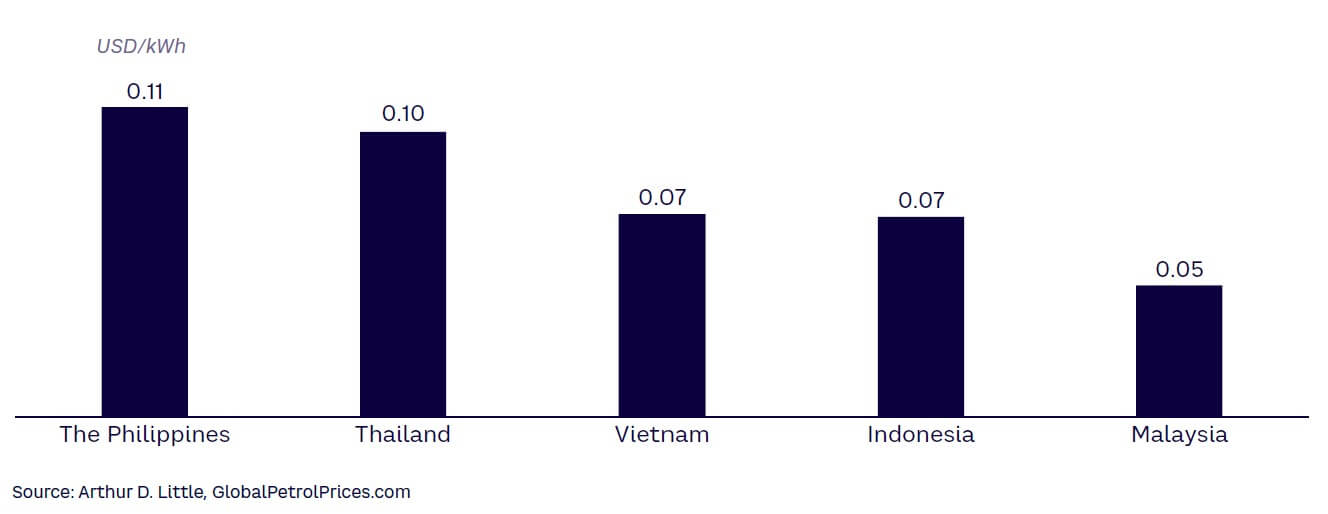

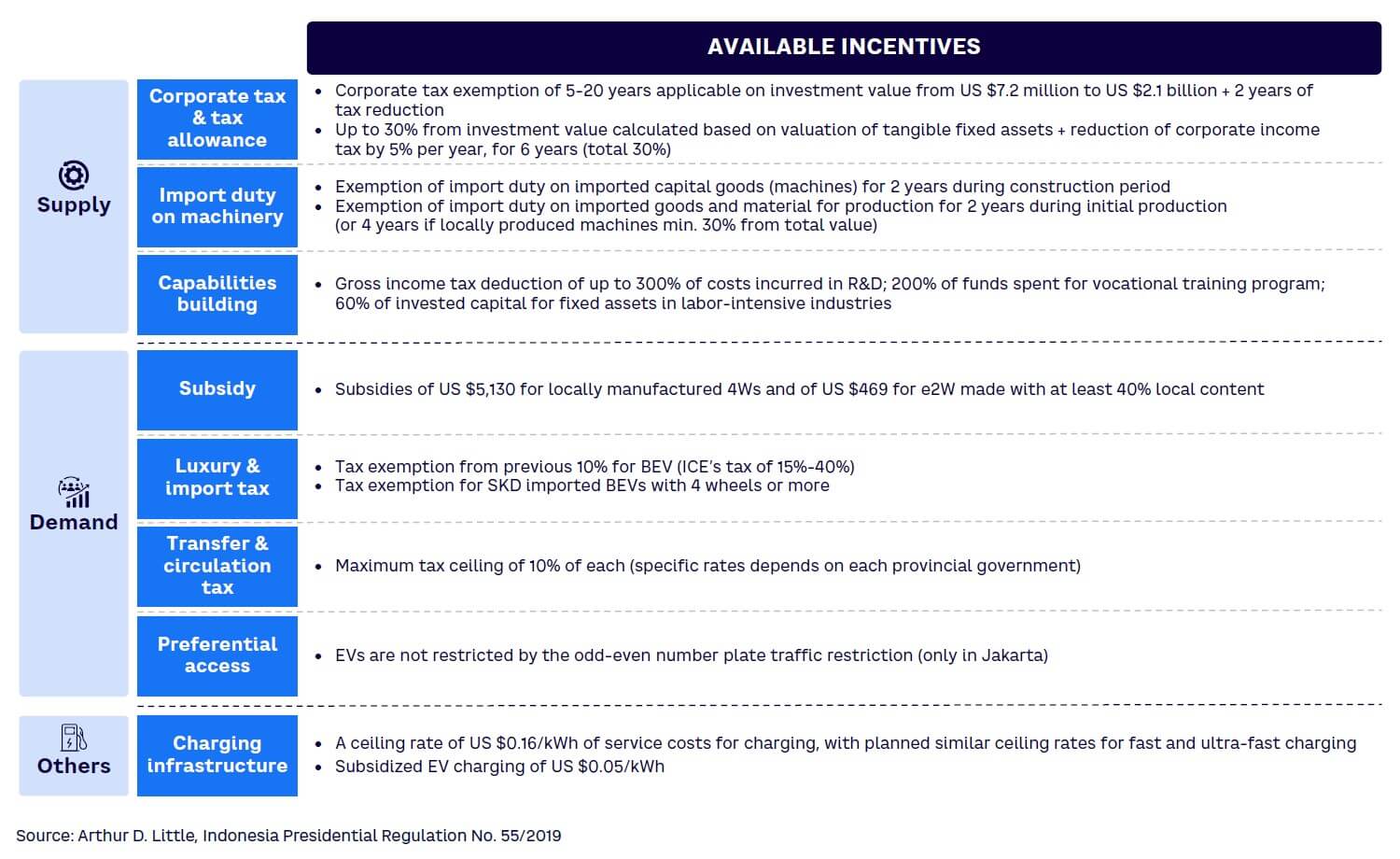

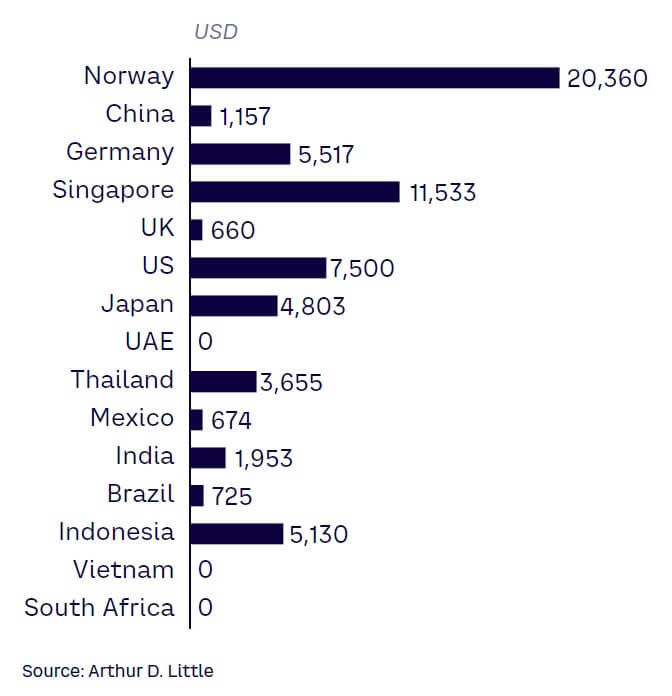

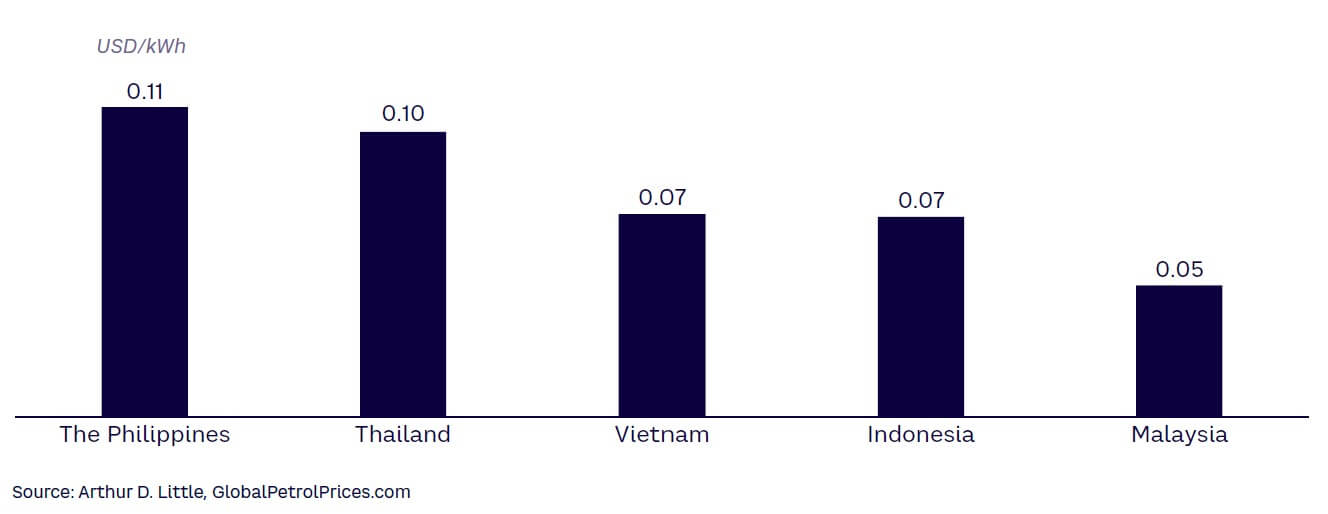

Indonesia provides several incentives to EV manufacturers, such as import duty exemptions for machinery and raw materials and corporate income tax reductions of up to 100% for five to 20 years, applicable on investment values between US $7.2 million and US $2.1 billion. EV manufacturers are also offered gross income tax deductions of up to 300% of costs incurred from R&D, technology innovation activities, and training to enhance capacity building in the EV industry. On the demand side, the government has introduced a subsidy of US $5,130 for e4Ws manufactured using 40% local materials, US $469 for locally produced e2Ws with 40% local materials, and exemptions from luxury sales tax on imported EVs. On the charging infrastructure, it offers customers a ceiling rate of US $0.16/kWh of service costs for fast and ultra-fast chargers and a subsidized rate for EV charging (US $0.05/kWh). There is no incentive for charging infrastructure operators at this time. However, EV adoption rate remains low despite these and other incentives offered by the government.

LOW ADOPTION FACTORS

-

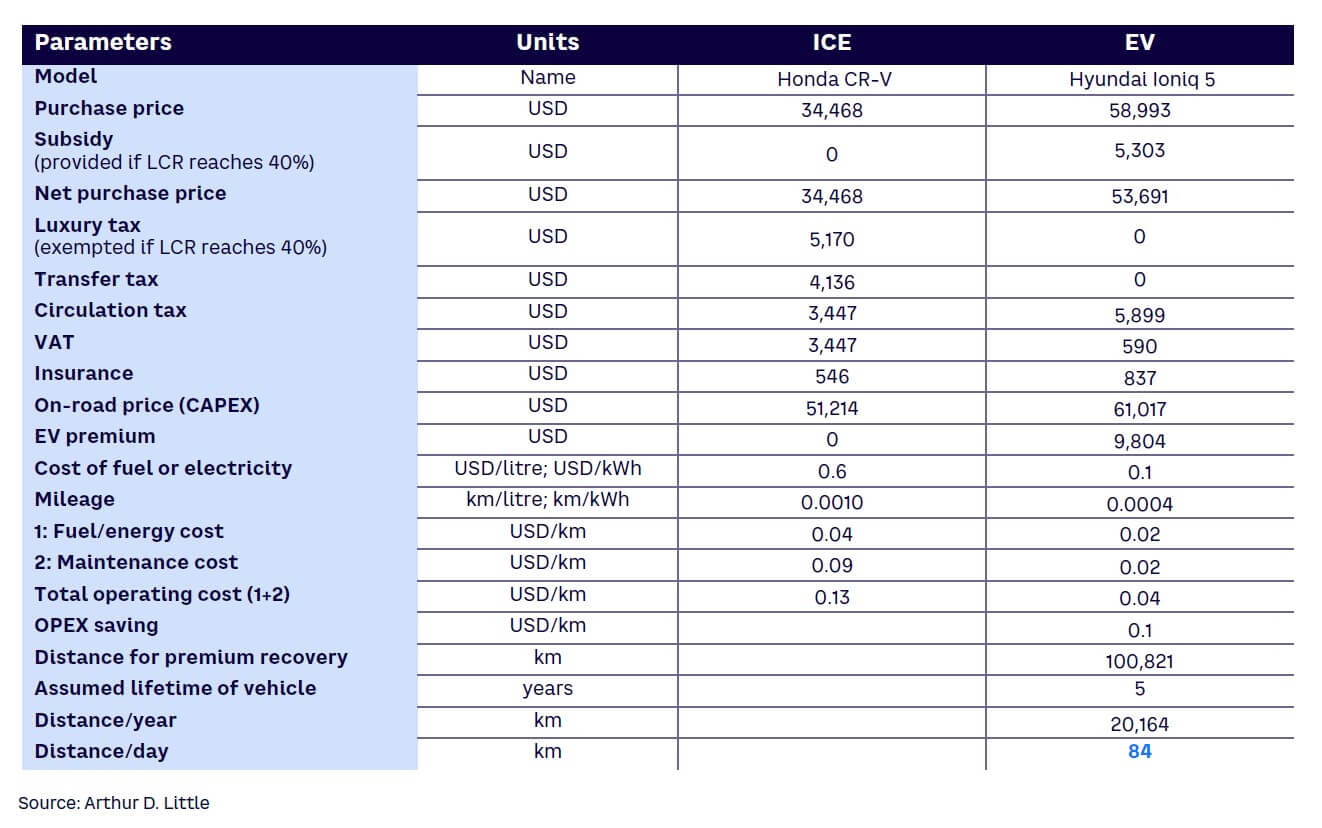

Vehicle affordability. The cost of an entry-level EV model starts at US $18,125 (Wuling Air EV), while a similar model of an internal combustion engine (ICE) vehicle starts at only US $9,825 (Daihatsu Ayla). Initial acquisition cost is important, given that individuals make purchasing decisions on up-front cost rather than entire lifecycle cost. An ADL analysis discovered that a driver must travel 84 km per day minimum to break even on the cost differences between an EV and an ICE, which is higher than the average daily driving distance in Indonesia of 34 km per day. As a result, current price differentials between ICE vehicles and EV vehicles limit B2C adoption.

-

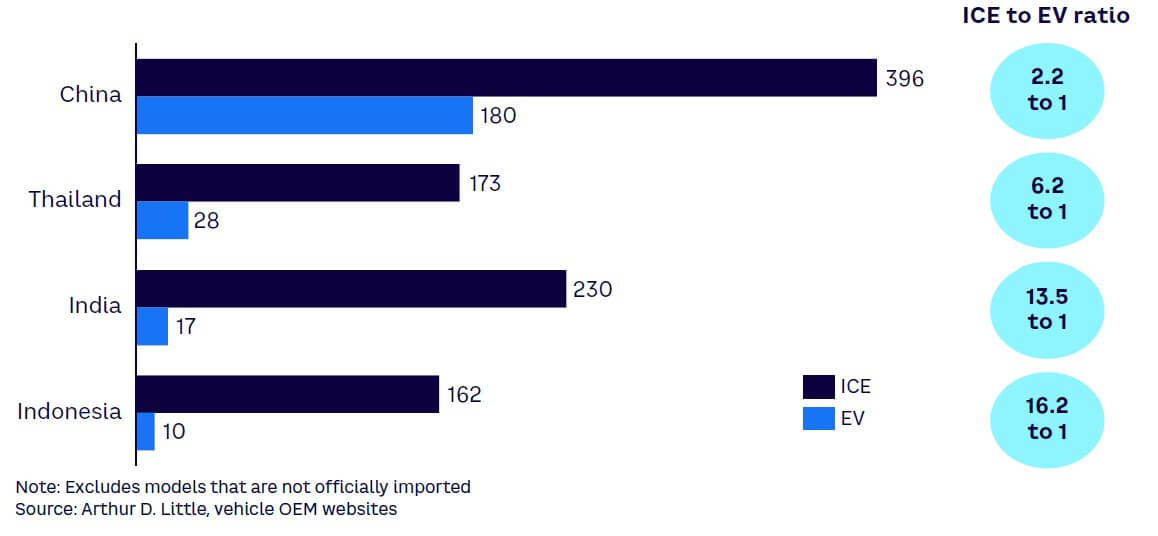

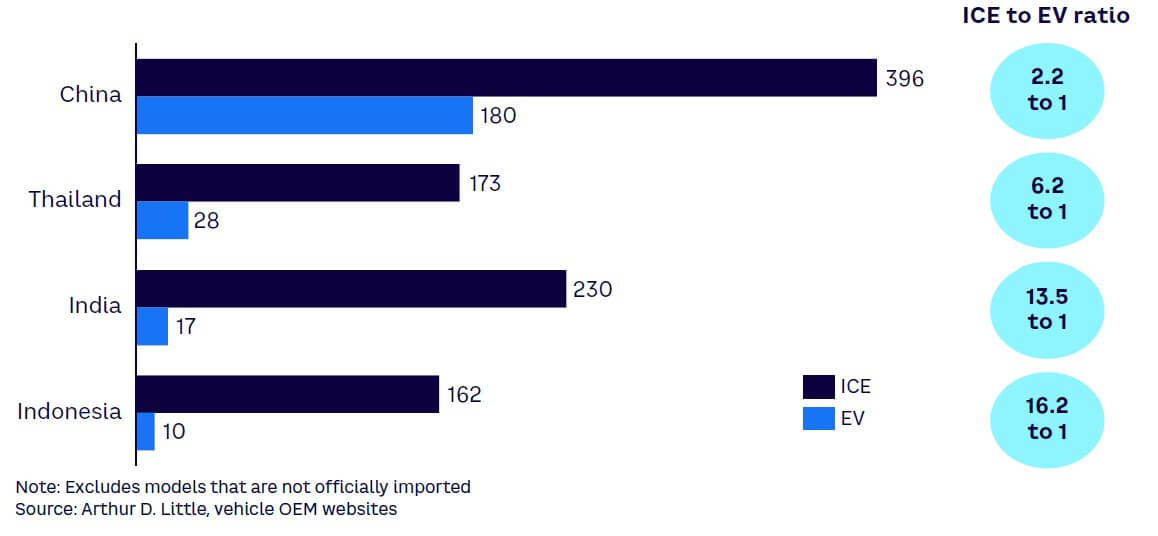

Coverage of EV demand subsidy is limited. Currently, the ratio of ICE to EV in Indonesia is 16:1, while market leader China’s ratio is 2.2:1, demonstrating a narrow difference between ICE and EV in terms of model availability. Only two models available in Indonesia, Wuling Air EV and Hyundai IONIQ 5, qualify for a government subsidy of US $5,130 because they are the only models to satisfy the 40% local material regulation.

-

Limited charging infrastructure. According to an ADL survey, over 65% of respondents cite a lack of sufficient charging infrastructure as one of the critical barriers to EV adoption. Currently, there is no incentive offered to charging infrastructure operators. Indonesia’s lack of progress on building charging infrastructure also delays EV adoption.

MARKET MOVEMENTS

Upstream: Commercializing local cell components/cell & pack production

-

Partnerships and joint ventures (JVs) have been created to process raw materials, such as nickel. In Indonesia, various companies have entered into partnerships and JVs to build new cell components and increase manufacturing capabilities. For example, PT Vale Indonesia partnered with China’s Zhejiang Huayou Cobalt and the US’s Ford Motor Company to work on nickel-processing projects. Indonesia’s Harita Group and China’s Ningbo Lygend Mining established a JV to build a high-pressure acid leaching (HPAL) plant, an eight-year supply agreement for nickel and cobalt from China’s GEM Co.

-

Cell components, such as cathodes, are being developed by nontraditional players. Chinese companies are intensifying efforts to secure a significant position in Indonesia’s upstream activities, especially for cathodes. In February 2023, Chinese chemical company Jiangsu Lopal Tech tapped into cell components by investing US $290 million to construct an EV battery cathode material production project in Central Java province, Indonesia.

-

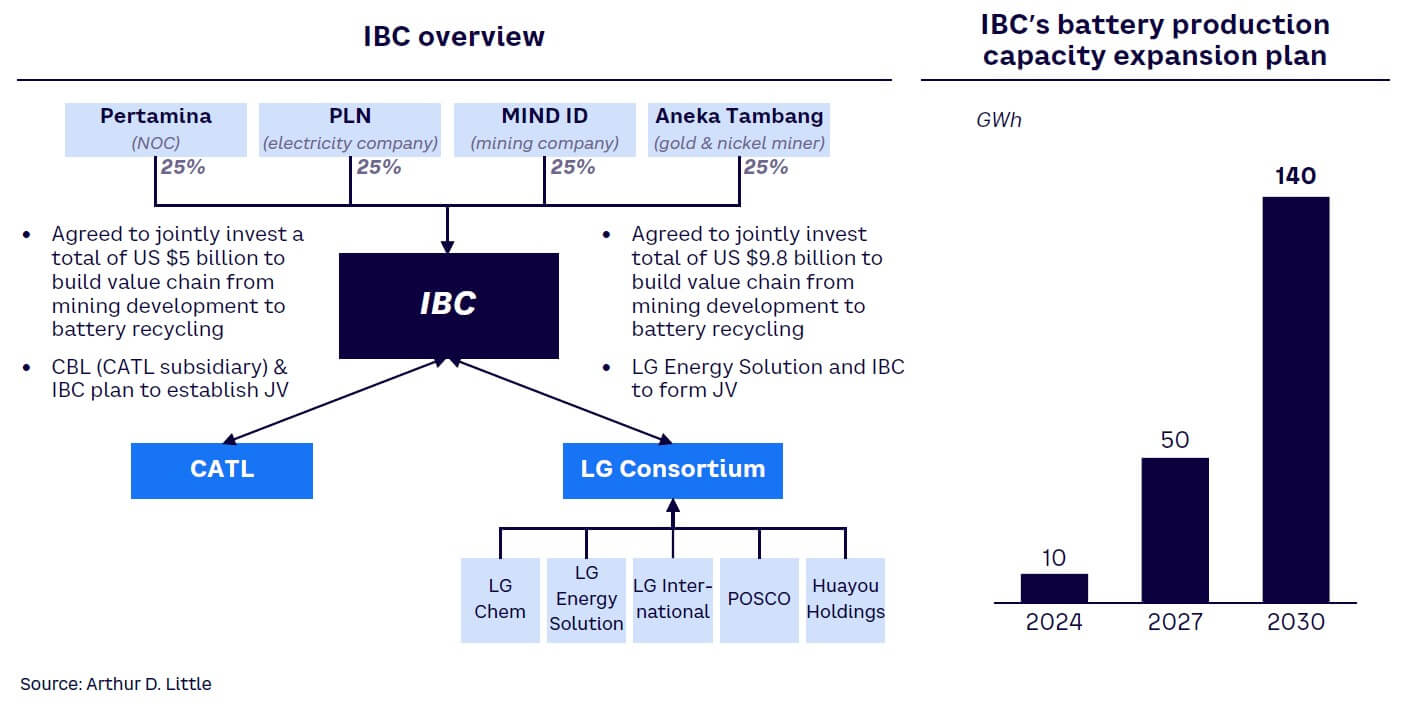

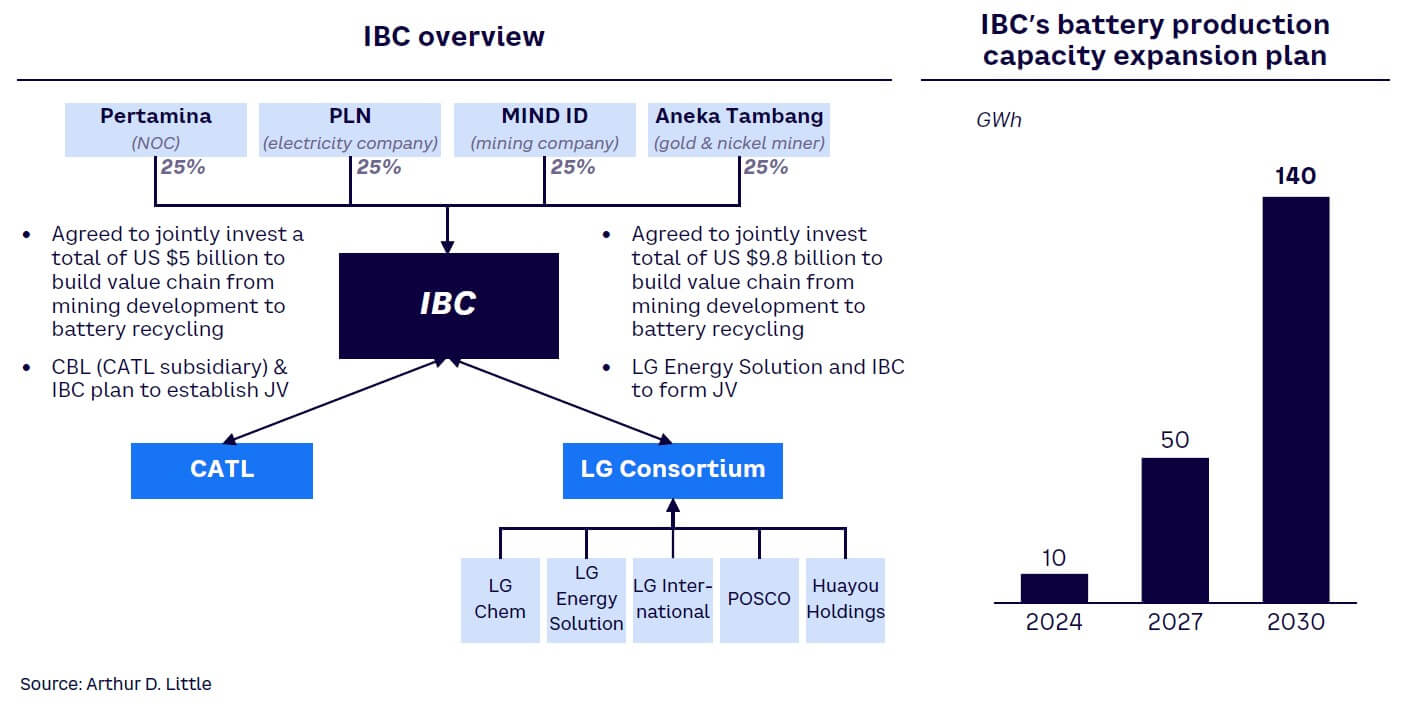

Indonesia Battery Corporation (IBC) is leading efforts to become a global LIB cell supplier with technological support from CATL and LG and a cumulative investment of approximately US $16.8 billion. In addition, IBC has already signed a memorandum of understanding (MoU) with Malaysia’s Citaglobal Bhd to produce EV battery cells and battery energy storage systems (BESS). EV OEMs are mostly doing pack assembly in-house. Indonesia mainly relies on overseas companies for BMS. VKTR is a prominent BMS vendor and the country’s only local option.

Midstream: Vehicle sales covering e2W, e3W & e4W

-

Japanese OEMs, such as Toyota, Daihatsu, and Honda, have yet to indicate concrete EV plans. However, other Japanese OEMs, such as Nissan and Mitsubishi, have a product on the market or have plans for one. In contrast, Korean OEMs, such as Hyundai, have set up production plants in Cikarang, Indonesia, to produce EVs. The US-based OEMs, like Tesla, are in discussions with Indonesian policy makers to build an EV production plant. European OEMs, including BMW and Daimler, also plan to launch EVs in 2023 in the passenger vehicle and commercial vehicle categories. In addition, Chinese OEMs Wuling Motors, Chery Automobile, SAIC-MG, and BYD Auto have commenced their EV push in Indonesia by launching EV models in 2022. Indonesia’s first national brand, PT Solo Manufaktur Kreasi, trading as Esemka, is making efforts to invite overseas partners to build EV platforms.

-

As of December 2022, only 21K motorbikes in Indonesia were electric, with top players such as Gesits Motors, Viar Motor Indonesia, and SELIS accounting for approximately 65%-70% of the market share. Seven years ago, these leading players entered the e2W space with assorted models, styles, and ranges to serve customer needs and preferences. Other local startups followed with similar strategies, including Volta Indonesia, Ilectra Motor Group, and Charged Indonesia, and launched their EV models in 2017, 2021, and 2022, respectively. In addition, Japanese OEMs, such as Honda, have announced plans to launch seven electric motorbikes toward the end of the decade. Honda is also collaborating with Panasonic to conduct a feasibility study on battery swapping.

Downstream: Charging infrastructure needs more traction

-

As the primary energy provider of EV charging in Indonesia, PLN is leading the way to supplying electricity to public and private charging stations. By 2023, PLN plans to install 24,720 public e4W charging stations (from the current 600) and 12K e2W charging stations (from the current 6,700). The company aims to partner with the private sector to install more charging stations.

-

Swapping and charging infrastructure operators are coexisting. A few local major companies, such as Astra Group, PT Starvo Global Energi, and Swap Energi, are at the forefront of charging infrastructure and battery swapping in Indonesia. Moreover, some oil and gas companies like Shell, Pertamina, and MedcoEnergi have also entered the swapping business, but with limited traction. Equipment providers ABB and Schneider Electric are in the market for charging infrastructure; however, they have a limited presence and are opting for a “wait and see” strategy.

Despite these initiatives, an ADL assessment predicts that the Indonesian government’s ambitious target will likely not be met, as projections indicate sales of only 81K e4Ws by 2030. A significant achievement is expected for e2Ws, with an estimated sale of 2 million BEVs within the same time frame. These numbers reveal a shortfall of 519K e4Ws and 450K e2Ws.

5 KEY CHALLENGES

ADL has identified five key challenges Indonesia needs to address to achieve its mission of becoming an EV vehicle and battery manufacturing hub. The four challenges are: (1) cautiousness of Japanese OEMs, (2) insufficient ambitions to expand charging infrastructure, (3) underdeveloped nickel processing, (4) LFP batteries threatening NMC’s existence, and (5) balancing regional dependence and national priorities.

1. Cautiousness of Japanese OEMs

Japanese OEMs account for a large share of Indonesia’s automotive industry and pose a significant challenge for the country as it aims to become an EV hub. Thus, the role of Japanese OEMs is paramount in developing Indonesia as an EV hub. Given Japanese OEMs’ low focus toward EV in general, Indonesia must focus on encouraging OEMs from other countries to lead the electrification revolution. Chinese OEMs and Indian OEMs are closely tracking the SEA market given the recent electrification push by the government.

2. Insufficient ambitions to expand charging infrastructure

Charging infrastructure can take the form of a home charging station, destination charging, or battery swapping. The Indonesian government is emphasizing battery swapping, given its focus on e2W; however, overall charging infrastructure is still limited. While the government has given PLN a mandate to expand the charging infrastructure, the pace of progress remains slow. The current absence of supply-side incentives for charging infrastructure limits prospective providers from entering the charging infrastructure market. This problem is something the government of Indonesia should address as it attempts to expand battery swapping via initiatives such as battery standardization.

3. Underdeveloped nickel processing

Thanks to its abundant nickel reserves, Indonesia has strong potential to produce nickel manganese cobalt (NMC) batteries to support EVs. However, it lacks the capacity for class 1 nickel production for the battery, which may hinder the country’s goals. Nickel, which can comprise about 10% of total battery cost, is a significant component in battery production. Indonesia holds the largest reserves of nickel in the world, giving the country a strategic opportunity for financial and economic growth. The level of importance is further increased as higher levels of nickel are processed within NMC-based cells. Nickel producers in Indonesia have mainly focused on class 2 mining and smelting but need more presence in class 1 production because class 1 nickel is needed for battery cell production. Most nickel demand is driven by the steel sector, rather than the battery sector. In addition, constructing a technology smelter for class 1 production is capital-intensive and complex. Hence, it is challenging for conventional nickel producers to upgrade their capabilities to class 1 production.

4. LFP batteries threatening NMC’s existence

Indonesia can leverage its vast nickel resources to produce NMC batteries, which have the advantages of high energy density and good charging performance at low temperatures. However, NMC batteries may be under threat because the characteristics of lithium ferrophosphate (LFP) batteries show greater potential, thanks to their longer lifespan, better tolerance and safety at higher temperatures, and longer lifecycle. LFP batteries have additional advantages:

-

LFP can store more power than NMC over time due to slower degradation.

-

Stable lithium chemistry makes LFP safer than NMC.

-

LFP batteries degrade less at higher temperatures than NMC, making them more suitable for low-cost EVs operating in hot temperatures.

-

A longer lifecycle gives LFP higher durability than NMC.

-

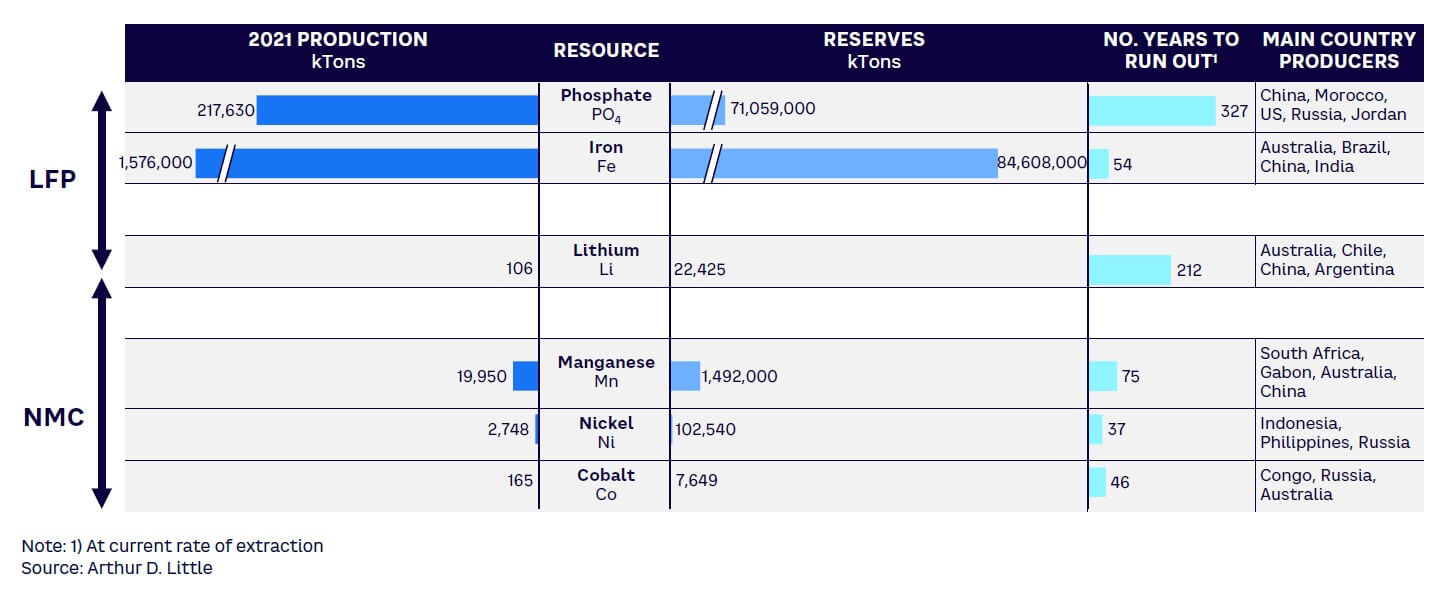

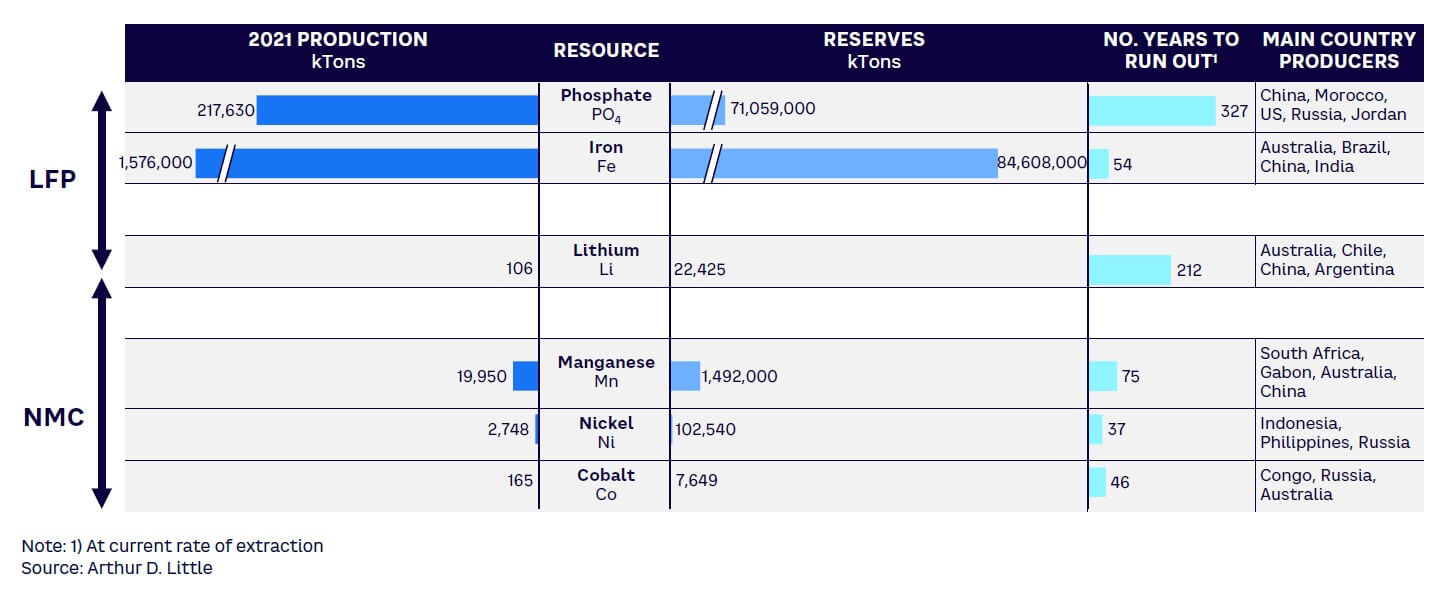

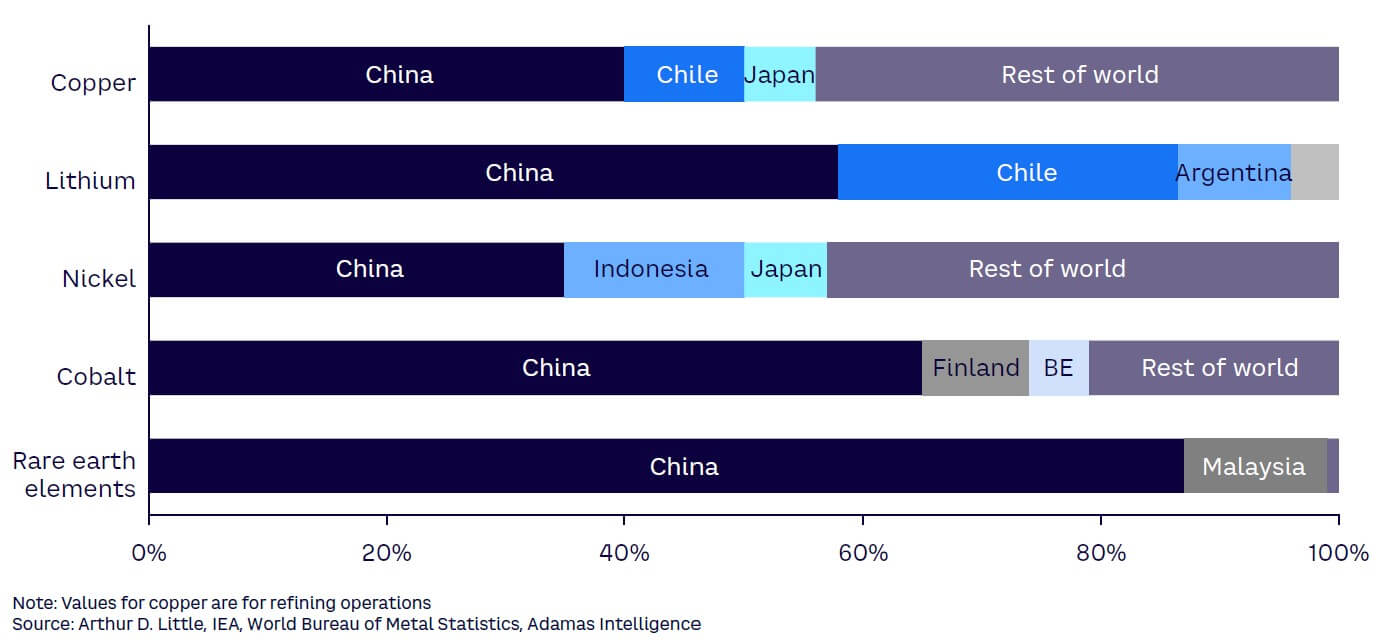

Compared to NMC, LFP has fewer supply chain risks. LFP’s major components are iron and phosphate, which have abundant sources, and, unlike NMCs, do not rely on nickel and cobalt, which are concentrated in only a few regions.

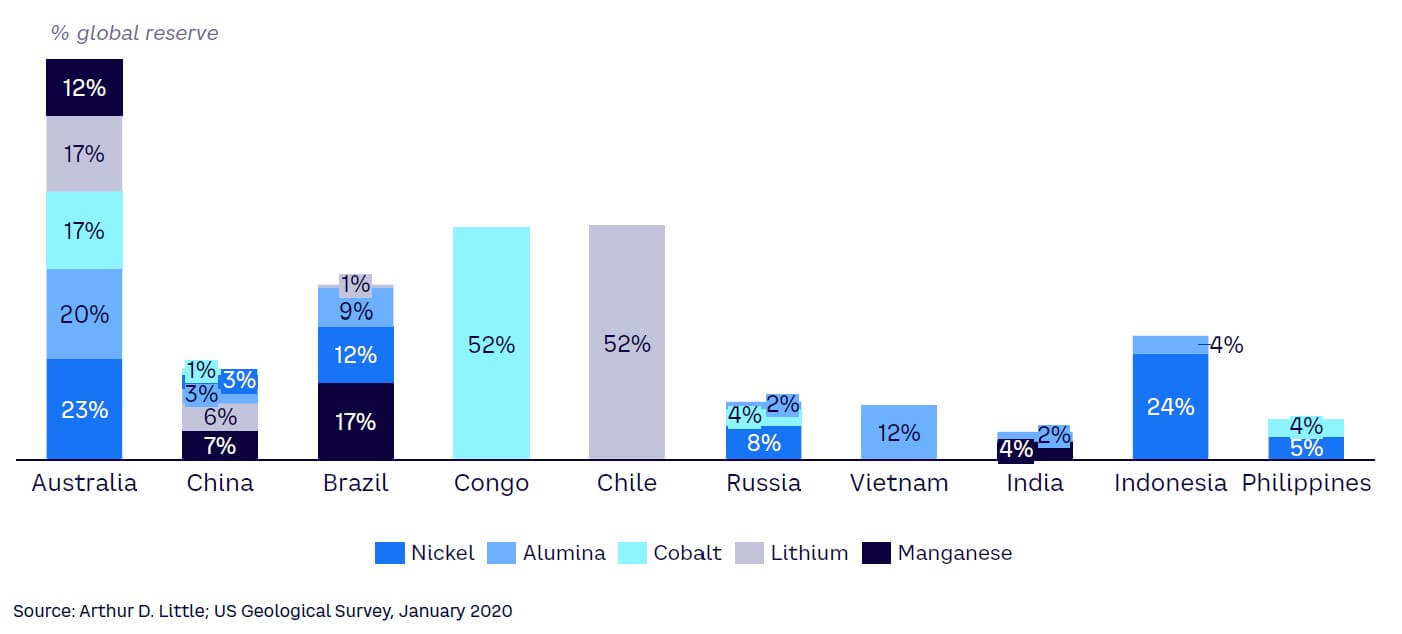

5. Balancing regional dependence & national priorities

Indonesia sources nickel locally but still depends on nearby countries for other minerals. The country’s overemphasis on local content regulation may trigger similar unilateral or bilateral responses from other countries, which would have negative implications for the supply chain. Indonesia depends on nearby countries, including Australia, India, and the Philippines, for other minerals. As some countries consider prioritizing local sourcing and local industries in developing their EV ecosystem, advocating for a national agenda can magnify supply chain risks for LIB cell minerals in Indonesia. According to ADL, Australia is expected to have a strong demand for xEV, including EVs. Australia may also aim to build its own LIB cell manufacturing plant, given China’s stronghold over LIB supply chain material and Australia’s plan to de-risk from China. If Australia’s LIB cell manufacturing industry accelerates, the government may impose trade restrictions on nearby countries, including Indonesia. Given the above challenges, ADL has developed a series of recommendations to manage them.

INDONESIA’S READINESS FOR ELECTRIC MOBILITY

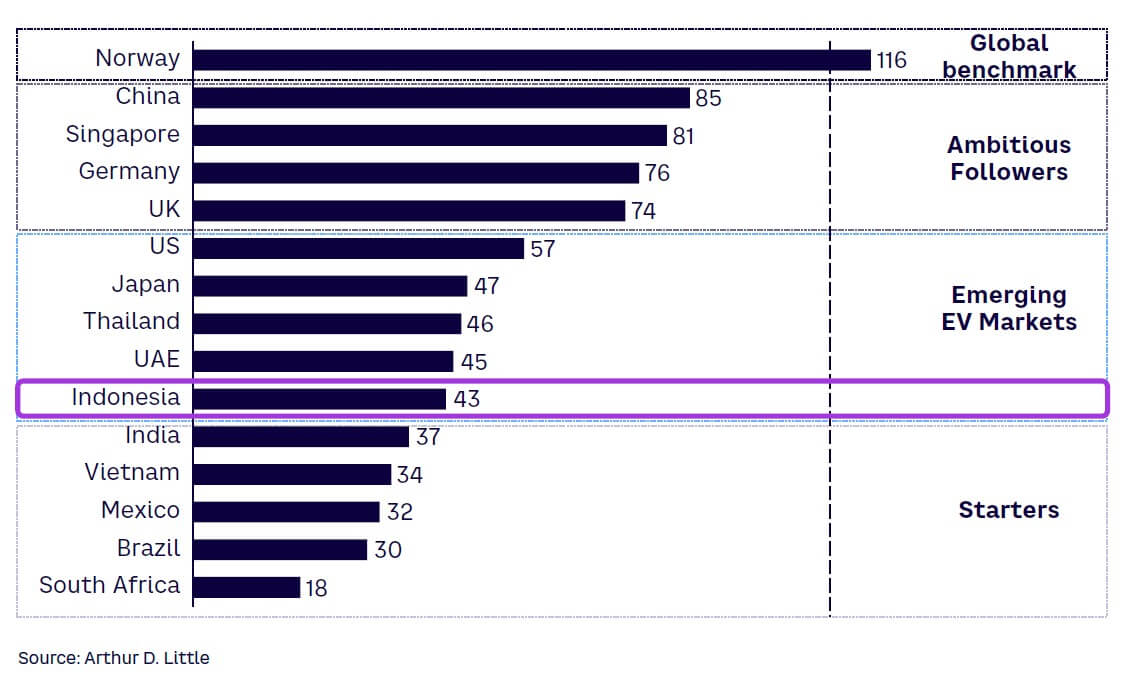

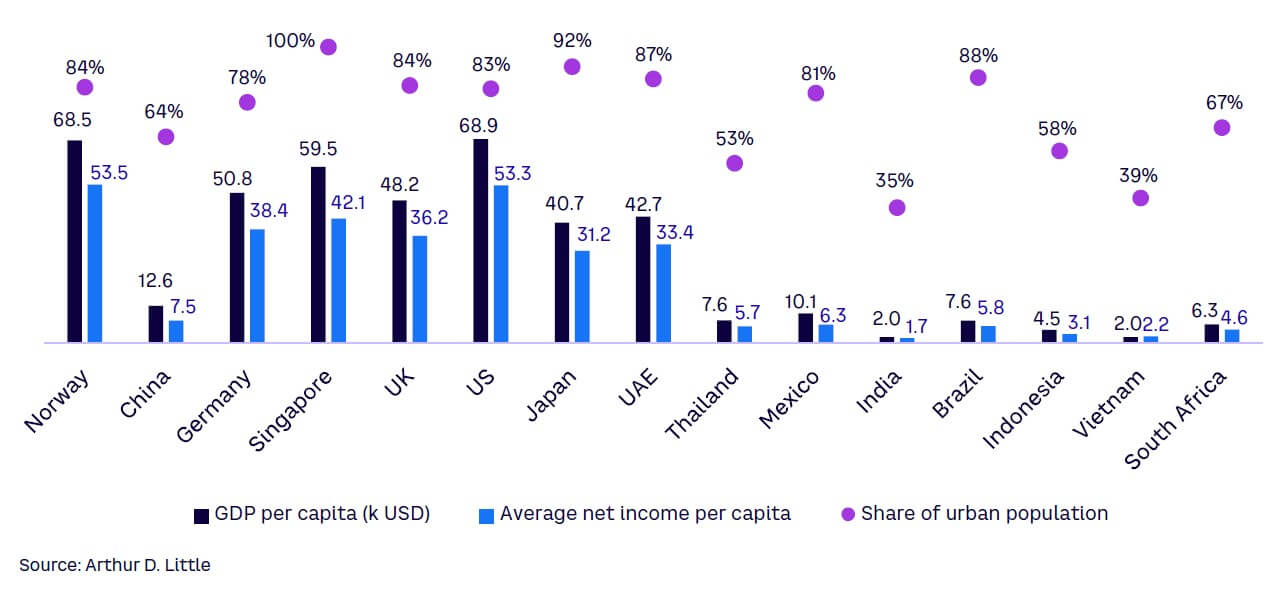

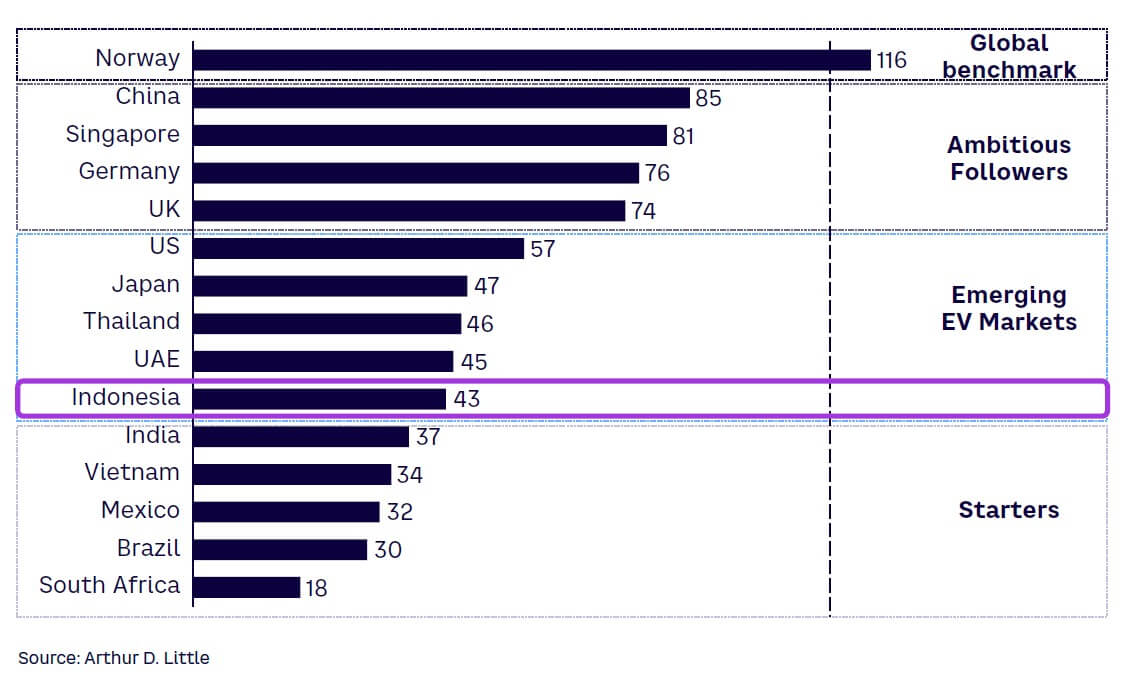

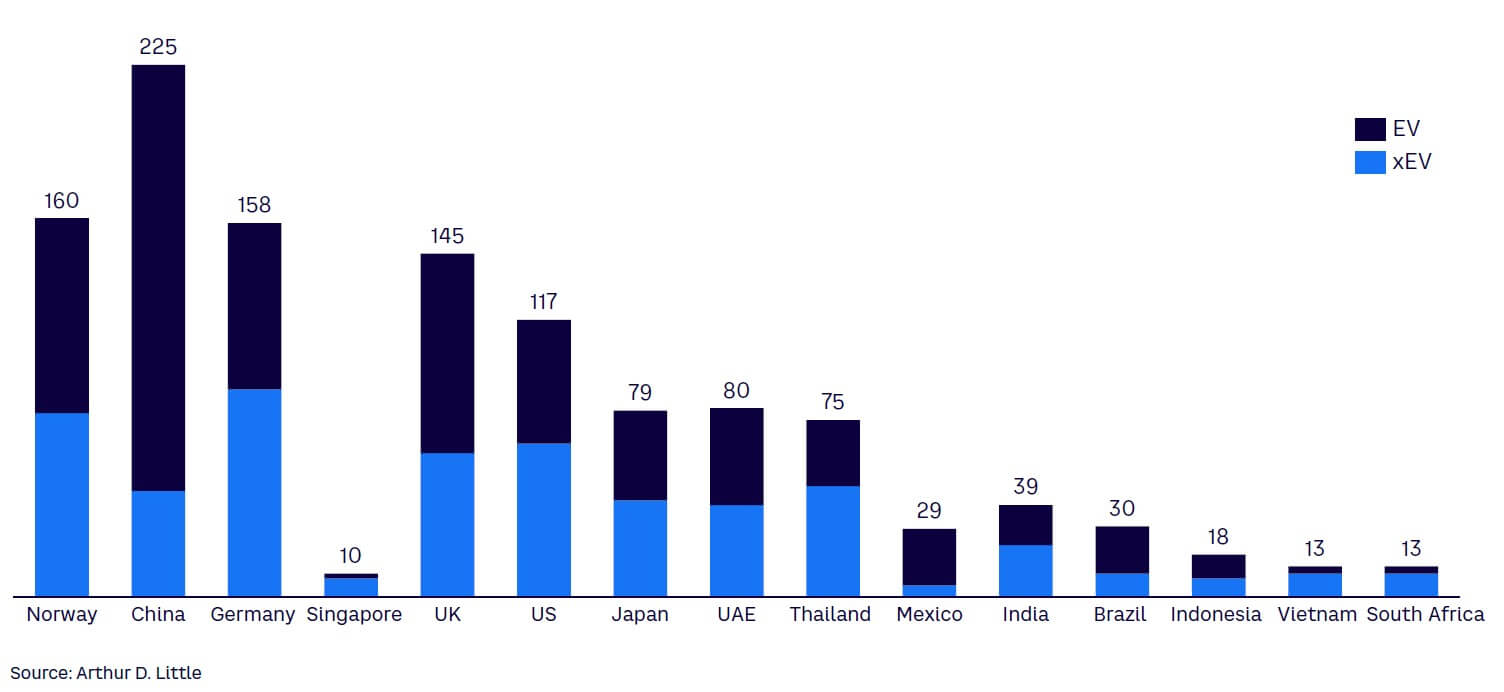

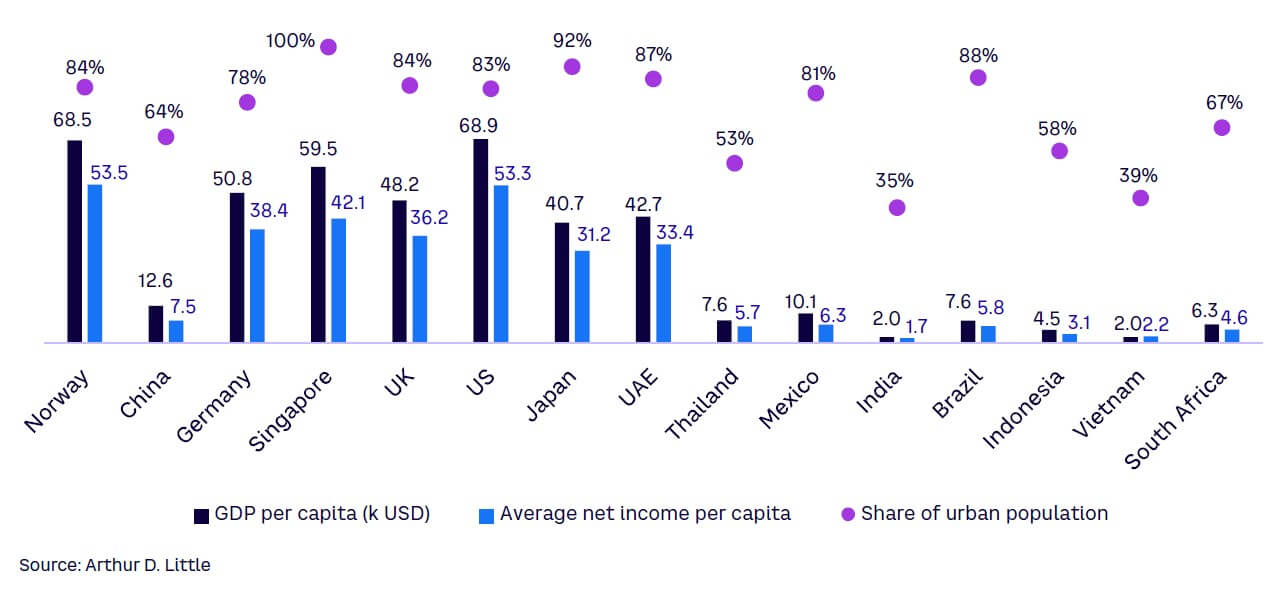

Globally, Indonesia is ranked among Emerging EV Markets, as per the ADL Global Electromobility Readiness Index (GEMRIX).[1] Indonesia’s position places it alongside the US, Japan, Thailand, and the United Arab Emirates. ADL sees enormous potential for future growth in Indonesia due to government support, upstream supply condition, and a strong demand base. The country’s current overall rank is 10 on our BEV readiness index. Charging infrastructure is a key issue that Indonesia should address and may determine its future performance. Although Indonesia’s EV industry is in its early stages, the EV market movement is attractive to the overall industry player and ecosystem.

Recommendations for the ecosystem

To support the EV transition, Indonesia needs to diversify by exploring Chinese and Indian OEMs and startups, which are more active in the region’s EV market. This will help ease Japan’s current dominance of Indonesia’s EV market. Chinese OEMs Wuling Motors, BYD Co., Great Wall Motor (GWM), SAIC-MG, Geely Auto, and others are already expanding into Thailand, Malaysia, and Vietnam. Indonesia should examine the potential of specialized incentives and investment promotion schemes to attract some of these OEMs. India-based OEMs Tata Motors and Mahindra & Mahindra (M&M), as well as India’s flagship ride hailing and e2W company Ola Cabs, plan to enter the Southeast Asia market in the near future.

In addition, the Indonesian government should consider a strategic approach to charging infrastructure deployment. First, it should provide incentives not only to consumers and users of charging infrastructure, but also to charging infrastructure providers and operators. Second, the government should leverage the network of Indonesia-based ride-hailing firms like Gojek, Blue Bird, and Grab to collect micro-level data about passenger movement to help charging operators plan their deployments and expansion. This micro-level data may also help convince financiers and credit issuers that a viable business case for charging infrastructure exists.

On the supply side, Indonesia should make the investments needed to upgrade its nickel infrastructure while proactively seeking overseas partners that can help improve and increase production of high-grade nickel. Based on ADL estimates, environmental, social, and governance (ESG)–related concerns may arise. Producing 1 kg of nickel in Indonesia generates 20-25 kg of CO2 equivalent. As Indonesia aims to expand its cathode supply overseas, it must consider this and similar factors and their environmental impacts. Competing in this market requires that environmentally friendly practices in nickel mining be introduced.

Indonesia must also focus on expanding its cell chemistry capability beyond NMC and LFP. Recently, LFP batteries have gained higher market share because they do not rely on nickel and cobalt for production, which are more expensive raw materials. LFP batteries are also more suited for energy storage system applications, a segment that may see strong battery demand.

As Indonesia develops new capabilities, it must also balance its national priorities of promoting local industry with its regional dependence. Indonesia should make the most of its favorable relations with Australia, the Philippines, and India and must look to consolidate its position through a more collaborative role with a focus on developing an LIB industry in this region through cooperation and support. Initiatives such as local content regulation and banning nickel exports may be counterproductive and may encourage other nations to impose unilateral or bilateral trade restrictions. These actions should be discouraged, as Indonesia can benefit from the support of these countries when developing their LIB industry and for other enablers for the EV ecosystem.

For example, Skill India, an Indian government project, has embarked on a re-skilling initiative in an after-sales service program to minimize disruption from EVs and diminish the threat of job loss. Such programs can be leveraged by Indonesia to make the workforce more future-ready. Other areas of support include inviting overseas EV component producers to set up local facilities in Indonesia and considering more targeted duty exemptions for selected EV components (e.g., motor, power electronics controller, battery management systems [BMSs]).

1

CURRENT SITUATION OF EVs IN INDONESIA

THE SIGNIFICANCE OF THE AUTOMOTIVE INDUSTRY

The sector’s dominant economic role

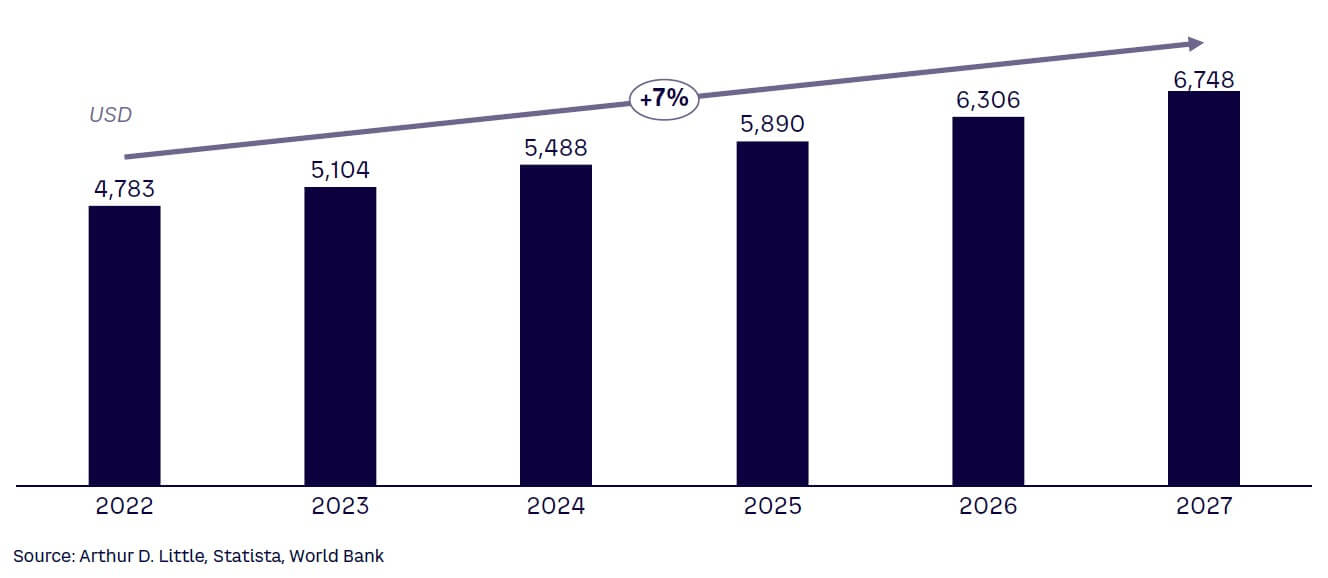

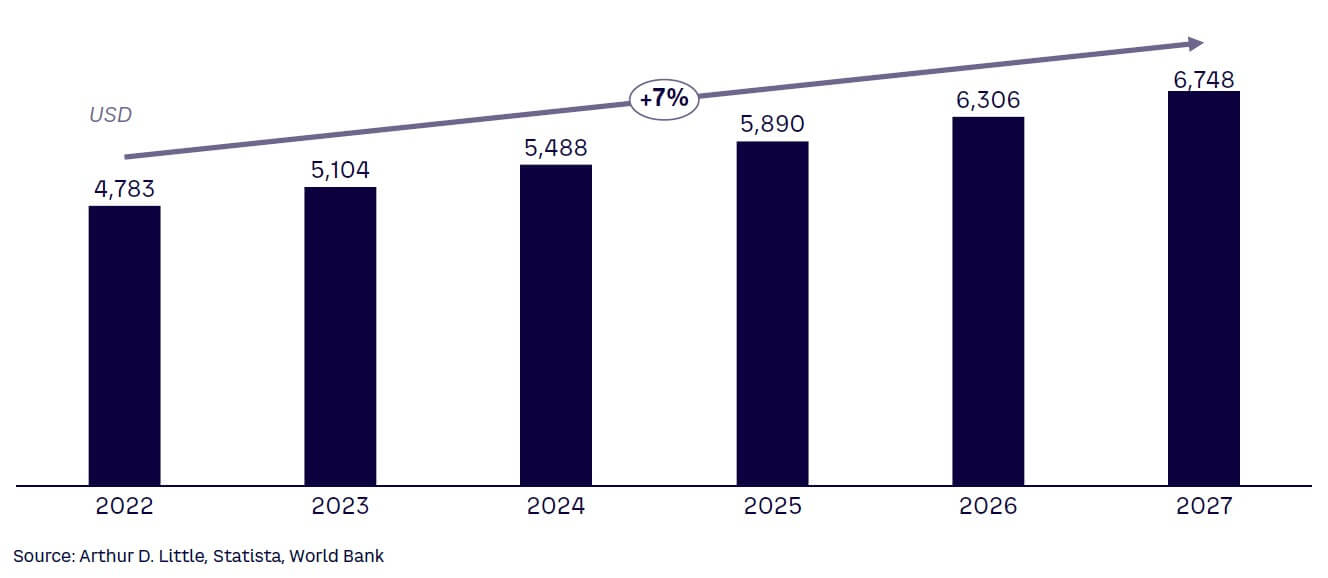

The automotive industry is among the key sectors in Indonesia, contributing 19% to manufacturing and 4% to GDP. On the supply side, the country is the second-largest vehicle producer in the SEA region, turning out 1.5 million 4W units in 2022. On the demand side, Indonesia has the world’s largest demand for 2W, with 5.4 million units sold, and ranks as the third-largest producer globally for 4W with 1 million units sold in 2022. According to the Indonesian Chamber of Commerce and Industry, the automotive sector is one of the country’s major employers, with 1.5 million people engaged in direct labor and 4.5 million employed in indirect labor, thanks to the huge demand-side and supply-side potential.

The industry’s growth has fueled the development of training centers and programs to provide workers with the necessary skills and knowledge to work in the automotive field. As a result, the skilled workforce becomes an alluring factor to attract foreign investment. In fact, the industry has seen a CAGR of 19% in foreign direct investment for the 2019–2022 period, with the US investing $1.5 billion in the country during 2022.

A source of forex reserves

Foreign exchange (“forex”) reserve management is a key priority for the Indonesian government, given the country’s dependence on oil imports and fluctuation of the Indonesia currency with the US dollar, implying the importance of maintaining the automotive sector’s continued presence as a key export industry. The automotive industry is one of the largest contributors to the country’s exports. In 2019, automotive exports accounted for around 7% of Indonesia’s total non-oil and gas exports, making it the second-largest non-oil and gas sector after electric machinery and electronics equipment. Given the importance of forex and debt management, the country has entered various free-trade agreements with its major regional and global trade partners, including Australia, South Korea, and Southeast Asia countries, to further make it an attractive base for export-oriented production.

Influence of CASE trends

CASE (connected, autonomous, shared, and electrification) trends in the region are impacting the global automotive industry with electrification and shared mobility as the dominant trends. The importance of the electrification trend is more pronounced, given the concerted efforts across the globe toward decarbonization and sustainability. All major economies — global and regional — have announced aggressive electrification policies, including some of the major automotive hubs in the Asia-Pacific region (APAC). India has a target of 30% EV penetration among private automobiles, 70% among commercial vehicles, and 80% among 2Ws and 3Ws, while Thailand announced its zero-emission 30@30 policy, which stipulates that the manufacturing capacity of zero-emission vehicles must reach 30% of total capacity by 2030. In order to boost domestic manufacturing, these major countries have also focused on attracting supply-side investments.

In 2021, the Indian government introduced the Production Linked Incentive Scheme (PLI) for the automobile and auto components sectors, providing incentives to automakers based on milestone-based production targets. This is expected to reduce the cost of advanced components by 15%-20%. In June 2022, the Thailand Board of Investment announced a similar new measure offering a 90% reduction of import duty for five years on raw and essential materials for EVs and high-energy-density battery producers, provided the output is sold domestically. With the global trend moving toward electrification and major economies in APAC aiming to establish itself as a global manufacturing hub for EVs, Indonesia must pivot and embrace electrification as a key trend to remain competitive in the global automotive production market.

THE CASE FOR EVs

Cleaning up the environment & meeting net-zero targets

Indonesia’s commitment to achieving net-zero emissions by 2060 is underscored by the need to decarbonize the transport sector. According to 2019 data, the transport sector is the second-biggest contributor of GHG, accounting for 27% of the country’s emissions. Furthermore, pollution in Indonesia has been on the rise; between 1990 and 2018, GHG increased 313.47%, resulting in an economic loss of over US $220 million (6.6% of Indonesia’s GDP purchasing power parity in 2019 alone, as reported by the World Bank).

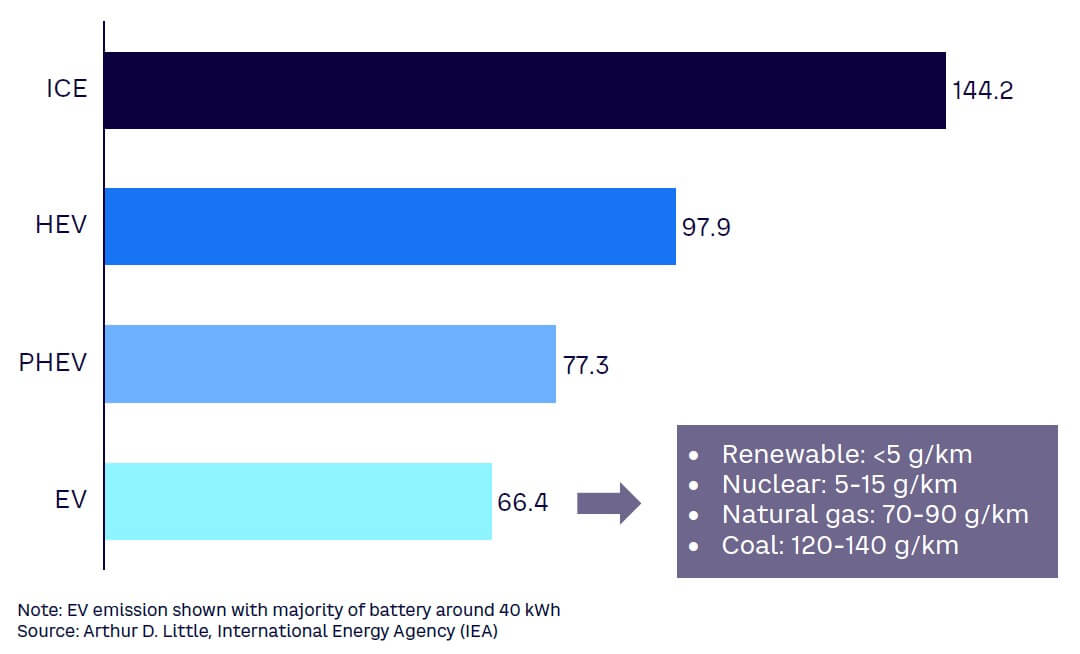

To address the GHG increase and attain its net-zero goal, Indonesia submitted an enhanced nationally determined contribution to the United Nations Framework Convention on Climate Change in 2022, which outlined its plans to reduce emissions by 32% (without any support) and by 43% (with conditional support) by 2030. Prioritizing xEV, especially EV, is therefore vitally important, given its critical role in emissions reduction (see Figure 1).

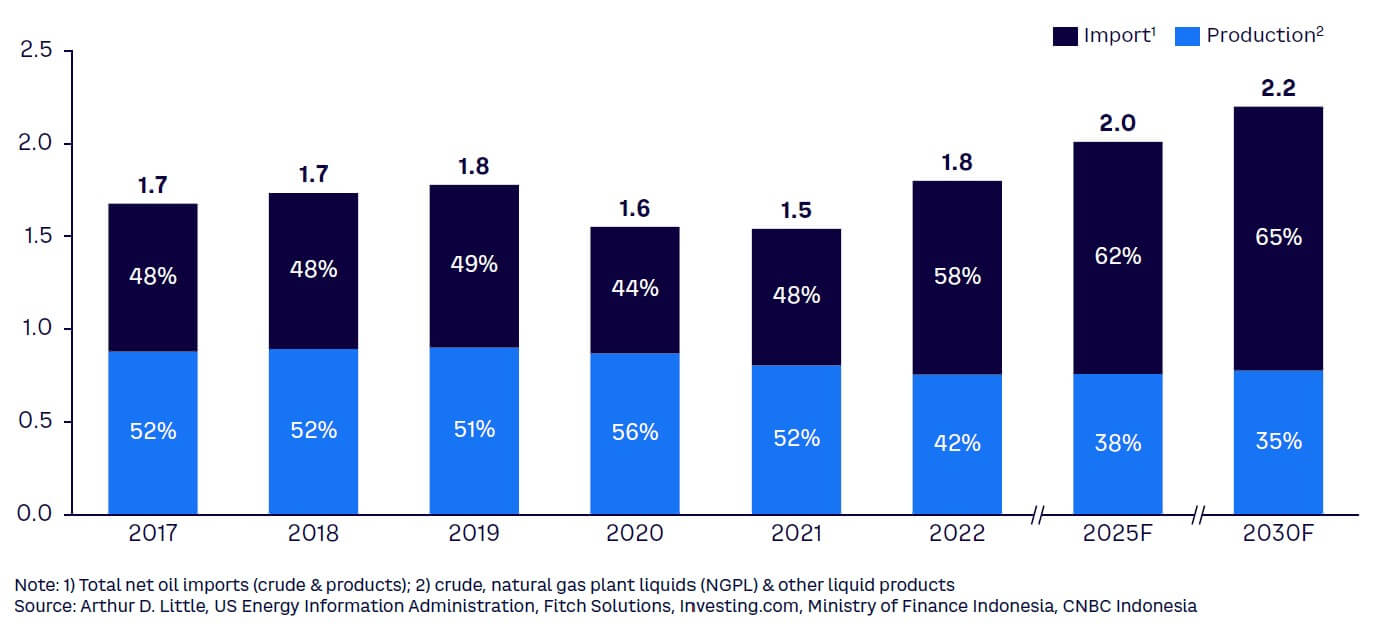

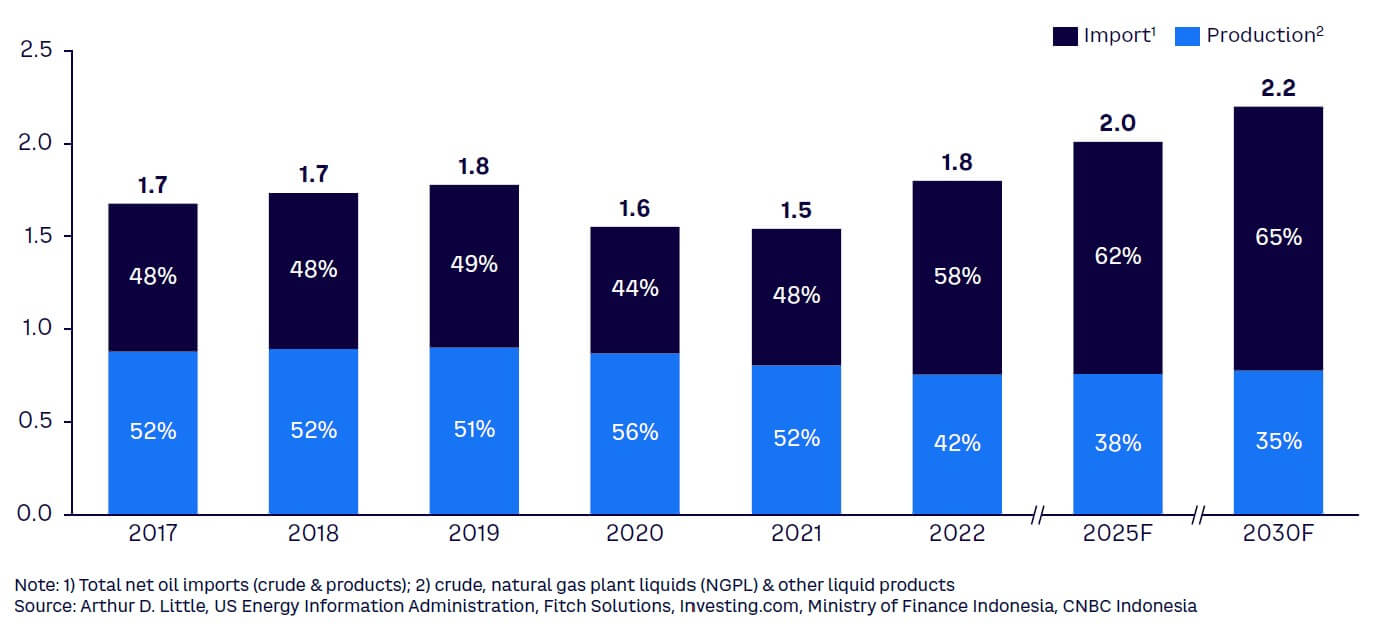

Reducing reliance on costly oil imports

The growth of EVs presents an opportunity to reduce reliance on imported oil, which in turn would reduce dependence on external oil reserves. According to Figure 2, imported oil made up 58% of Indonesia’s oil demand in 2022. High dependence on imported oil, combined with the frequent depreciation of local currency against the US dollar, escalate expenses for oil imports, which constituted US $29 billion in 2022, or 1.7% of GDP. This situation is a significant drain on Indonesia’s financial resources and highlights the need for the country to prioritize the adoption of EVs.

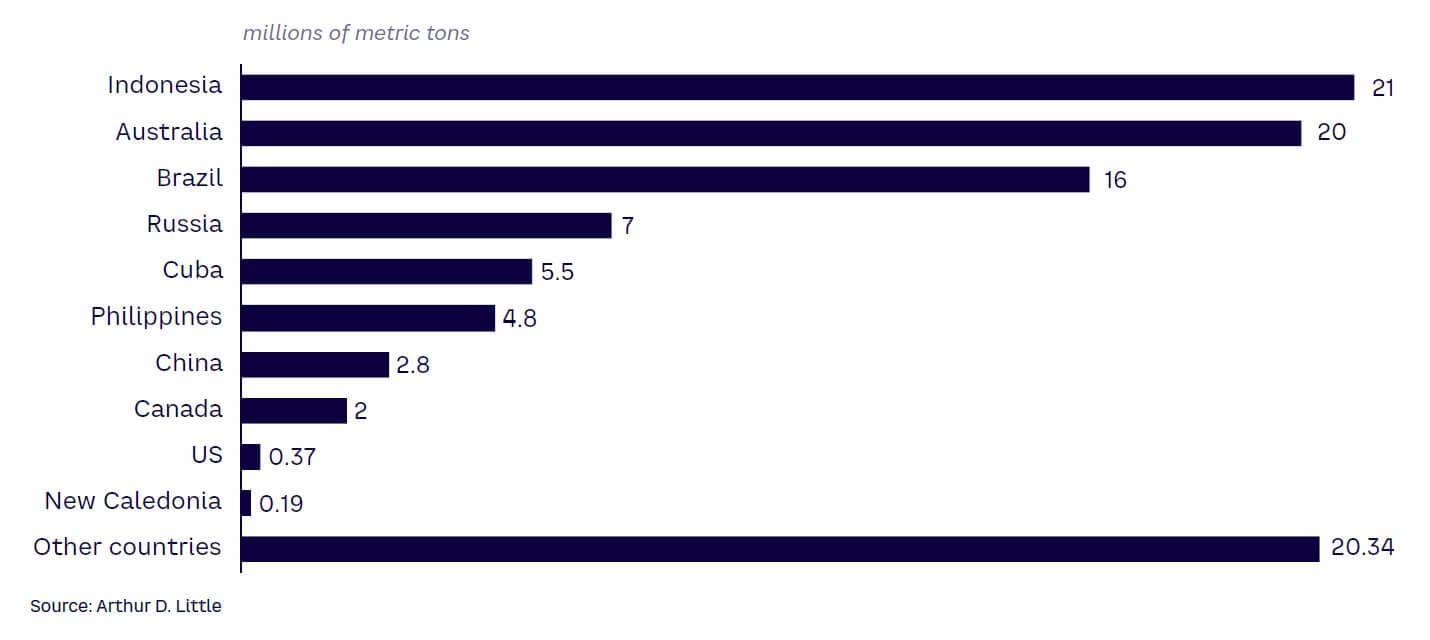

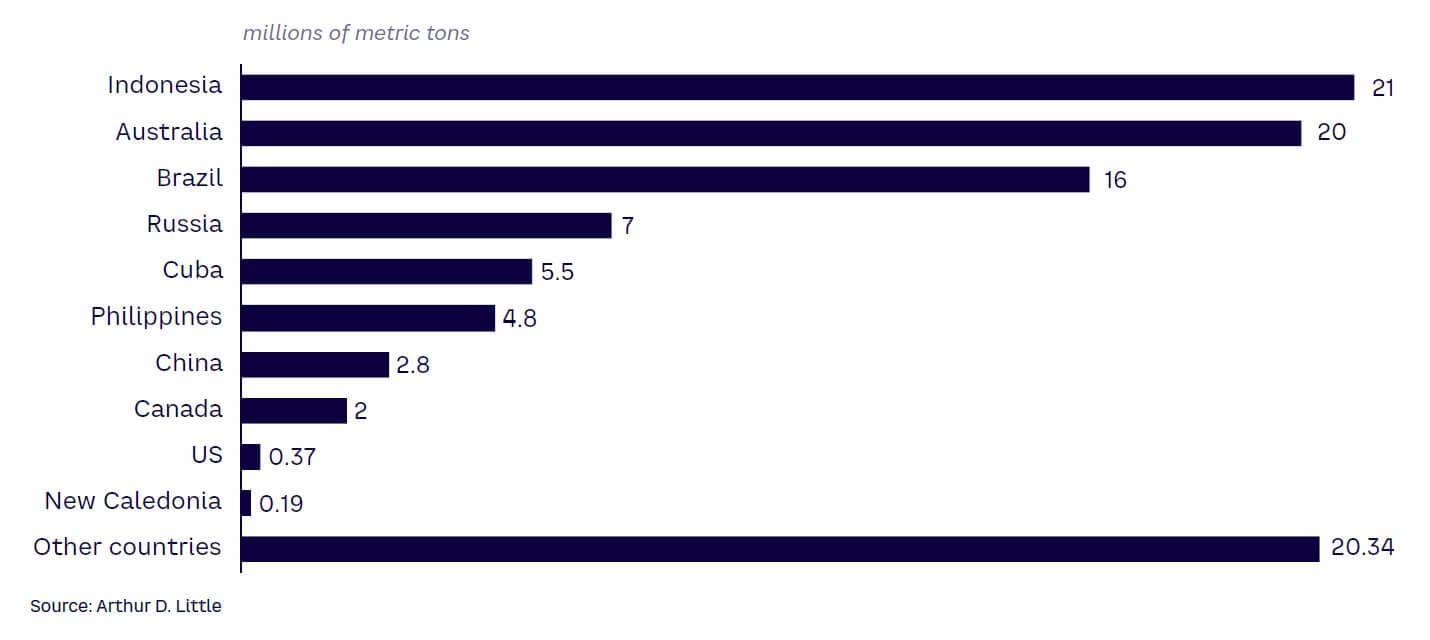

Tapping abundant nickel reserves

Indonesia has one of the largest nickel reserves in the world, making it a major player in the global nickel industry. The country’s nickel reserves are estimated at approximately 21 million metric tons (see Figure 3). This abundance presents Indonesia with a significant opportunity to focus on the upstream part of cell manufacturing and become a major figure in the EV value chain.

In fact, Indonesia’s large nickel reserves places it in an advantageous position to commence local production of cells and batteries, which may make vehicles more affordable. LIB cell material prices have been a serious concern for cell manufacturers, given the recent price fluctuations of critical materials. Substantial local demand and potential export opportunities offer Indonesia the chance to realize its dream of becoming one of the top three EV battery OEMs by 2027.

Developing a homegrown EV brand

Indonesia has both environmental and financial motivations to embrace electrification. However, ADL believes that electrification is also an opportunity for Indonesia to develop a homegrown EV brand. All major automotive economies have their own OEMs, which helps them gain strategic advantages in prioritizing their national agendas. In Thailand, PTT recently announced a JV with Foxconn to enter EV manufacturing. Similarly, India has several local OEMs, such as Tata and Mahindra. While Indonesia has Viar and Gesits, e2W OEMs, it lacks a local 4W OEM. The option of a local 4W OEM is important for three reasons:

-

The demand perspective. Battery demand is driven by the larger capacity of 4Ws. For example, 4W Wuling Air has a battery capacity of 17.4 kWh, while the Indonesian-made Viar Q1, a 2W vehicle, has a battery capacity of only 2 kWh.

-

The innovation perspective. Batteries for 4Ws are designed for longer drives and power car functions like air conditioning and infotainment features. These higher-capacity batteries drive innovation in battery technology.

-

The strategic interest perspective. Input from a local OEM can assist the Indonesian government in prioritizing its national agenda. In rural India, Mahindra Electric partnered with Common Service Centers, a government agency that creates employment opportunities in rural India, to promote EV adoption. Providing EVs to rural customers helps penetrate rural markets and boosts momentum in achieving the country’s EV mission.

INDONESIA’S xEV TARGETS

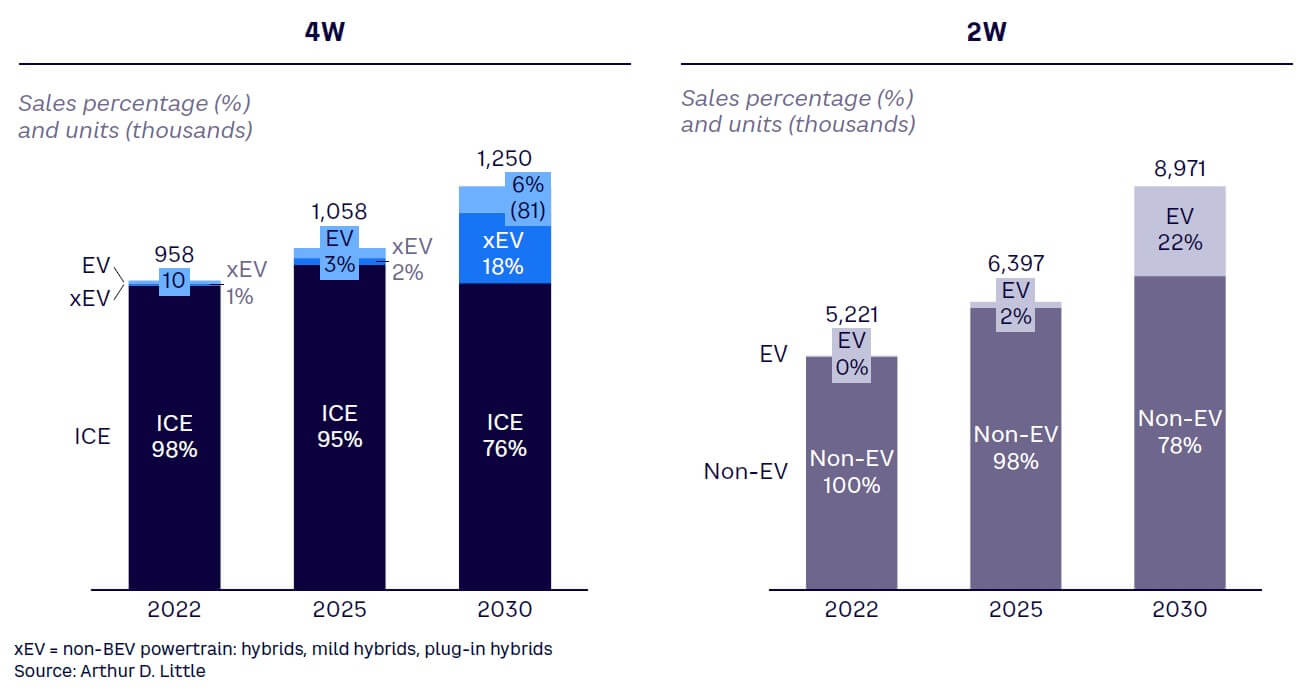

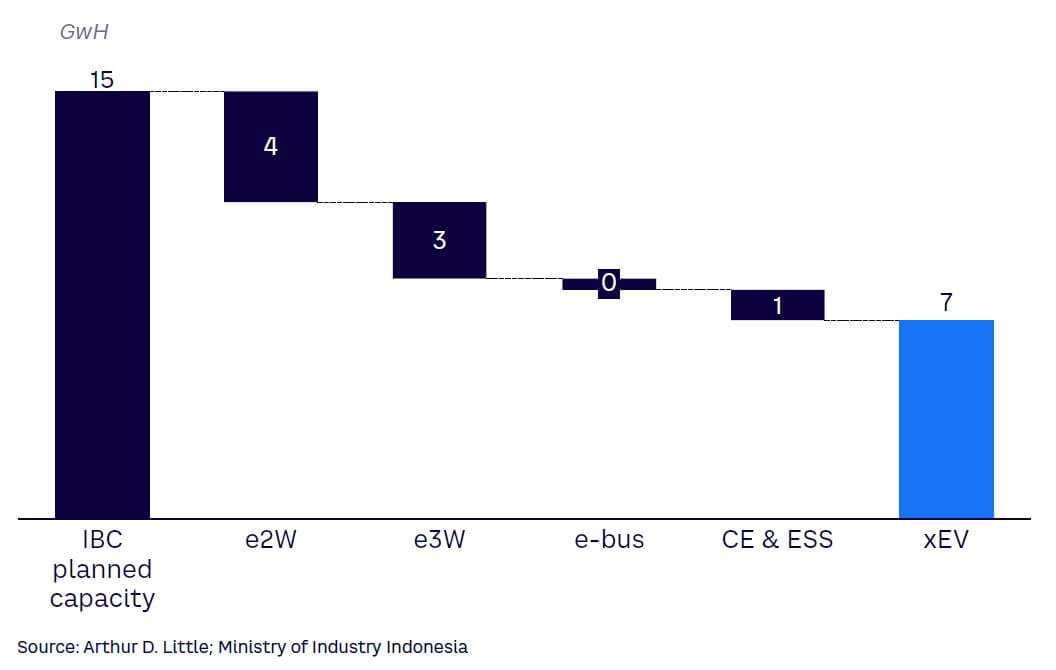

Indonesia’s Ministry of Industry outlined its plans to produce 400K BEVs by 2025, as shown in Figure 4. It intends to raise production to 600K by 2030. The manufacturing target for e2Ws is 2.45 million by 2030.

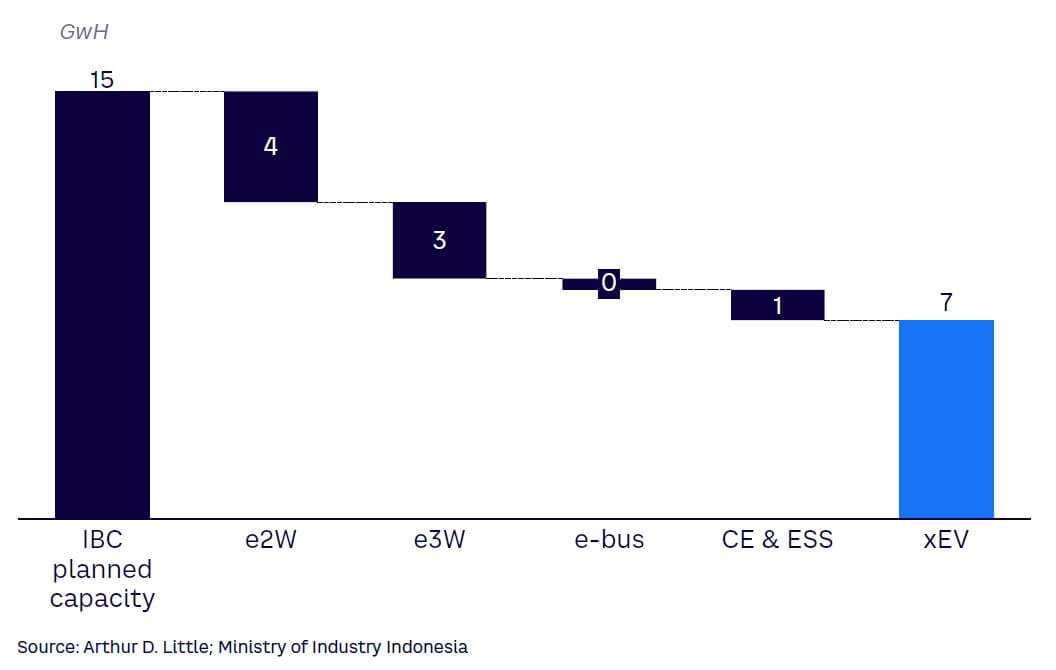

The government’s target is ambitious, given 2021’s sale of only 259 e4Ws and 5,486 e2Ws. By the end of 2022, e4W sales totaled around 10,327 vehicles, led primarily by Wuling, while 25,782 e2w vehicles were sold. Indonesia’s ambitious target also grew from the IBC’s plan to build an initial battery capacity plant of 10-15 GWh, which is expected to be ramped up to 20 GWh. An ADL internal analysis found that Indonesia would need a bare minimum of 340K EVs (amounting to 56% of the 600K original target) to meet the capacity of 15 GWh from domestic demand. For this calculation, ADL assumes that 50% of the capacity can be met via e2W, e3W, consumer electronics, and energy storage applications, while 7 GWh would have to be met from passenger vehicles (see Figure 5).

Based on the market projection of hybrids from ADL internal data and average battery capacity in different hybrids (full hybrid, mild hybrid, plug-in hybrid), only 0.5 GWh can come from this type of vehicle, implying 6.5 GWh must come from EV. While EV models available in Indonesia are limited, India serves as a comparable case of average battery capacity, which can meet Indonesian consumer driving needs and requirements. For this purpose, a battery capacity of 19 kWh has been assumed, resulting in an estimated EV sales volume of 340,000. This is based on 15 GWh domestic capacity and can be higher and closer to the 600K set by the Ministry of Industry if Indonesia expands its battery capacity more aggressively or the expected export market is not able to bring in the resulting 5 GWh of planned sales.

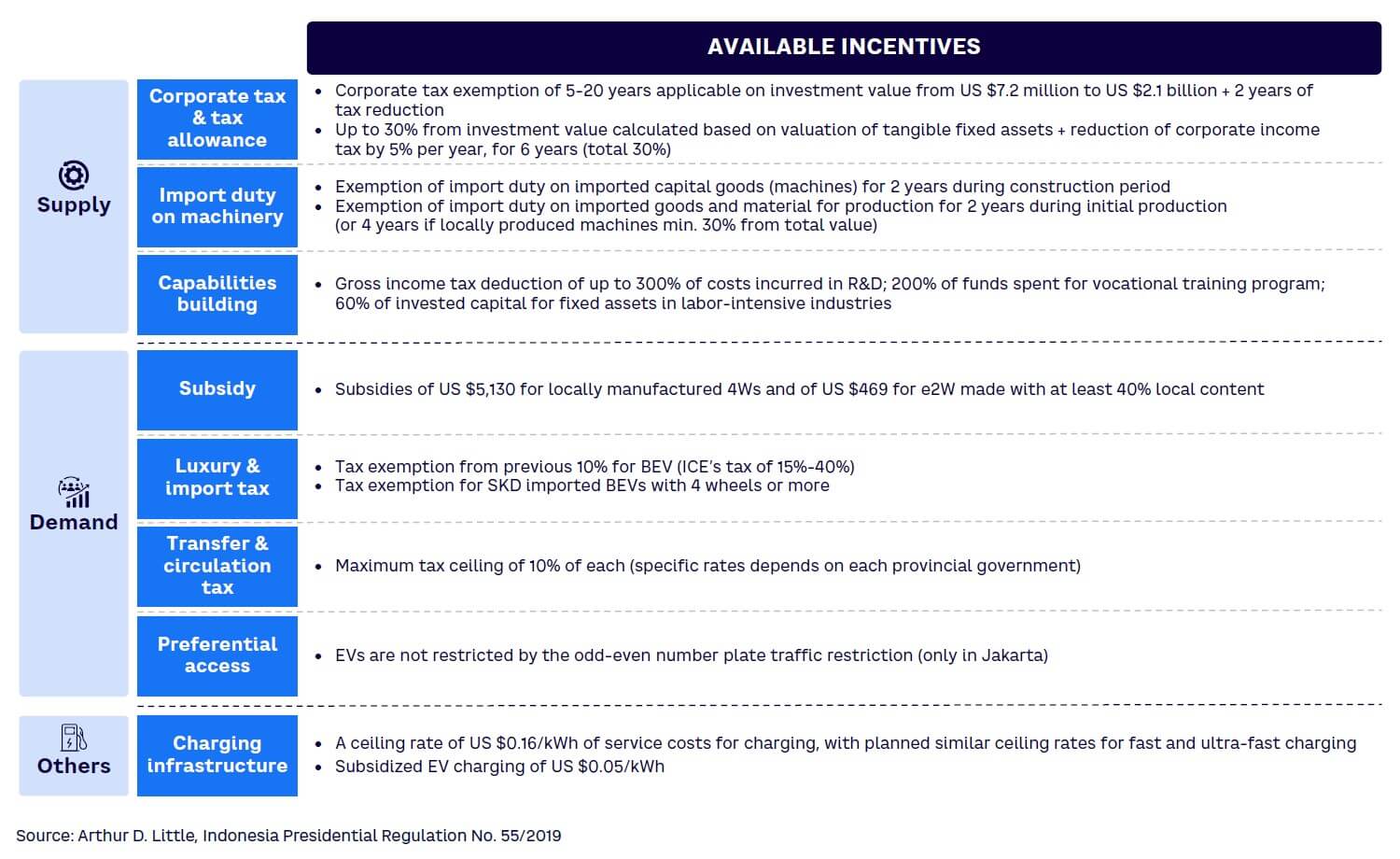

GOVERNMENT EFFORTS TOWARD xEV TARGET

The Indonesian government announced incentives for xEVs in 2013 through the LCEV program, while Presidential Regulation No. 55/2019 was the first regulation to specifically address the scope of EVs and offer guidelines on building domestic manufacturing capabilities and deploying charging infrastructure, along with fiscal and non-fiscal incentives related to EVs for industries and end users (see Figure 6).

On the supply side, several incentives for manufacturers have been introduced to stimulate xEV production. Investment incentives include tax holidays, corporate income tax (CIT) reductions of up to 100% for five to 20 years, applicable on investment value from US $7.2 million up to US $2.1 billion, and import duty exemptions for machinery and raw materials used in EV production. Moreover, costs incurred in R&D, technological innovation activities, and training are eligible for 300% of their value to be deducted from taxes.

On the demand side, the government has introduced subsidies US $5,130 on every electric car sale and has lowered value-added tax (VAT) on battery-based electric cars and buses from 11% to 1% from April-December 2023. However, these incentives are limited to two models (Hyundai IONIQ 5 & Wuling Air EV) that meet the local content requirement of comprising 40% local materials (see Figure 7).

EV purchases are also exempt from certain taxes such as the luxury sales tax, which is typically 15%-40% for an ICE. EVs are also exempt from transfer (one-time payment at transfer of vehicle ownership) and circulation tax (paid annually), which are usually at around 12% and 2%, respectively, for an ICE. Furthermore, to boost the availability of EV models, the Indonesian government has allowed imports of EVs in semi-knocked-down (SKD) form at 0%, which is typically 7.5% for xEV and ICE. On the non-fiscal side, EVs are not restricted by the odd-even ruling in Jakarta.

For charging infrastructure, a ceiling rate of US $0.16 per kWh has been put in place with the government planning to introduce a similar ceiling rate for fast chargers and ultra-fast chargers at US $1.5 per kWh and US $4.5 per kWh, respectively. The government also offers customers subsidized rates for EV charging (US $0.05 per kWh). However, no incentives are offered to charging infrastructure operators or manufacturers.

FACTORS BEHIND LOW EV ADOPTION

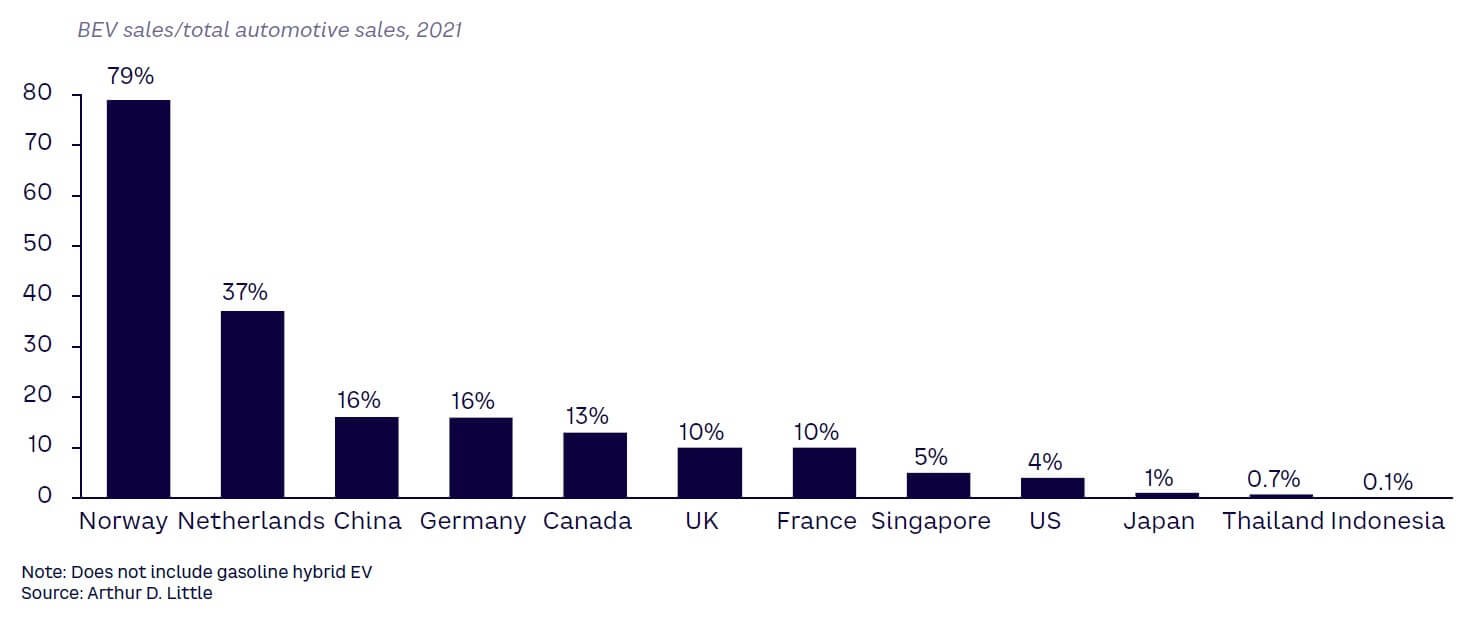

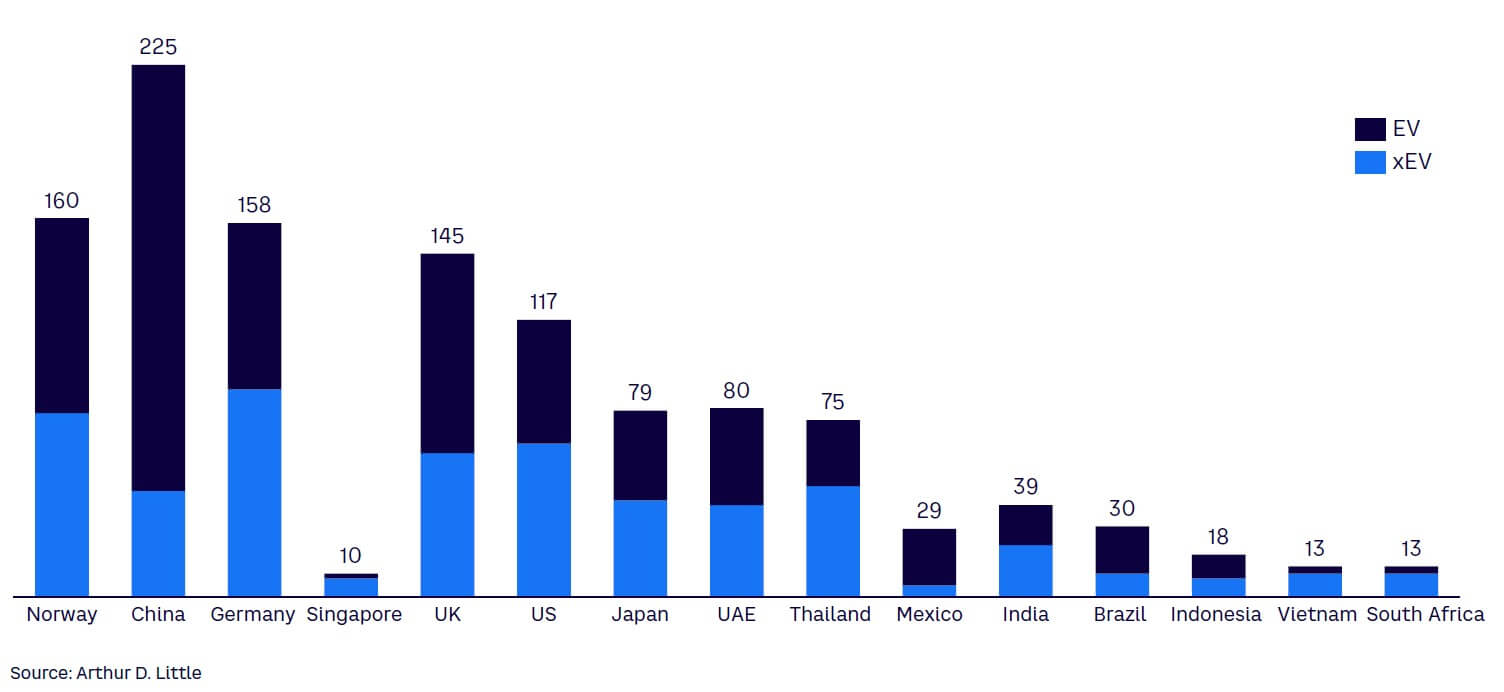

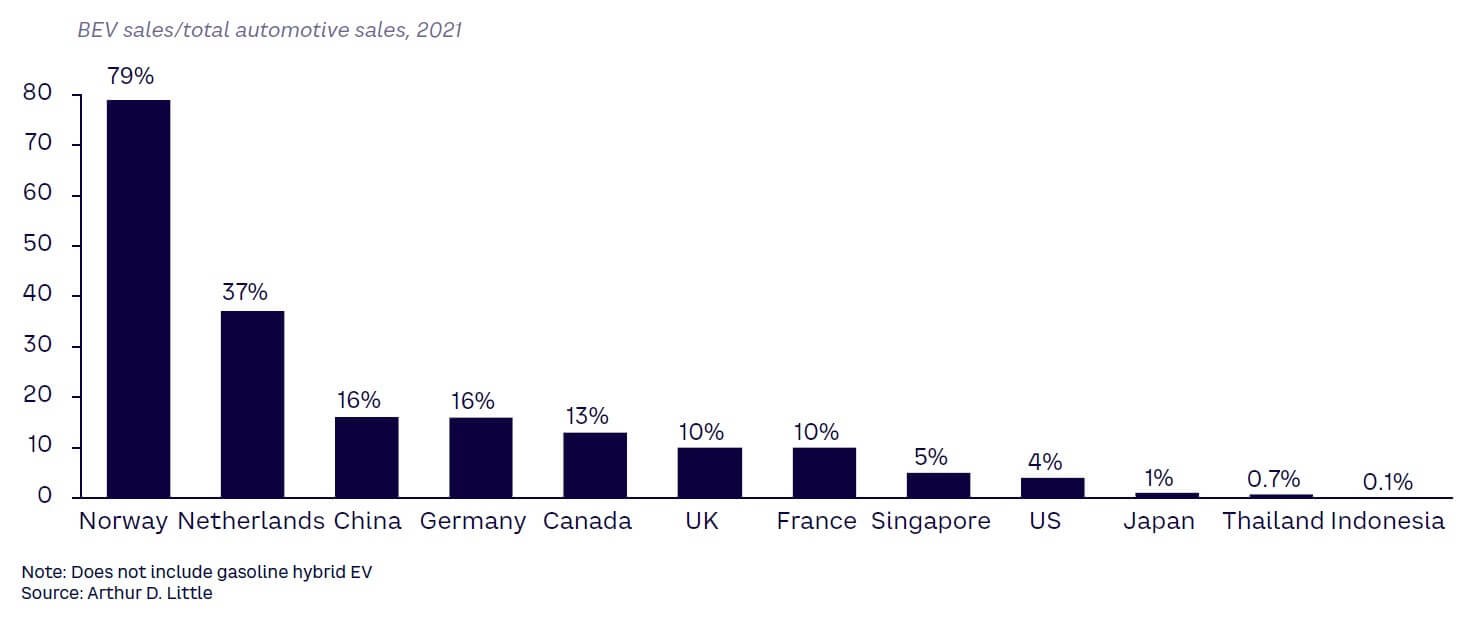

Compared to other countries in APAC, Indonesia’s EV adoption rate still lags (see Figure 8). Its 0.1% adoption rate places it far behind its peer Thailand, which has a 0.7% adoption rate. Indonesia needs to increase its rate of EV adoption if it wishes to attain its ambitious goal of becoming a global hub for EV production. The low adoption rate can be attributed to three issues.

1. Vehicle affordability

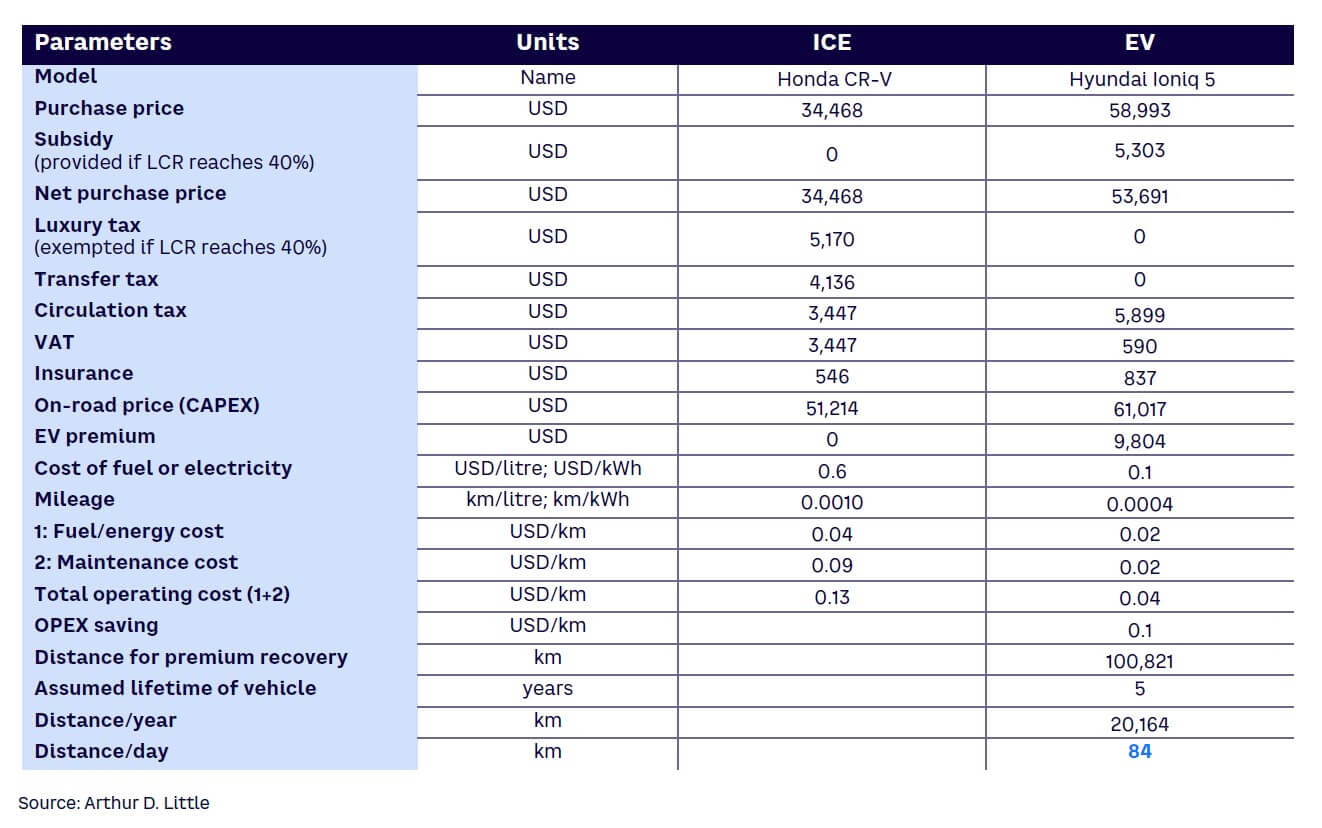

Most EVs being offered in the Indonesian market are imported, making them more expensive and less appealing to potential buyers. The costs for an entry-level model of EV starts at US $18,125 (Wuling Air EV), while a similar model of an ICE vehicle starts at only US $9,825 (Daihatsu Ayla). According to an ADL analysis by comporting the total cost of ownership (TCO) between Hyundai IONIQ 5 and Honda CR-V, a minimum of 84 km (after accounting for tax exemption) has to be driven per day to achieve a breakeven for the cost differences between ICE and EV (see Figure 9). That is higher than the average daily driving distance of 34 km when using a car as the primary means of transportation. This lack of affordable options discourages potential buyers who may be interested in purchasing an EV but do not have enough purchasing power.

2. Limited model availability

Currently, only 10 models of EVs are available in Indonesia, while there are 167 models of ICE available, translating into an ICE-to-EV ratio of 16.2:1 (excluding hybrid vehicles), which is the highest among its peers (see Figure 10). The current selection of EV models available tends to be limited to small, urban cars that may not cater to the diverse needs of the Indonesian population. Furthermore, only two models, namely Wuling Air EV and Hyundai IONIQ 5, are eligible for subsidy (US $5,130), as the Indonesian government has imposed condition that models complying with 40% local content requirement would only be eligible, which limits the efficacy of such a policy. As a result, model launches for EV from incumbent players have been slow.

3. Inadequate charging infrastructure

The availability of charging infrastructure is critical to counter range anxiety. An ADL survey found that 65% of respondents reported lack of sufficient charging infrastructure as one of the key barriers for EV adoption. Currently, there are approximately 600 charging stations in Indonesia, which represents only 2.4% of PLN’s 2030 goal of the 24,720 charging stations needed to support the EV adoption goal. Indonesia’s progress on building charging infrastructure has been slow. This lack of traction can be attributed to the divided focus between charging infrastructure and battery swapping. The Indonesian government is keen to develop battery-swapping stations for e2W and charging infrastructure for e4W.

Given that electrification has commenced for e2W, the Indonesian government is prioritizing deployment of battery-swapping stations, which puts lesser emphasis on charging stations. The absence of a strong push for charging infrastructure from the government is also shown by the lack of any incentives for suppliers and operators of charging infrastructure, unlike Thailand and India, which offer incentives. These include a three-to-five-year CIT exemption for charging infrastructure operators and provisions of low-cost capital plans for deploying charging infrastructure.

CHAPTER SUMMARY

Indonesia is highly motivated to develop its xEV industry to meet its decarbonization targets and realize the potential from nickel. The Ministry of Indonesia has announced a production target of 600,000 for EV and 2.45 million for e2W by 2030. ADL estimates that at least 340K units of EV are needed to meet IBC capacity of 15 GWh by 2030. As of 2022, Indonesia’s EV sales total 25,782, which means the market needs to grow at a CAGR of 55%, and CAGR 66% to achieve the prescribed target by ADL and the Indonesian Ministry of Industry, respectively. Such exponential growth is difficult in light of the current market situation, which explains low EV adoption. The next section discusses market movements and key challenges that the government of Indonesia must address to achieve the EV target of 600K.

2

REGULATORY PUSH & MARKET MOVEMENTS SPARK OPTIMISM

Indonesia has identified EV targets and regulations to meet as it works to decarbonize the transport sector and achieve carbon neutrality by 2060. In this chapter, we present Indonesia’s EV market movement to give a sense of the market’s overall direction of market and to spark a sense of optimism. We have captured various market movements and initiatives by different players across the EV value chain by first discussing EV upstream (cell components and battery manufacturing), followed by EV midstream (EV sales and manufacturing), and finally EV infrastructure (EV charging and swapping stations). Within each value chain, we look at different activities executed by different players, including established players (automotive OEMs and global companies), nontraditional players, and startups in the EV space.

UPSTREAM: COMMERCIALIZING LOCAL CELL COMPONENT/CELL & PACK PRODUCTION

Collaborating to process raw materials

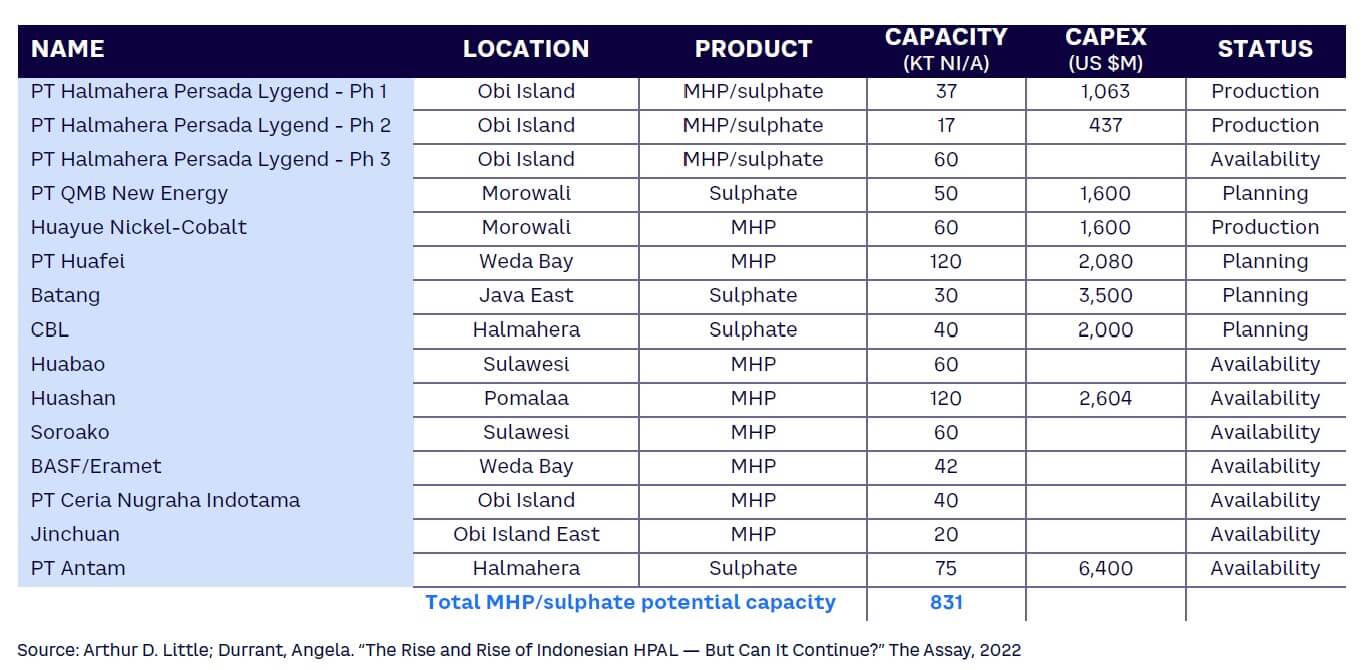

Indonesia possesses immense potential in its nickel industry. The country holds 21 million metric tons in reserve, making it the second-largest nickel reserve in the world. Recent analysis of player movements reveals that Indonesian companies are seeking partnerships and JVs to build new capabilities in the domain of cell components and manufacturing. For instance, PT Vale Indonesia announced three nickel processing projects worth US $8.6 billion with external partners, such as Chinese battery materials producer Zhejiang Huayou Cobalt and US OEM Ford Motor in Sulawesi, Indonesia. Likewise, the state-owned Indonesian mining company PT Inalum is considering a partnership with China’s Zhejiang Huayou Cobalt to process nickel for EV batteries. Lastly, PT Halmahera Persada Lygend, a JV between Indonesia’s Harita Group and China’s Ningbo Lygend, has signed an eight-year supply agreement for nickel and cobalt from China’s GEM and is building a HPAL plant on Indonesia’s Obi Islands. Indonesian mining company Antam, Pertamina, PLN, and Mining Industry Indonesia (MIND ID) are already part of the IBC, which is focusing on production of 50K-100K tons of nickel sulfate per year via HPAL plant for captive-based supply to IBC.

Cell components developed by nontraditional players

Chinese companies are keenly observing the market and regulatory developments in Indonesia with respect to upstream policies. China currently controls an 87% share of global cathode production and intends to further consolidate its position as new sources are identified. In February of 2023, Chinese chemical company Jiangsu Lopal Tech decided to expand its product portfolio to include cell components and invested US $290 million to construct an EV battery cathode material production project in Central Java province, Indonesia. The project, which has an annual capacity of 120,000 tons of lithium iron phosphate, is divided into two phases: phase one with a capacity of 30K tons will be ready by December 2023; phase two with the remaining capacity of 90K tons will be added later based on market conditions.

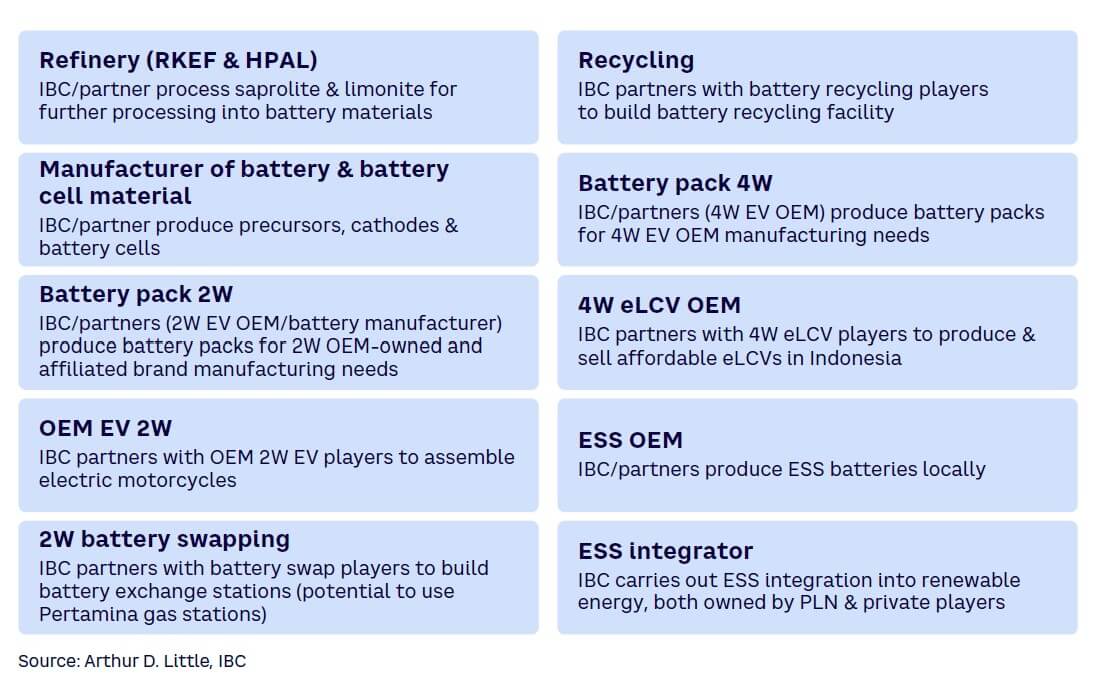

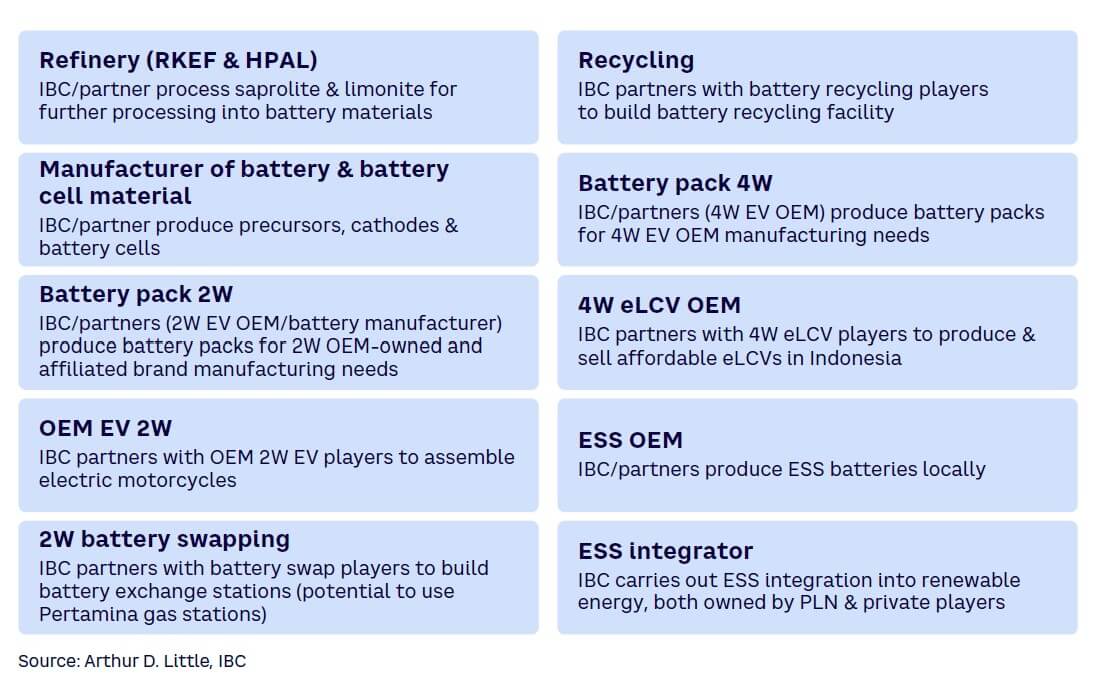

IBC leads cell manufacturing

IBC, founded in 2021, is a consortium of four state-owned enterprises (SOEs): O&G company Pertamina, electricity company PLN, mining company MIND ID, and nickel miner Antam. This collaboration is leading efforts to emerge as a global LIB cell supplier, with technological support from CATL and LG (see Figure 11a). IBC aims to invest close to US $17 billion and an initial capacity of 15-20 GWh with a long-term plan of ramping it to 140 GWh, provided market conditions are favorable. IBC has plans to be an end-to-end player in the EV value chain (see Figure 11b), similar to PTT in Thailand; however, in the initial years, focus is on the upstream part before moving to midstream and downstream. A technology partnership with Chinese battery manufacturer CATL is valued for an investment of US $5 billion, while one with Korean chemical company LG Chem is valued for an investment of US $9.8 billion. IBC has plans of not only targeting the domestic market but also the SEA and APAC regions. To achieve this, IBC has already signed an MoU with Malaysian engineering company Citaglobal to manufacture EV battery cell and BESS.

EV OEMs, although limited in the region, are mostly executing pack assembly in-house. BMS relies on overseas players, as there are very few local players, with the only local player in the BMS market being VKTR. VKTR is a prominent BMS vendor that has partnered with Sebelas Maret University in Indonesia to strengthen thermal management systems and conduct research on battery materials and recycling.

MIDSTREAM: VEHICLE SALES COVERING E2W (INCLUDING E3W) & E4W

e4W led by mostly traditional OEMs

All initiatives in EV manufacturing and production are being undertaken by foreign OEMs:

-

Traditional OEMs Honda and Toyota currently dominate the Indonesian 4W market, though neither company has indicated concrete EV plans. Toyota has committed to investing US $2 billion to manufacture 250K alternate powertrains per year over the next five years, but the company has not offered any explicit EV targets.

-

By contrast, Japanese OEMs Nissan and Mitsubishi have a product or plans in the market. Mitsubishi plans to launch a microvan xEV (Minicab-MiEV) in 2024. In 2021, Nissan launched Leaf and plans to launch a mini electric multipurpose vehicle, Sakura, in late 2023.

-

Adding an electric product to its vehicle portfolio has been a priority for Hyundai. The automaker launched IONIQ 5 and set up a production plant in Cikarang, Indonesia, with an annual capacity of 250K EVs.

-

BMW is present in Indonesia, with the availability of the electric SUV BMW iX, while Daimler has plans to launch an electric bus in Q2 of 2023.

-

The US OEM Tesla is currently in discussion with the Indonesian senior minister to establish an EV manufacturing site with a capacity of 1 million units.

-

Volkswagen intends to partner with Vale, BASF, and Merdeka Copper Gold to invest in Indonesia’s car battery sector. This move is in response to the country’s objective to diversify the number of OEMs in Indonesia, utilizing its nickel reserve.

The emergence of Chinese OEMs, such as Wuling Motor, Chery, SAIC, and BYD, is a significant development for Indonesia. In August 2022, Wuling launched the Wuling Air EV, while Chery displayed its EV (Chery eQ1) at the 2022 Gaikindo Indonesia International Auto Show and plans to locally manufacture either the Chery eQ1 or the Chery Omoda 5 EV in the near future. In February 2023, SAIC showcased its first electric-powered crossover, MG4 EV, with a limited 100 prebooking orders at the 2023 Indonesia International Motor Show. BYD, one of the first movers in SEA’s EV market, has partnered with Indonesia’s VKTR and Tri Sakti to deliver the first batch of 30 electric buses to Indonesia’s rapid transit system TransJakarta in 2022 and a second batch of 22 electric buses to bus system Mayasari Bakti in 2023.

Despite the large presence of foreign OEMs, the growth of EVs presents Indonesia with an opportunity to develop its first homegrown brand, following the lead of India’s Tata and Vietnam’s VinFast. PT Solo Manufaktur Kreasi, trading as Esemka, is Indonesia’s first national car brand. The company has produced a few SUVs and mini trucks but is also building an EV prototype called Esemka Bima EV, which was displayed at the 2023 Indonesia Motor Show in an effort to forge a collaboration with an overseas manufacturer. In addition, Indonesia’s Indika Energy and Foxconn launched a US $2 billion JV in 2022 focusing on EV production, batteries, and energy storage.

Local startups lead e2W segment; Japanese 2W to “wait and see”

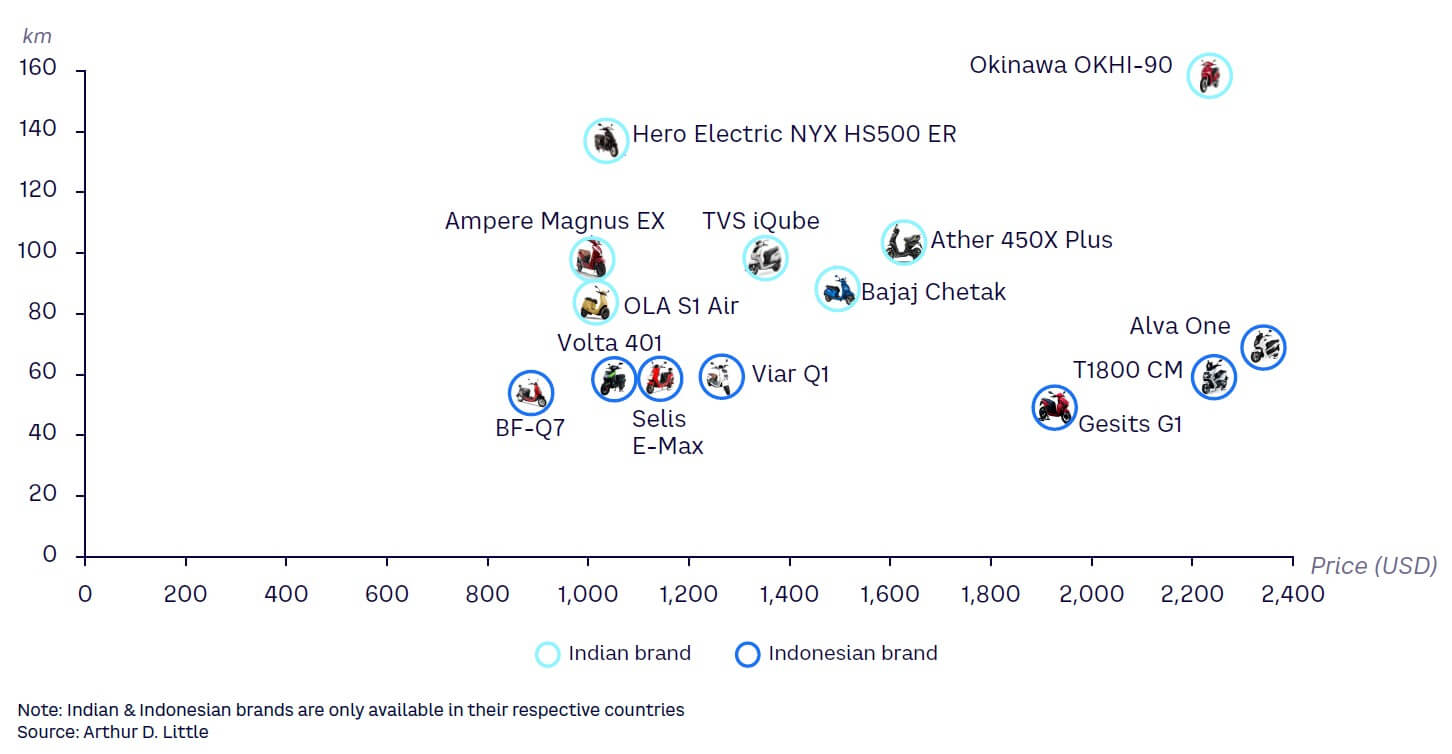

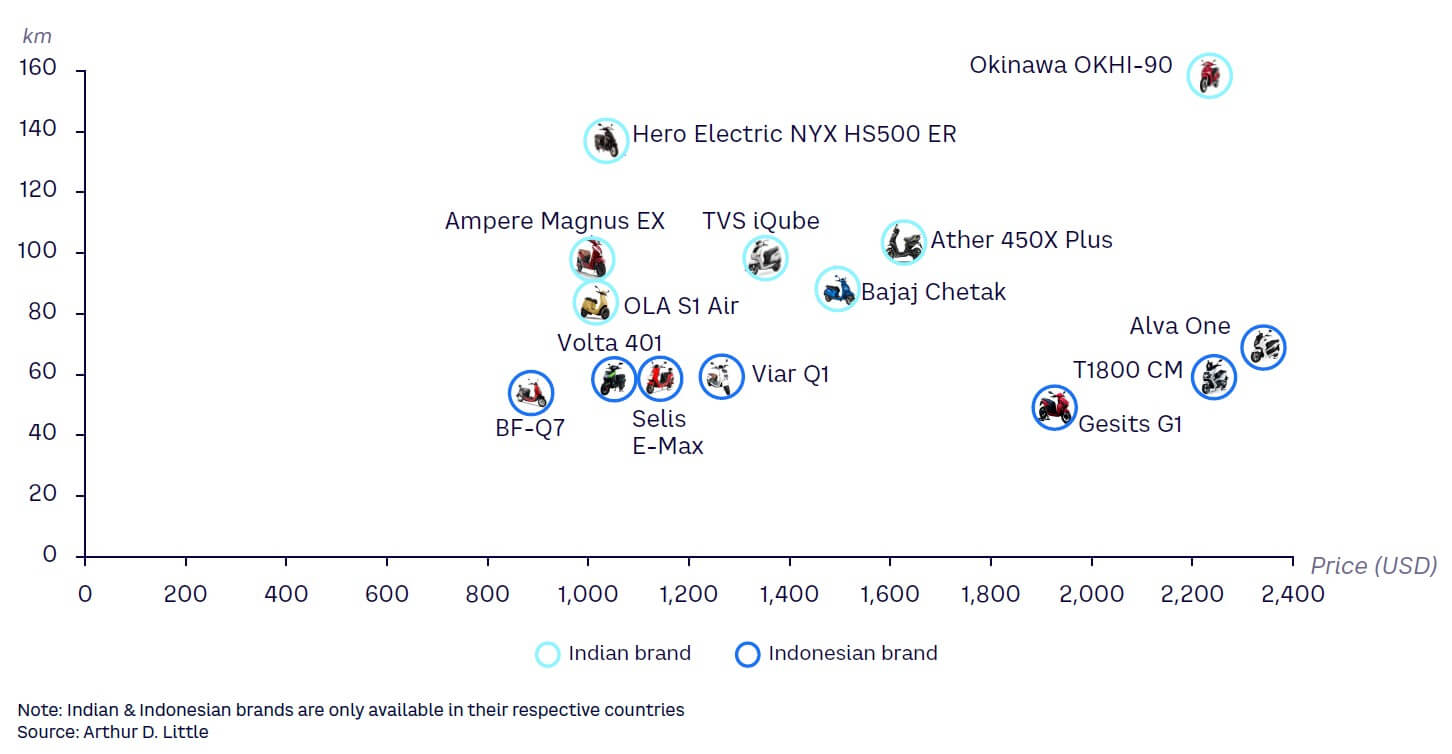

Local startups are well represented in the e2W segment. Figure 12 demonstrates different model configuration maps by different prices and ranges.

Even though Indonesia and India produce e2W vehicles that share similar characteristics, Indonesia has a lower EV penetration rate for 2Ws than India (0.2% in Indonesia versus 0.9% in India in 2021) for three reasons:

-

Indian e2Ws have higher ranges than Indonesian e2Ws, despite similar price points, indicating that the Indian product delivers higher value to the consumer.

-

Regulatory incentives in India focus on both the demand side and the supply side, including charging infrastructure.

-

India’s startup ecosystem, with approximately 898 EV startups, is more developed than Indonesia with its 10-15 EV startups. The end result is an EV ecosystem with various products, services, and business models.

By December 2022, only 25,782 motorbikes in Indonesia were electric, with top players Gesits Motor, Viar Motor Indonesia, and SELIS accounting for approximately 65%-70% of market share. Gesits Motor, a venture acquired by IBC in 2022, is engaged in the manufacturing and distributing of electric scooters (e.g., Gesits G1 and Gesits Raya G) with ranges of 45-70 km and multiple options for color and styles for mass consumers. Going forward, Gesits Motor aims to increase its current capacity from 40K units per year to 100K units per year to serve the growing demand for e2Ws. It plans to introduce cheaper electric scooters to cement its leading position in this segment.

Viar Motor Indonesia sells multiple electric scooter models (e.g., Viar New Q1, Viar N1, and Viar N2) and electric bicycles (e.g., Viar U1, Viar UNO, and Viar Akasha1) covering a wide variety of vehicle range (50-150 km). These diverse options cater to different customer preferences, needs, and requirements. Viar has been able to earn the government subsidy of US $469 by meeting the condition of using 50% domestic materials for the Viar Q1. As a result, its vehicle price is more attractive to consumers.

SELIS, an EV manufacturer of 2W vehicles (e.g., Go Plus, E-Max, and Agats) and 3W vehicles (e.g., New Balis, Bromo, and Urban Trike) has various models with ranges of 25-70 km, catering primarily to B2B and short-term transit. Similar to Gesits Motor and Viar Motor Indonesia, SELIS is also qualified to receive government assistance of US $469 for its electric scooter (E-Max, Agats).

Volta Indonesia, a startup owned by Indonesian IT solution provider PT M Cash Integrasi, produces myriad electric scooters (e.g., Volta Virgo, Volta Mandala, and Volta 401) at a range of 60-65 km for mass consumers. Volta Indonesia has a strong position in technological advancement because its electric scooters are equipped with the latest Internet of Things (IoT) technology. More importantly, it has partnered with PT Pos Logistik Indonesia to offer electric scooter rental services. Going forward, it plans to initiate more collaborative moves with different sectors to push EV development forward.

Ilectra Motor Group (IMG), founded in 2021, targeted premium customers in the growing upper-middle class with an electric scooter (Alva One) that has a range of 70 km. IMG plans to expand beyond 2W brands to build its supporting ecosystem, including EV, infrastructure through partnership.

Electrum, a JV formed by TBS Energi Utama and Gojek, was established in 2021 to build an integrated and holistic 2W EV ecosystem in Indonesia. In February 2022, it partnered with Pertamina and Taiwan-based startup Gogoro to develop both EV infrastructure and e2Ws for Gojek. Electrum plans to deliver 2 million e-motorbikes to Gojek by 2030 from the current supply of 300 e-motorbikes.

Charged Indonesia, established in 2022, produced and distributed three different models of electric scooters (Anoa, Maleo, Rimau) at a range of 100-125 km and offered mobility options to consumers that cover personal needs, logistics, company fleets, and ride-hailing services. It is working to roll out a 16,000-square-mile zero-energy facility in Greater Jakarta to house its experiential center, R&D, and production engineering teams. Charged Indonesia plans to launch more affordable e2W models to accelerate the adoption of EV in Indonesia.

Seeing high growth in the 2W segment, Gogoro entered the Indonesian market by partnering with Gojek to deploy a 2W EV pilot of 250 Gogoro SmartScoots in Jakarta, Indonesia. It plans to scale up the pilot to 5K electric scooters in the future and recently signed a MoU with Electrum to establish an Indonesia EV ecosystem with a main focus on 2W production and high-efficiency battery development. Additionally, Japanese OEMs such as Honda have announced plans to launch seven electric motorbikes in Indonesia by 2030.

DOWNSTREAM: CHARGING INFRASTRUCTURE NEEDS MORE TRACTION

PLN leads the charge for EV charging infrastructure

As a state-owned electricity company, PLN is the primary energy provider of EV charging in Indonesia. PLN plays a crucial role in the development and expansion of the EV charging infrastructure across the country, supplying electricity to both public and private charging stations. In 2022, PLN allocated approximately US $8 billion for the construction of EV charging infrastructure to accelerate the EV ecosystem. For e4W, it currently has around 600 public charging stations and is considering partnering with shopping malls, banks, fast food restaurants, and other public facilities with spacious parking spaces to reach 24,720 public charging stations by 2030. For e2W, it has 6,700 charging stations and plans to increase the number to 12,000. PLN is looking to engage with the private sector to install more charging stations through a value-sharing partnership model.

Coexistence of swapping & charging infrastructure operators

Despite PLN’s efforts, charging infrastructure lags. As per industry estimates, Indonesia needs a minimum of 31K chargers, of which PLN plans to install 24,720. As a result, business opportunities exist. Astra Group has entered into the charging infrastructure business via its Astra Otopower charging station (this is its only charging station, as it awaits the market to develop). PT Starvo Global Energi, an Indonesian EV charging company, aims to offer 5,000 new privately owned EV charging stations by 2025. It has also linked up with Indonesian real estate developer Jababeka to build public EV charging stations in Cikarang, Indonesia. For battery swapping, Swap has set up 800 swap centers across Indonesia and recently raised US $7.2 million to support business expansion. The firm aims to become a key player in battery infrastructure by establishing more swap centers in other Indonesian regions and by partnering with large enterprises such as Lazada Logistics, Pos Indonesia, Alfamart, and Circle K to accelerate the adoption of EVs. Seeing the Indonesian government’s openness to both swapping and charging stations, Taiwan-based unicorn Gogoro is partnering with Gojek to deploy a battery-swapping station (GoStation) with plans to make it a nationwide network. Various oil and gas companies have also entered the charging infrastructure business but with limited traction, including small-scale deployments from Shell, Pertamina, and MedcoEnergi.

For charging equipment providers, ABB and Schneider Electric are present in the Indonesian market. For instance, ABB has successfully installed two DC fast chargers for BPPT in West Java and at a PLN distribution unit in Jakarta in 2018 and 2019, respectively. In addition, ABB also installed ABB’s home charging AC wallbox for Verde Two Apartment in South Jakarta and offered Terra 54 DC fast chargers to three Shell stations in North Jakarta, South Jakarta, and Bogor in 2021. It aims to provide more EV charging equipment to strategic partners but is opting for a “wait and see” approach.

To increase participation of these players, the Indonesian government should focus on introducing supply-side incentives for charging infrastructure equipment providers as well as operators. Currently, Indonesia is offering a subsidized rate for EV charging (US $0.05/kWh) to customers; however, no focus is being given to EV charging station operators, which may limit the pace of initial expansion.

CHAPTER SUMMARY

ADL’s market analysis shows that Indonesia’s EV market movement is attractive. For EV upstream, significant movement is happening with different SOEs commercializing LIB cell production using nickel and other cell components. Regarding midstream, incumbent players are delaying the launch of e4Ws, as major launches are expected from new players like Chinese OEMs. On the other hand, the e2W segment is mainly being developed by local startups Gesits Motor, Viar Motor Indonesia, and SELIS. For EV downstream, PLN is the primary energy provider of EV charging infrastructure, while a few local companies, including Astra Group, PT Starvo, Global Energi and Swap, are leading initiatives in the charging infrastructure domain with a two-pronged approach that covers charging infrastructure and battery swapping. While this is indeed a positive move, the government must ensure that promoting two forms of charging does not compete with each other, resulting in revenue cannibalization.

3

KEY CHALLENGES IN ENABLING INDONESIA AS EV HUB

Indonesia has singled out the transport sector in its decarbonization strategy, recognizing the industry’s substantial contributions to emissions. The path to decarbonization begins with electrification. In Chapter 1, we discussed the importance and current status of EV adoption, while Chapter 2 captured some of the market movements spurred by recent EV initiatives. In this chapter, we identify some fundamental challenges that Indonesia must address if it wants to achieve its mission of developing into an EV vehicle and battery manufacturing hub.

CHALLENGE 1: THE NEED FOR CAUTION

Japanese OEMs’ steady, slow transition to EVs

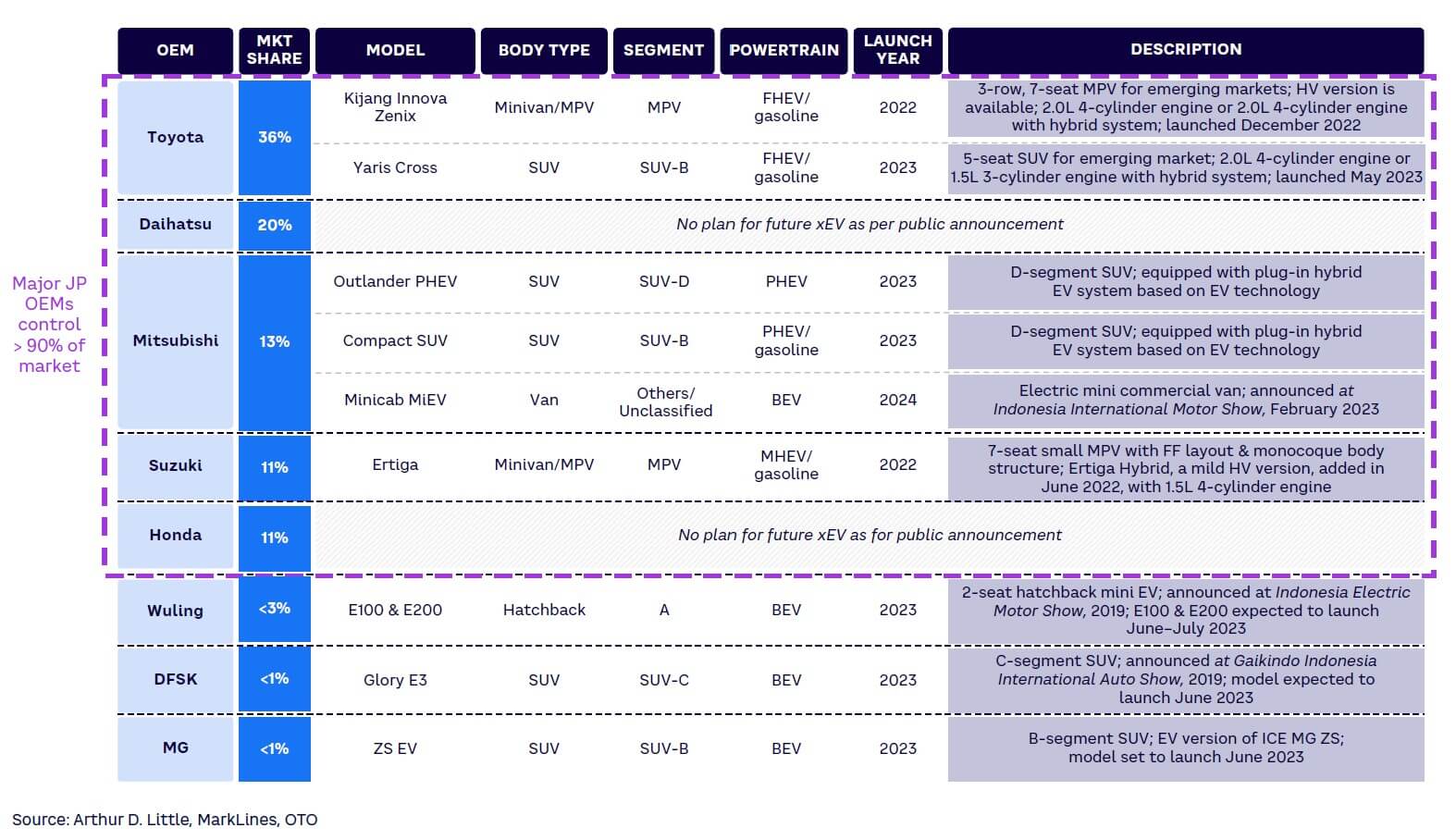

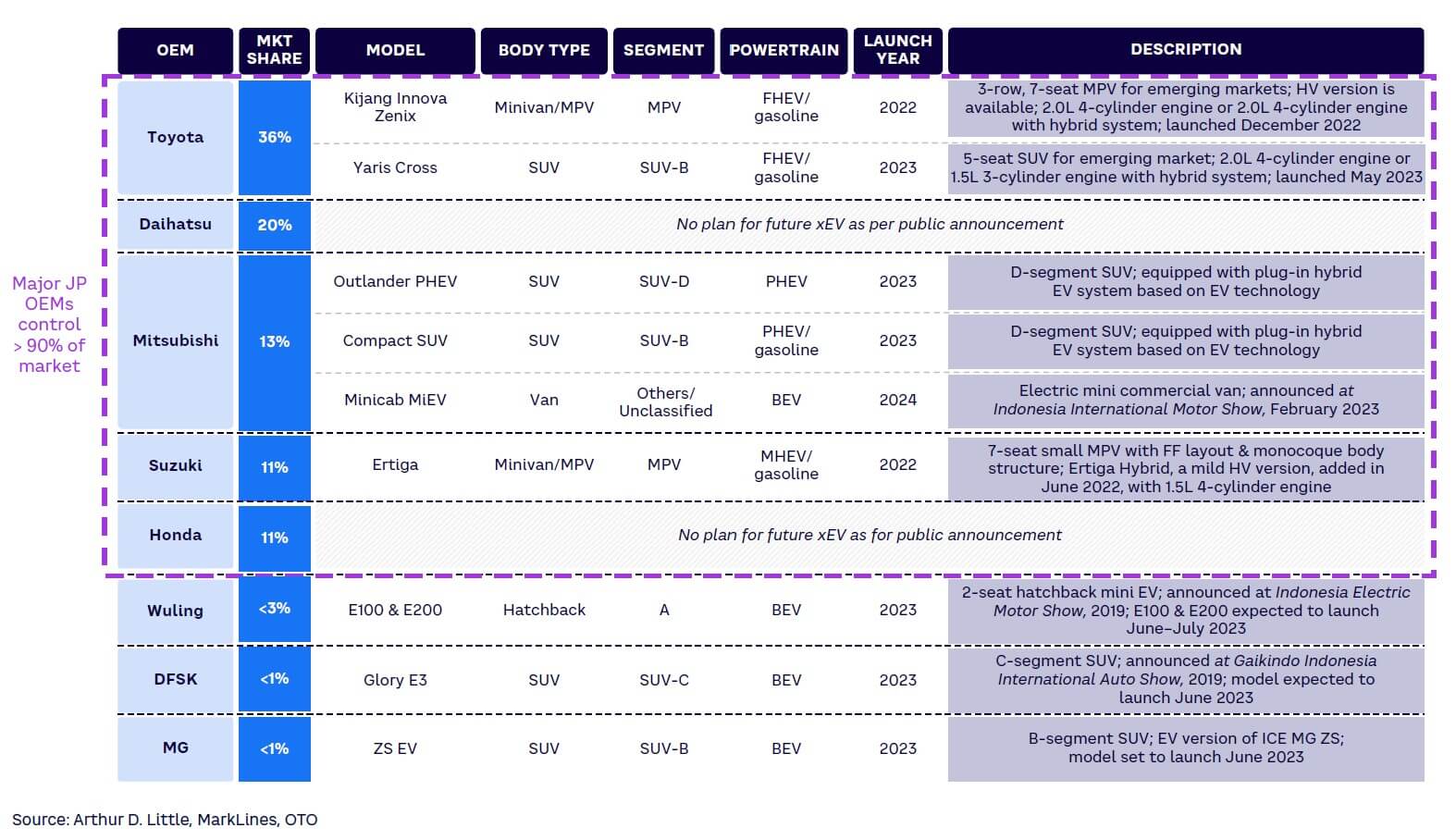

The dominance of Japanese OEMs in the Indonesian automotive industry presents a significant challenge for the country as it seeks to become an EV hub. The top five automakers in Indonesia — Toyota, Daihatsu, Mitsubishi, Suzuki, and Honda (all Japanese OEMs) — command a market share of 92.4%, with Toyota alone controlling 36.4% of the market. As a result, the dominance of Japanese OEMs and their vision toward EVs is highly influential on the Indonesian market.

Current movements in Indonesia’s EV market are limited to smaller players, namely Hyundai and Wuling, while the Japanese OEMs have been slow to adopt EV. Currently, the only EVs available from Chinese OEMs are the Wuling Air EV and the Dongfeng Gelora. Two mini-EV models (Wuling E100 and E200) and two EVs (MG Indonesia’s ZS EV and DFSK Indonesia’s Glory E3) will be launched in 2023. However, China’s introduction of EVs to Indonesia from its OEMs is currently minimal at this stage. Activities focusing on xEV, including EVs from Japanese OEMs, can be seen in Figure 13, which shows Toyota, Suzuki, and Mitsubishi’s movements in the xEVs domain in Indonesia. Among the five models to be launched, only Mitsubishi plans to launch an EV model (Minincab MiEV) along with two more PHEV models.

Aside from this, the OEMs’ initiatives are limited to the xEV domain. Toyota recently launched two fully hybrid electric vehicles (FHEVs), the Kijang Innova Zenix in December 2022 and the Yaris Cross in May 2023, while Suzuki launched the Ertiga, a mild hybrid electric vehicle (MHEV), in June 2022. Japanese OEMs’ preference for ICE and hybrid technologies stems from their established production infrastructure, skilled labor, existing consumer demand, and their belief that a more gradual transition from the ICE powertrain to the electric powertrain via HEVs, PHEV, and finally EV is most realistic, noting that the immediate cleanup of a current energy source is difficult. The combination of significant investments in ICE production, plenty of local skilled labor, and huge excess production capacity as previously mentioned resulted in a sluggish push for EVs in Indonesia.

Lack of local OEM to pioneer transformation

Unlike India, the US, and China, Indonesia lacks a domestic OEM brand despite being a major automotive market. While countries like Malaysia sought state sponsorship to create a national car brand and industry, Indonesia and Thailand became the hub for Japanese manufacturers to establish their production facilities and develop an automotive industry. For Indonesia, the absence of a local OEM limits the government’s ability to achieve its objective of pioneering development in the EV industry. Creating an EV production base requires support from manufacturers, as it entails new requirements of parts, supply chain, human capital, and infrastructure readiness. Currently, Indonesia is dependent upon foreign brands to bring about such changes.

Moreover, an absence of local brands means that Indonesia was never an innovation hub, but a sales and production hub. Electrification is relatively a new technology, and multiple areas of innovation exist in the domain of battery longevity, battery management, energy management, connectivity, and automation. This presents an enormous opportunity from a revenue standpoint. Creating an innovation hub also results in a series of positive benefits, such as enhanced labor skills, the development of innovative business models, increased consumer confidence from purchasing a locally manufactured brand, and reduced prices due to local production. India has embarked on a similar strategy with local brands such as Tata Motors and M&M, encouraging these OEMs to set up their R&D innovation hubs for e-mobility within the country. Thailand also realizes that electrification presents an opportunity to create EV manufacturing capabilities, given the development of PTT and Foxconn to create Horizon Plus. Energy Absolute, one of the largest renewable power producers in Thailand, has also stepped in by building an LIB factory, along with an EV assembly plant, to enhance its capability and become a one-stop-shop for EVs in that country.

The absence of a local brand in Indonesia has resulted in the country depending on foreign brands to launch its EVs and xEVs, which may not align with the Indonesian government’s internal plan.

CHALLENGE 2: LIMITED SUPPORT FOR ADDITIONAL CHARGING INFRASTRUCTURE

As of 2022, Indonesia had over 5,500 fuel stations, but only 600 EV charging stations, highlighting the stark disparity between the two and underscoring the inadequacy of the current charging infrastructure. A recent survey conducted by ADL revealed that over 65% of respondents cite the lack of sufficient charging infrastructure as one of the key barriers for EV adoption. Meanwhile, Indonesia is facing the need to invest approximately US $3.7 billion to install 31,000 commercial charging stations over the next decade, aiming to achieve its EV goals by 2030. This substantial expansion of charging infrastructure represents a significant development for Indonesia, considering the current state of charging infrastructure installations.

A divided strategic focus

Indonesia’s charging infrastructure progress has been hindered by the government’s divided focus on different segments. The country has prioritized the development of battery-swapping stations for e2W, while focusing on charging infrastructure for e4W. This strategy has been driven by the significant adoption of e2W vehicles in Indonesia, with an estimated sales target of 2.45 million e2Ws by 2030. Battery-swapping stations have emerged as a preferred solution to address the limited range and charging constraints of these vehicles. This approach reflects the government’s strategy to prioritize the segment with higher adoption rates and address the immediate needs of the market. As a result, the deployment of charging stations for e4W has received lesser emphasis, compared to battery-swapping stations for e2W.

However, it is crucial to recognize that charging infrastructure remains vital for the overall growth of Indonesia’s EV ecosystem. As the market expands and demand for e4W increases, the establishment of a comprehensive network of charging stations becomes increasingly important. To ensure balanced support for both e2W and e4W segments, the Indonesian government must allocate sufficient resources and attention to the development of charging infrastructure for e4W, alongside the deployment of battery-swapping stations for e2W. This holistic approach will facilitate the sustainable advancement of the overall EV ecosystem in Indonesia.

Absence of strong push

Indonesia’s infrastructure development is also restrained by the government’s lack of incentives for EV charging operators, in terms of financial support, regulations, and standardized protocol. Currently, there is no financial support provided to attract new players to enter the EV charging station market and regulations regarding infrastructure are still under development. Standardized charging protocols are absent, resulting in a fragmented charging infrastructure network.

Unlike other markets in Thailand and India, where incentives are offered to encourage the development of charging infrastructure, Indonesia has yet to implement similar measures. In Thailand, for example, charging infrastructure operators can benefit from a three-to-five-year CIT exemption, which incentivizes investment and growth in the sector. Similarly, India offers a low-cost capital plan specifically designed to support the deployment of charging infrastructure. These incentives play a crucial role in attracting private sector participation and stimulating investments in charging infrastructure. By providing tax exemptions and access to low-cost capital, governments can significantly reduce the financial burden on suppliers and operators, making it more financially viable to establish charging stations across the country. This, in turn, helps address the infrastructure gaps and supports the widespread adoption of EVs. In contrast, the absence of similar incentives in Indonesia hinders the pace of charging infrastructure development. Without such incentives, suppliers and operators face greater financial challenges and may be less motivated to invest in the necessary infrastructure. This results in slower progress and limited availability of charging stations.

State-owned electricity company monopoly

Indonesia’s primary energy provider, PLN, holds the authority to establish fixed prices for EV charging businesses, potentially creating barriers for new players to compete on pricing and limiting their market share. Additionally, PLN’s ambitious expansion plans in the charging infrastructure sector may further strengthen its dominant position and impede the entry of new competitors. To foster a more open and competitive market, the Indonesian Energy and Mineral Resources Ministry introduced a draft of new incentives for EV charging stations in February 2023, which included plans to subsidize a favorable electricity tariff of US $0.05/kWh for EV charging customers. However, given PLN’s advantage as an energy provider, it could potentially lower its prices to maintain its competitiveness in the market.

CHALLENGE 3: UNDERDEVELOPED NICKEL PROCESSING

The importance of nickel in battery processing

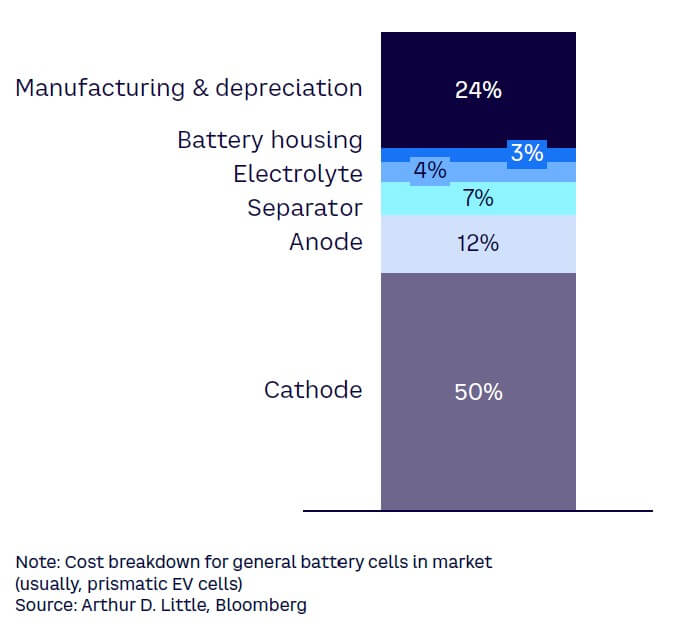

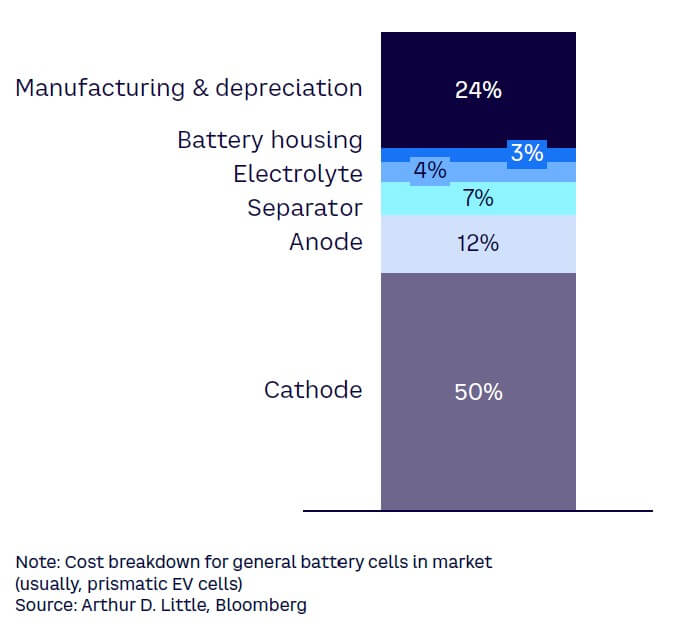

The cell constitutes approximately 42% of the manufacturing cost of a battery. Within the cell, the cathode and anode make up the largest share of the overall cell cost, accounting for 50% and 12%, respectively (see Figure 14).

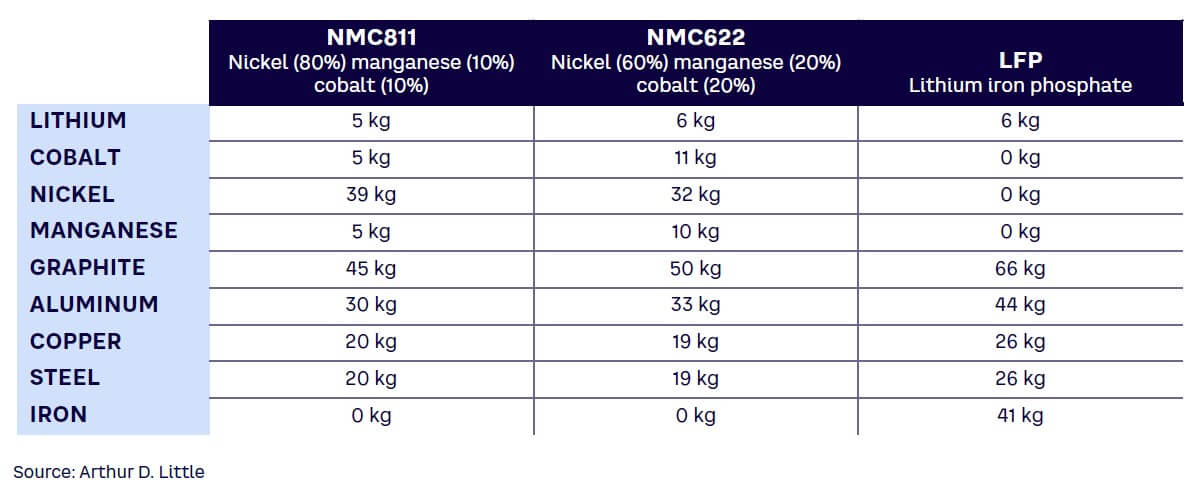

Within an NMC-based cell, nickel accounts for the biggest portion of cathode material, which is predominantly used for 4W vehicles and e-bus batteries, as it possesses the high energy density needed to power large-scale vehicles. As a result, nickel is estimated to make up about 10% of a battery’s total cost, which makes it a significant component of battery production. For Indonesia, being endowed with 21 million metric tons of nickel provides a strategic opportunity for financial and economic gain. Its importance is further intensified as much higher levels of nickel are preferred within NMC-based cells, with an evolution from NMC 333 to NMC 532 to NMC 662, and, most recently, NMC 811. According to Frontier Energy Research, NMC 811 is expected to be the dominant grade, given that lower usage of cobalt could help mitigate the supply risk.

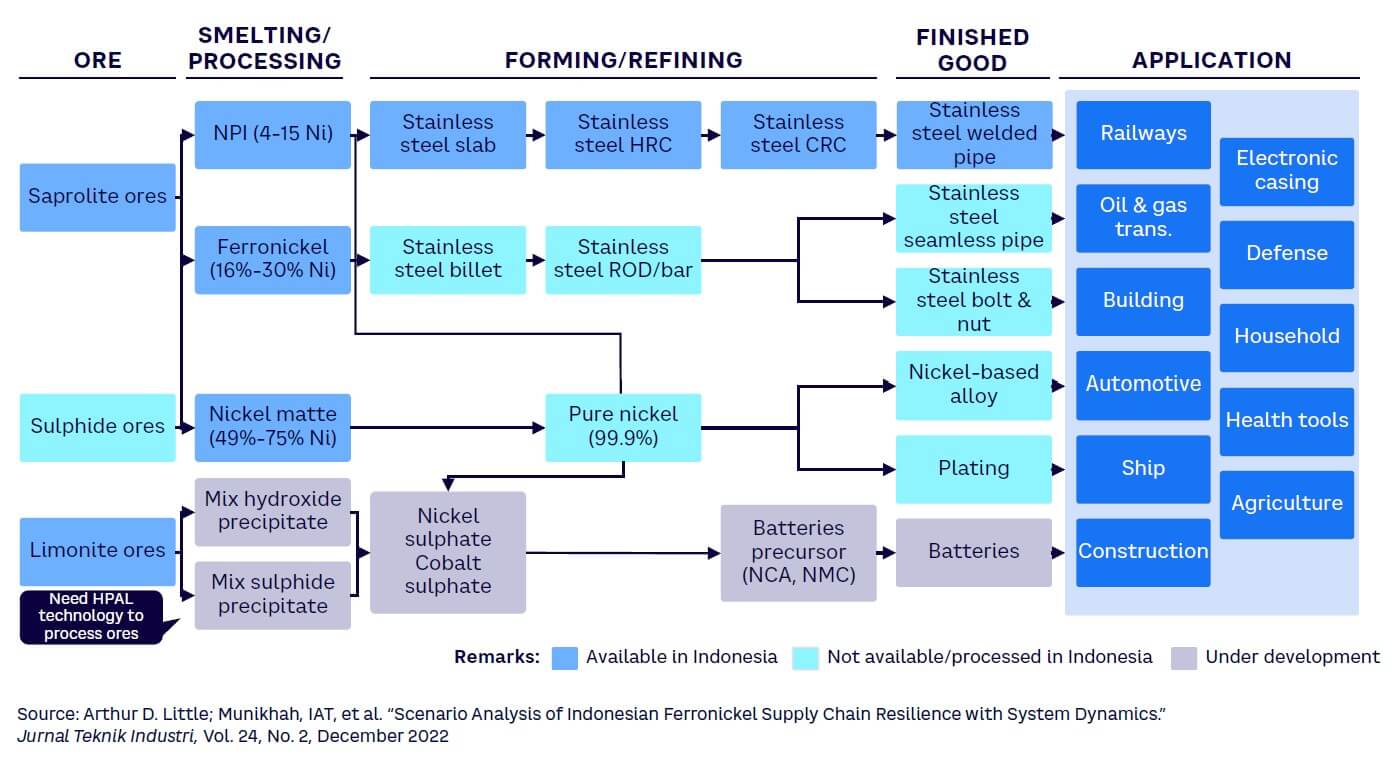

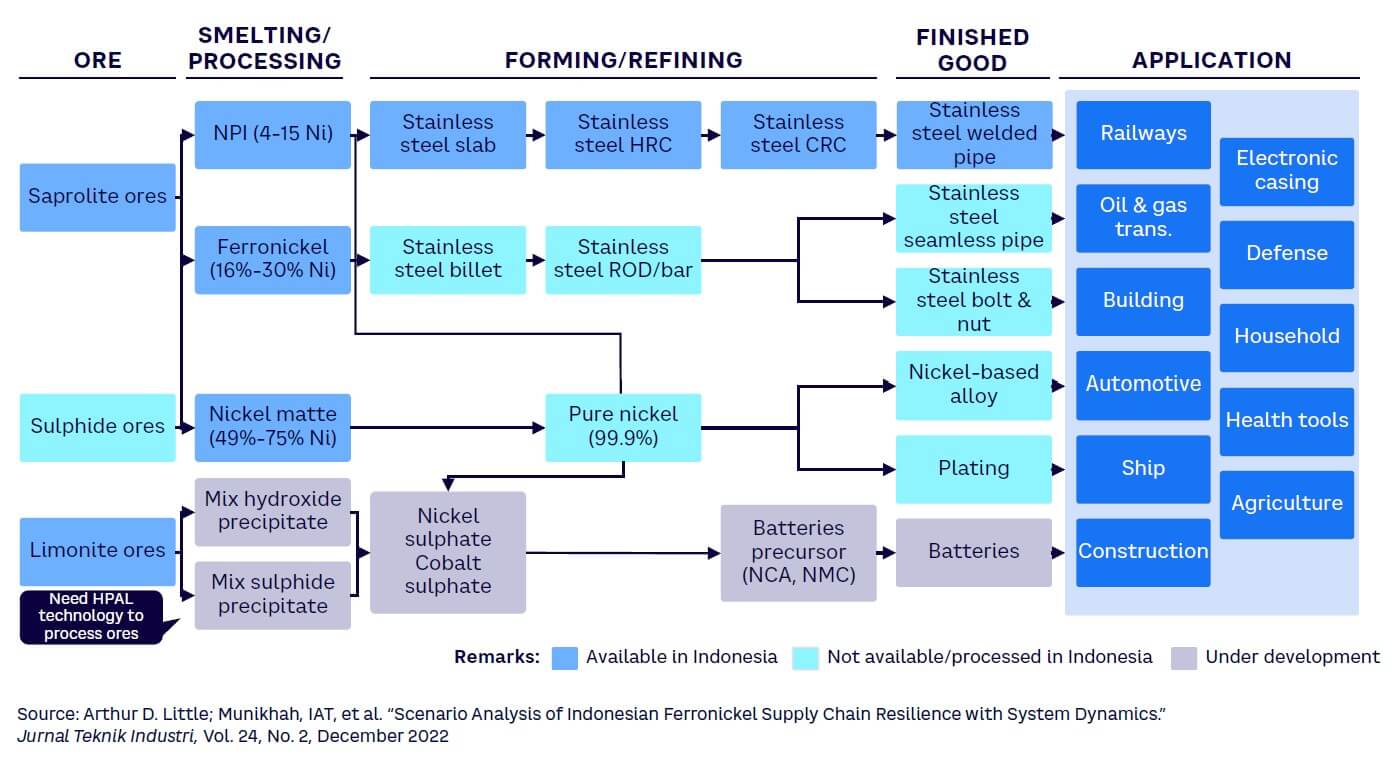

Underdeveloped class 1 nickel production

Indonesia has been endowed with substantial nickel reserves; however, the majority of existing capabilities are channeled toward exploiting class 2 nickel, a low-purity type in either unprocessed form or an intermediate product used in stainless steel and pure nickel metal or chemical production. For many years, this has been a source of Indonesia’s forex reserves, accounting for a value of US $1.1 million in 2019 before the country introduced its nickel-export ban.

High purity class 1 nickel can be used for cell manufacturing. Given that Indonesia possesses mostly low-grade ores, the most viable option to produce class 1 nickel is through the construction of an advanced technology smelter (HPAL) to process its existing low-grade reserves. However, there are critical concerns regarding the construction of HPAL, including intensive capital investments and technical complexity. According to a former Indonesian Deputy Minister for Energy and Mineral Resources, the CAPEX required for HPAL smelter construction could reach US $65,000 per ton of nickel, five times higher than the conventional smelter, the rotary kiln-electric furnace (RKEF). Some major local nickel manufacturers, such as Antam and PT Vale Indonesia, have been facing rising debt and declining profits. For example, Antam’s financial statements reveal significant year-over-year declines in profitability (down 193% in 2019), which has been further magnified due to COVID-19-induced slowdowns.

Another limitation of HPAL technology is that its complex process makes it difficult to deploy successfully. Technically, the process involves high-pressure and high-temperature chemical reactions, which require careful monitoring and control to ensure optimal performance and prevent equipment failure, which is difficult to manage. For example, First Quantum Minerals (FQM) reopened its Ravensthorpe mine and HPAL plant in Western Australia in March 2020 amid rising nickel prices, but the mine has faced two technical issues in temperature adjustment, which led FQM to downgrade its 2020 production guidance by 2,000 metric tons to 13,000-15,000 metric tons of nickel.

Historically, nickel producers in Indonesia have primarily focused on class 2 mining and smelting and did not have much presence in class 1 production (see Figure 15). Also, using class 1 nickel for cell manufacturing is a recent phenomenon, hence limited incentives are available for conventional nickel producers to upgrade their capabilities.

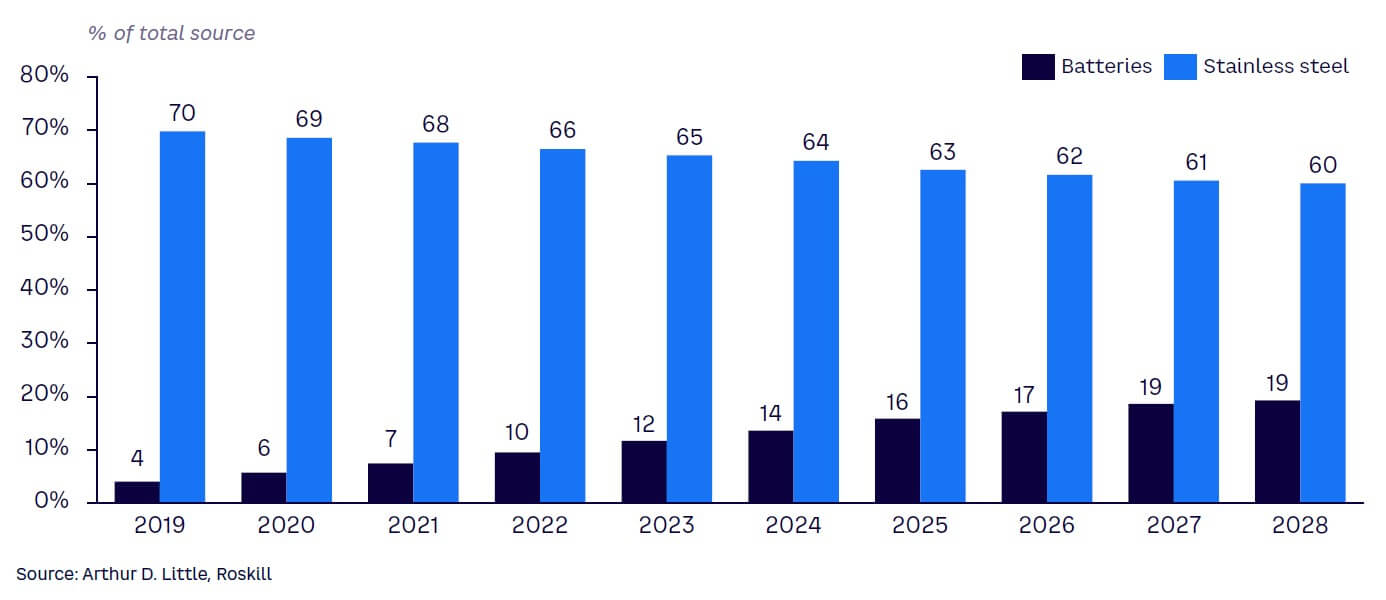

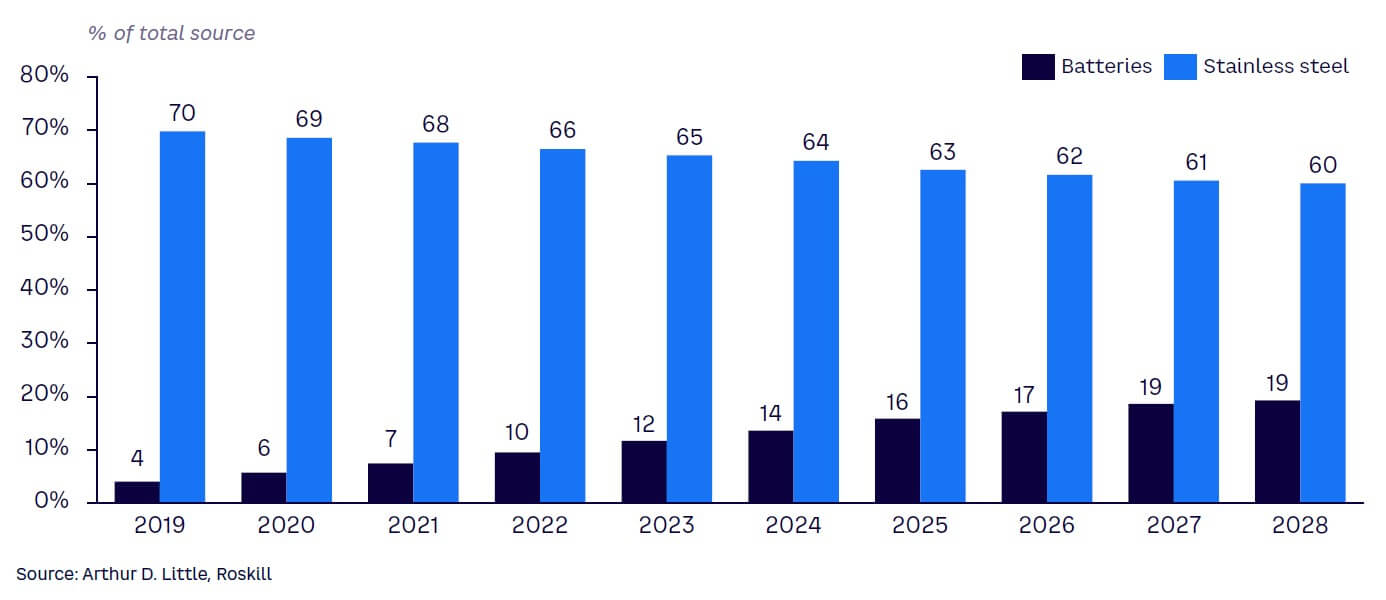

Today, nearly 70% of global nickel demand is driven by the steel sector, while batteries only represent approximately 10% (see Figure 16).

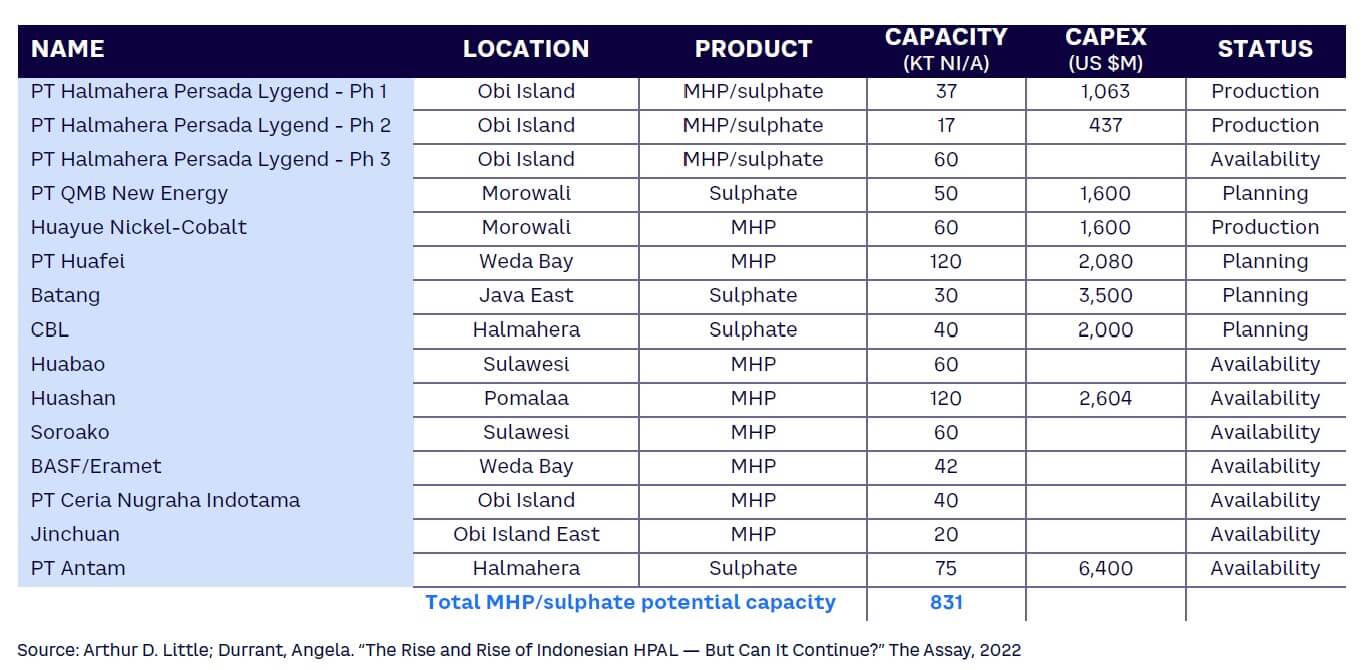

Only recently have some of Indonesia’s nickel smelters ventured into developing facilities for class 1 nickel processing. Thirteen development projects using HPAL technology have been announced; only one has been operational since 2021, while the rest are in the construction phase or undergoing feasibility studies (see Figure 17).

Indonesia’s Antam, the largest producer of nickel in the world, is building new capabilities including a nickel-iron plant using HPAL technology, which is yet to be commenced. Additionally, major foreign players have shown interest in battery material plants, as demonstrated by a signed agreement between US-based Ford Motors, China’s Zhejiang Huayou Cobalt, and Vale Indonesia, which included an investment of US $4.5 billion in an HPAL plant. The commercial operation of the plant is expected to commence in 2026.

CHALLENGE 4: LFP BATTERIES VS. NMC BATTERIES

LFP batteries contain lithium iron phosphate as the cathode, while NMC batteries contain lithium nickel manganese cobalt oxide. ADL identified some major differences between LFP and NMC batteries, which may result in certain applications and geographies preferring LFP over NMC:

- Cell lifespan. Degradation, the ability of batteries to hold a charge, directly affects cell lifespan. Degradation happens slower in LFP batteries than in NMC. As a result, over time, LFP can store more power than NMC.

- Cell safety. Cell and battery safety is of primary importance, given its explosive nature. Besides being a fire hazard, damage to the cell (and thereby battery) also has an impact on the expense to a consumer, given that 35%-40% of a vehicle’s cost is from its battery. LFP batteries are safer than NMC batteries, thanks to their stable lithium chemistry.

- Higher temperature tolerance. LFP batteries have less degradation at higher temperatures, which is described as “thermal runway.” LFP batteries hit thermal runway at 270 degrees Celsius, while NMC hits it at 210 degrees Celsius. This gap is quite significant and makes a key difference for high-capacity batteries where heat management is a key issue.

- Cycle life. NMC cycle life is around 800-1,000 cell cycles, while LFP batteries have a typical cycle life of 2,000 and may reach 3,000 if used properly, thereby showcasing higher durability.

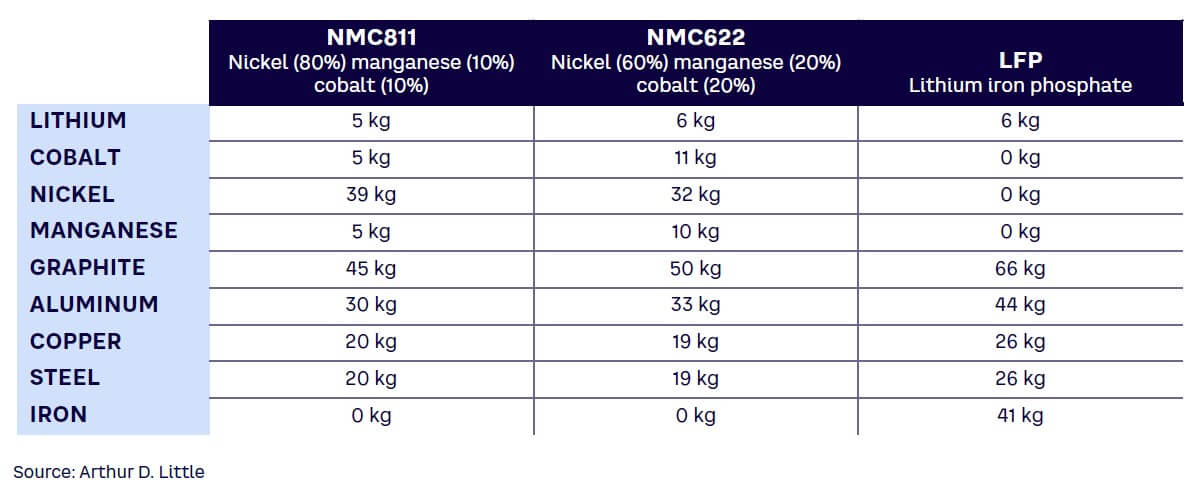

- Supply chain risks. LFP batteries do not rely on nickel and cobalt, which present supply chain risks. Moreover, certain markets are known to produce these minerals in an environmentally harmful manner, thus neutralizing the motivation for switching to EVs. For example, cobalt is primarily produced in the Democratic Republic of the Congo and Russia; both countries are mired in controversy. The Congo has been accused of using child labor, while sanctions against Russia have prompted industries to seek alternatives. On the other hand, LFP’s major materials are iron and phosphate, which are available in abundance. Lithium is common in both NMC and LFP, with NMC 622 and LFP containing the same amount of lithium, as shown in Figure 18. As a result, from a lithium perspective, the supply chain risks for both variants are the same. Hence, the overall supply chain risk in NMCs is much higher than LFPs (see Figure 19).

NMC batteries are preferred due to their higher energy density compared to LFP, which essentially means NMC would offer higher range for a similar weight of battery. This is because the chemical structure of LFP hinders the release of oxygen, resulting in a higher self-discharge rate.

The focus on fast and ultra-fast charge technology, as well as improvements to LFP-based cell chemistry make the drawback of lower energy density of LFP batteries less significant. This poses a threat to Indonesia’s potential from nickel, which is expected to be around US $4-$6 billion per year. This is calculated based on an expected annual production of 195,000 tons of class 1 nickel in 2027 and an expected price of US $21,000 per ton in the same year.

CHALLENGE 5: BALANCE BETWEEN REGIONAL DEPENDENCE & NATIONAL PRIORITIES

Regional dependence in cell manufacturing

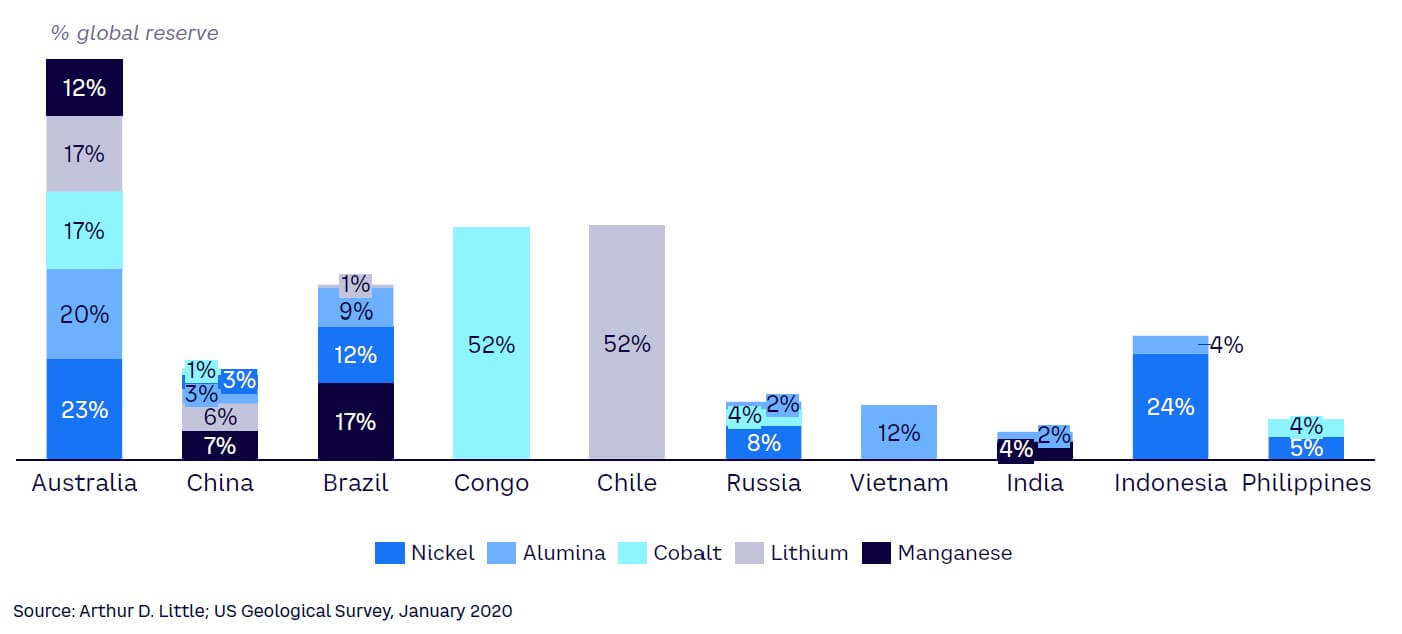

Depending on the cell type (LFP, NMC, or others), different minerals are required, leading to different composition in overall cell, battery, and thereby vehicle. Given Indonesia’s ambition of 2.5 million e2Ws and e3Ws and recommended target of 340,000 EVs by ADL, Indonesia would require 25 million tons of lithium, 134 million tons of nickel, and 46 million tons of cobalt. While nickel can be sourced locally, Indonesia is dependent on nearby countries for other minerals. From a regional perspective, Australia, India, the Philippines, and China are key countries that could provide Indonesia other minerals (see Figure 20).

To drive their goals to build their EV ecosystems, some of these countries are considering prioritizing local sourcing and local industries. India, for instance, under its FAME-II policy is considering restricting incentives to only those models that meet a certain level of local sourcing. Indonesia’s local content requirement will increase from 40% to 80% after 2030. Advocating a national agenda may exacerbate supply chain risks for LIB cell minerals. An ADL analysis reveals that by 2030, lithium and nickel will be the key minerals facing a supply chain risk with the expected supply falling short by 52% for lithium and 5% for nickel. While Australia and the Philippines have not introduced policies like India and Indonesia, Indonesia’s overemphasis on local content regulations and policies such as restricting export of nickel may prompt these markets to undertake similar countermeasures that would further magnify the supply chain risks.

Australia may step up localized LIB battery manufacturing

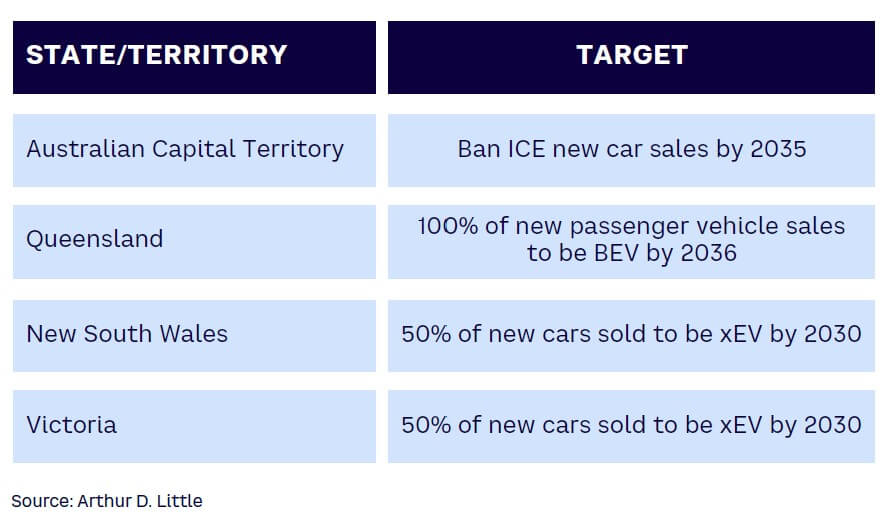

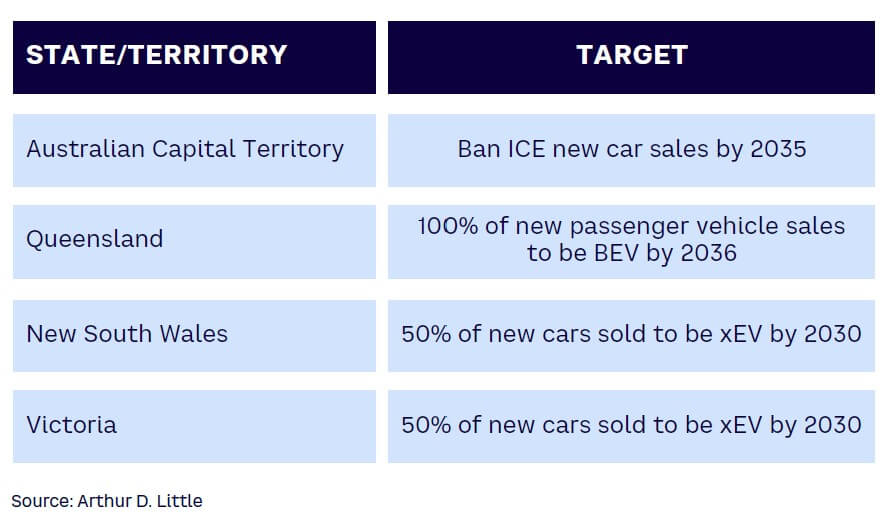

Australia’s automotive industry has a high vehicle penetration at around 800 per 1,000, which indicates an oversaturated car market. The automotive car market in Australia is expected to get a new life as its government plans a target of 3.8 million xEVs on the road by 2030, up from the current volume of 83,000 vehicles, implying a CAGR of 61%. Furthermore, the major states and territories that account for 80% of new car sales in 2022, including New South Wales, Victoria, Queensland, and the Australian Capital Territory, have set specific targets to promote xEV and EVs (see Figure 21). In light of these developments, a strong demand for xEVs, including EVs, is expected.

Australia is one of the only countries to have a good balance of major LIB cell materials. From conservative estimates, this presents a revenue opportunity of US $11.3 billion by 2030, which Australia would look to exploit in light of a recent recession. The country experienced negative GDP growth of -0.1% in 2020 for the first time in 20 years and a slowdown in the mining sector, which contributes around 10% of GDP. The mining industry has been registering a slower growth rate over the last decade. Local automotive manufacturing is one of the proposed goals in the recent release of a National Electric Vehicle Strategy consultation paper, a strategic document released by the government to solicit feedback from interested stakeholders.

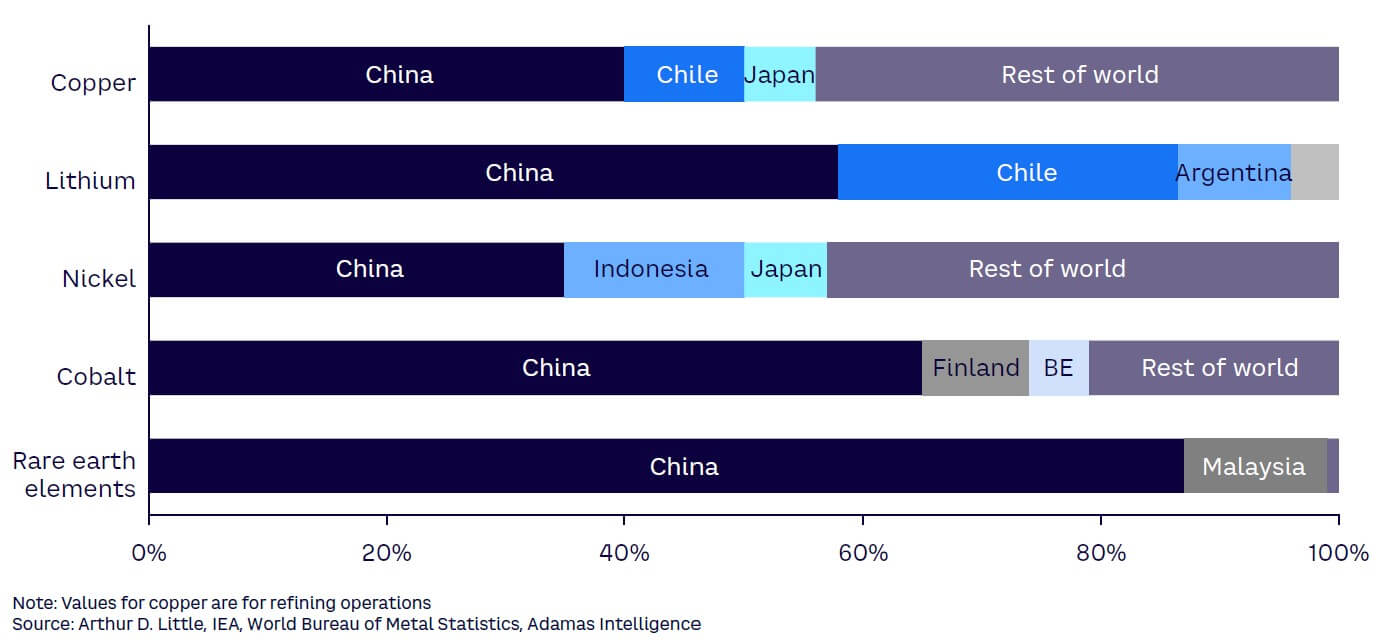

ADL believes Australia may look to develop its own LIB cell manufacturing given China’s stronghold over LIB supply chain material (see Figure 22) and Australia’s plan to de-risk from China.

Startup Recharge Industries is setting up a 2 GWh facility without any materials from China, which was heavily advertised across Australian media. Assuming Australia’s LIB cell manufacturing industry picks up, local governments may consider unilateral trade restrictions and nation-focused agenda if similar policies are introduced by nearby countries, including Indonesia.

CHAPTER SUMMARY

Indonesia’s EV ambition faces some fundamental challenges such as overdependence on Japanese OEMs, the potential threat of LFP, lack of grade 1 nickel capabilities, and balance between regional dependence and the national agenda. These challenges need to be addressed after taking a pragmatic view of the market situation, regional factors, and global circumstances. The level of impact these challenges have can drastically impact government overall targets for 600,000 EVs and 2.45 million e2Ws by 2030. In the next chapter, we introduce ADL’s GEMRIX rating to showcase Indonesia’s ranking against other global benchmarks and its current standing before providing an assessment of Indonesia’s targets with some key solutions to these challenges.

4

INDONESIA ELECTRIC MOBILITY READINESS INDEX

The topic of climate change has caused heated debates over the last few years, garnering strong interest from corporate leaders and politicians around the world. Post-COVID-19, climate change and sustainability have regained attention, helped in part by the recent COP26 climate change summit and similar movements.

Companies find themselves facing legislative policy changes and societal pressure, leading them to undergo a strategic realignment. Globally, these fundamental drivers have motivated automotive executives to move e-mobility higher on their strategic agendas. The COVID-19 pandemic and climate change have also pushed governments to act and business operators to rethink their missions and how they can become more sustainable. Prioritizing the EV industry is a solution with significant potential to mitigate some of the environmental problems caused by climate change. Countries around the world differ in their EV-related requirements and their approaches for realizing true EV potentials. Understanding these differences would allow governments to implement a “once-in-a-century” disruption like switching from fossil fuel to electric energy and automotive leaders to invest in future mobility services like transitioning from ICE vehicles to EVs.

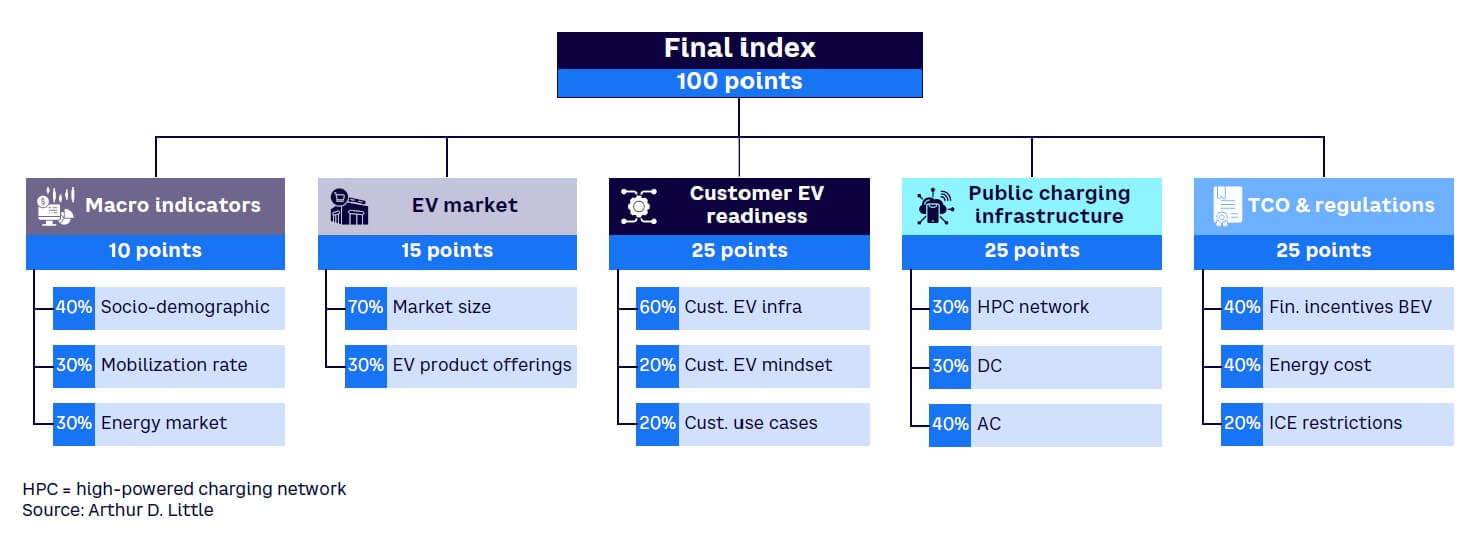

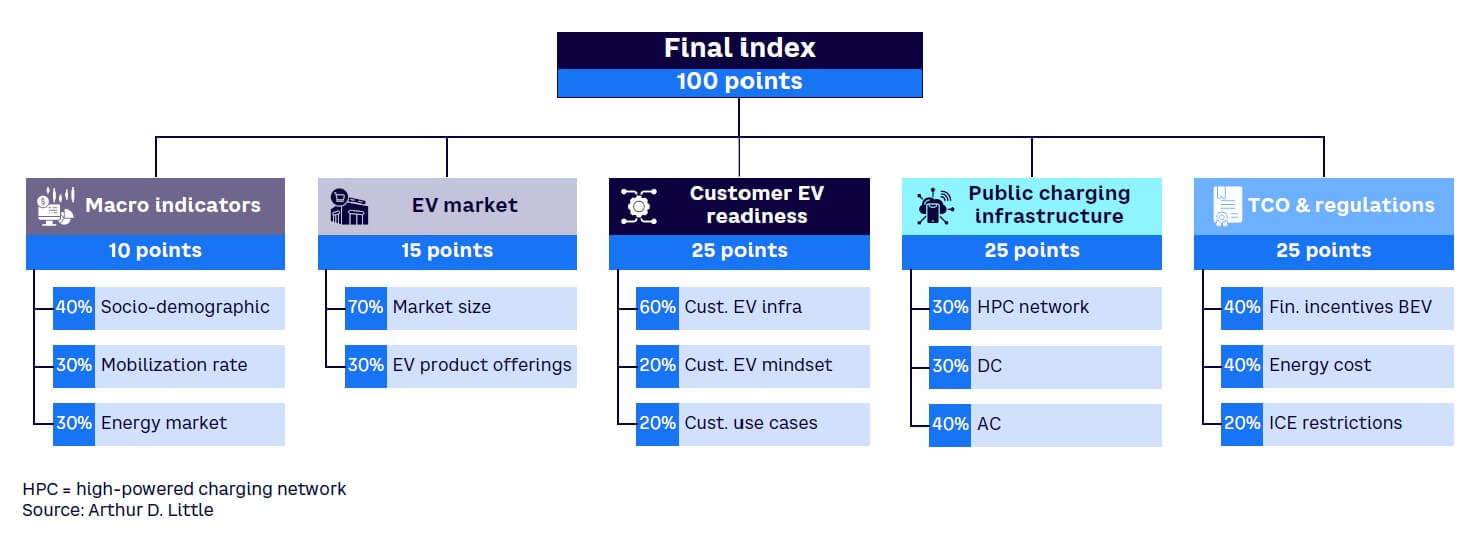

To assist executives in automotive organizations around the world, ADL has developed a methodology to evaluate the readiness of markets for electric mobility. Its metrics enable a solid understanding of the current situation. The standardized approach and an evaluation metric allow a comparison across markets of overall readiness.